Paytm Kyc Online Apply Form

Understanding the KYC Application

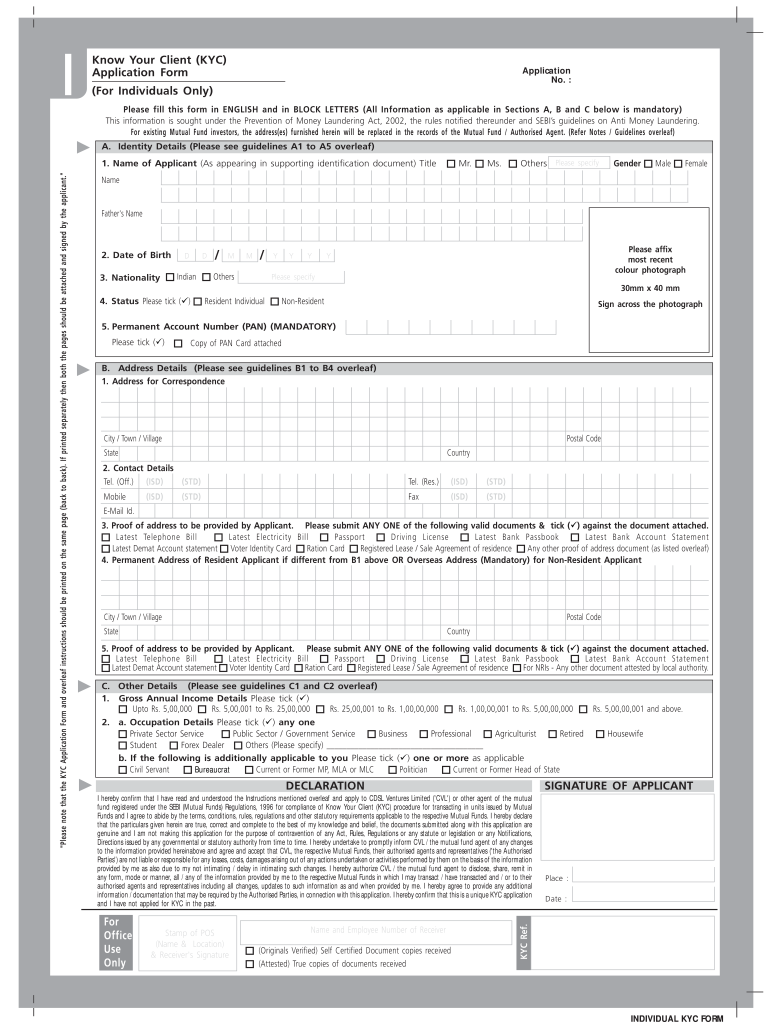

The KYC application, or Know Your Customer application, is a crucial process for financial institutions and businesses to verify the identity of their clients. This process helps prevent fraud, money laundering, and other illegal activities. By collecting essential information about clients, businesses can ensure compliance with regulatory requirements and build trust with their customers.

Steps to Complete the KYC Application

Completing a KYC application typically involves several key steps:

- Gather the required personal information, including full name, address, date of birth, and Social Security number.

- Prepare identification documents, such as a government-issued ID, utility bill, or bank statement, to verify your identity and address.

- Fill out the KYC application form accurately, ensuring all information is up-to-date and matches your identification documents.

- Submit the completed application form along with the required documents to the relevant institution, either online or in person.

- Await confirmation of your application status, which may involve additional verification steps.

Required Documents for KYC Application

To successfully complete a KYC application, you will need to provide specific documents that verify your identity and address. Commonly required documents include:

- A valid government-issued photo ID, such as a driver's license or passport.

- Proof of address, which can be a recent utility bill, bank statement, or lease agreement.

- Social Security number or taxpayer identification number, if applicable.

Legal Use of the KYC Application

The KYC application process is governed by various laws and regulations designed to protect consumers and prevent financial crimes. In the United States, institutions must comply with the Bank Secrecy Act (BSA) and the USA PATRIOT Act, which mandate customer identification procedures. Ensuring that the KYC application is completed accurately and submitted in compliance with these regulations is essential for legal validity.

Application Process & Approval Time

The application process for a KYC application can vary by institution but generally follows a similar timeline. After submission, it may take anywhere from a few days to several weeks for approval, depending on the complexity of the verification process and the institution's internal policies. Clients are often notified via email or phone regarding the status of their application.

Eligibility Criteria for KYC Application

Eligibility for a KYC application typically includes being of legal age, providing valid identification, and having a legitimate purpose for opening an account or conducting transactions. Financial institutions may have additional criteria based on their specific policies and the type of services offered. It is important to check with the institution for any specific requirements that may apply.

Quick guide on how to complete kyc application form

Uncover how to effortlessly navigate the Paytm Kyc Online Apply process with this straightforward guide

Electronic submission and verification of documents is becoming more prevalent and is the preferred option for many users. It provides numerous advantages over outdated paper documents, such as ease of use, time savings, enhanced precision, and better security.

With tools like airSlate SignNow, you can search for, edit, verify, and enhance your Paytm Kyc Online Apply without getting bogged down in endless printing and scanning. Follow this concise guide to initiate and finalize your document.

Follow these steps to obtain and complete Paytm Kyc Online Apply

- Begin by selecting the Get Form button to access your form in our editor.

- Pay attention to the green labels on the left that indicate required fields so you don't miss any.

- Utilize our advanced features to annotate, modify, sign, secure, and enhance your form.

- Protect your document or convert it into a fillable form using the tools on the right panel.

- Review the form and look for any errors or inconsistencies.

- Click on DONE to complete the editing process.

- Rename your document or leave it as is.

- Select the storage option you wish to use to save your form, send it via USPS, or click the Download Now button to save your document.

If Paytm Kyc Online Apply is not what you were searching for, you can browse our extensive collection of pre-existing forms that can be completed with minimal effort. Experience our solution today!

Create this form in 5 minutes or less

FAQs

-

Do I need to send a physical copy of the application form for a PAN card if I had filled it out online on NSDL using e-Sign/e-KYC?

Refer the following link for detail process for online pan application.How to apply for PAN card

-

How can I buy Tesla shares from India?

Apple, Microsoft, Amazon, Facebook. We all have grown up using these companies’ products/services. Obviously everyone’s interested in stock market would like to invest there too.But wait, since they won’t be listed on Indian stock exchange, how to do it?There are basically 3 ways you can invest in Tesla,Open an account with Indian Brokerage firm who has a tie-up with foreign broker. Like ICICIdirect, HDFC sec, Reliance Money etc.. They provides the service where you can open your overseas trading account with their foreign brokerage partner.Open account with foreign brokers. Some international brokers are out there who permits Indian citizen to open account and trade in US market like Interactive Brokers, TD Ameritrade, Charles Schwab International Account.Buy Indian MF(Mutual Fund)/ETF(Exchange Traded fund) with global equities. Mutual Fund basically invests in stock market, Government bonds and other securities. There are few firms which invest in international market. You can invest indirectly there but you will never know if your money went in Tesla or not. But this is probably safest option I know because you will not have to open Overseas trading account plus you will save the minimum deposit roughly $10,000. Here are few popular mutual funds who trade in global market, ICICI Pru US Bluechip Equity – D (G), Motilal MOSt Oswal NASDAQ 100 ETF, Reliance US Equity Opp. Fund DP (G), Edelweiss Greater China Eqty-Direct andKotak US Equity Fund – Direct (G).Now that you know the ways to invest, here are some food for thoughts.The reason why people invest in foreign stock exchanges.People want to invest in their favorite companies, of course Elon Musk/Steve Job are everyone’s idol. We all believe in them, their vision. Also Google, Amazon, Twitter, Facebook are darlings of this generation.Diversification - Investing in foreign companies helps in diversification. Investing in foreign companies mitigate the risk when Indian market gets crash.Bigger Opportunities - The point is there are thousands of better companies out there. There is no boundary anymore.Investors believe that foreign companies have better resources, facility, government cooperation. That makes them high rated.Some Critical Points to know before you invest in TeslaUp to $2,50,000 can be invested overseas by Indian resident as per RBI. That is roughly 1.7 crores. That’s enough, right?High Charges - Here you will be transecting in foreign money. You will be paying brokerage charges in their currency that is USD (1 USD~68.5 INR). So, will the AMC(annual Maintenance charges).Profit are subjected to currency exchange rate - Price of INR against USD will constantly change, so suppose you invested when it was 1$=₹68 , so when you sell the stock maybe the price changes to 1$=₹60. In such case you already lost 11.7%. That’s why when you invest in foreign stocks, profits are always subjected to the currency exchange rate.To know more about such topics please visit, Blog - Trade Brainsor Join Pundits of Stock market at Indian Stock Market Tribe- TRADE BRAINS.

-

How do I get KYC verified for mutual funds online?

KYC complianceKYC compliance is compulsory for investing in Mutual Funds in India. You have to fulfill KYC verification requirement with a KYC registration agency. KYC verification is one-time exercise post which you can invest in any mutual fund in India. There are two ways to become a KYC compliant - offline KYC process andeKYC process (online). These days, it is possible to complete your KYC online through certain fund houses or transfer agents in the following ways.PAN card based e-KYCSome fund houses offer this service. The entire process is easy and simple. You have to fill a form online. Take a print out of this form, paste a photograph and sign on it. Now upload its scanned copy along with other relevant documents. Documents required would be PAN card, proof of identity, proof of address and a photograph. Your in-person verification will be done using a webcam or your smart phone without going anywhere.Aadhaar card based e-KYCIn this process, you have to provide your Aadhaar number and the mobile number (registered with the Aadhaar card). An OTP will be sent to your registered mobile number. You have to enter the OTP. You have to also upload a scanned self-attested copy of your Aadhaar card. This method has some restrictions. You can invest up to a maximum of Rs. 50,000 per annum in one fund house.Always opt for PAN card based e-KYC instead of Aadhaar card based e-KYC to avoid investment limits.Check your KYC statusYou can check your KYC status with your PAN number with any of the KYC registration agencyhttps://camskra.com/https://www.nsekra.com/https://kra.ndml.inhttps://www.karvykra.comhttps://www.cvlkra.com/You can also read: How to invest in mutual funds online?

-

How to trade US stock market from India?

Yes, an Indian can invest in US equity market. Follow the below process:1. Open a trading account to invest in International Capital MarketsTo facilitate you to do the same, an Indian stock broker enters into a tie-up with a foreign broking partner who has the license to act as an intermediary and execute the trades on your behalf in the foreign markets.The Indian stock broker will act as an introducing intermediary between you and the foreign broking house. The Indian stock broker will also help you in getting your account opened and completing the formalities of Know Your Customer (KYC) applicable for that country.You just need to fill an application form and provide your identity proof such as passport or PAN card and residential address proof such as Voters ID card or latest bank statement as the documents required to open an account.Once your necessary details are registered, you will be provided the bank account details of the foreign broker to which funds are to be transferred. You will also get the contact details of the account executive who will take care of your account in case you require any kind of assistance.2. Funds Transfer – Pay-In/Pay-Out ProcessAs per the remittance norms of the Reserve Bank of India (RBI), an Indian citizen can remit a maximum of USD 2,00,000 in a financial year, from any of the authorised banks in India, including for investments in international capital markets.The foreign brokers accept funds originating from your bank account only and will reject any third party fund transfer. Also, they do not accept bankers drafts, cheques or cash depositsIt takes around 24 to 48 hours to remit money from your bank account to your trading account with the foreign broker and around 48 to 72 hours from your trading account to your bank account.Once your account is opened and funds are transferred, you will be provided a client Login ID and password to have an immediate access to the foreign brokers trading platform to buy and sell shares of the listed foreign companies. All dealings like trading, delivery of shares/funds etc. will be done directly with the foreign broker without any involvement of the Indian stock broker.3. Demat AccountUnlike here in the domestic markets, where your bought shares get transferred into your demat account in T+2 days, when you buy shares in the foreign markets the shares remain in a pool account with the brokers custodian but start reflecting in your trading account immediately after buying.Unlike with most Indian brokers, margin trading and short selling will not be allowed with a foreign broker. You will be able to buy shares only when there is sufficient cash in your account and sell shares only when you already hold them.You can have the access to all your transactions, account history and ledger balance on the trading platform. You will also get the contract notes for your executed trades in your mailbox.4. Brokers in India providing this serviceOnly a few Indian broking companies like Kotak Securities, ICICI Direct, India Infoline, Reliance Money and Religare, are offering these trading services to Indian investors.As your overseas investments will be made in some foreign currency, your investment gain or loss will also be linked to the movement of that currency. So, if you invest in some stocks in USD and USD appreciates in value, then it would add to your gains or lower your losses. e.g. Suppose you paid Rs. 50 per USD at the time of investment and liquidate your investment when the USD appreciates to Rs. 55, you will get back Rs. 55 per USD.The process of transacting in equity markets overseas is not that complicated if you are aware about the global dynamics.Hope this is useful :)

-

How should I start investing in mutual funds if I want to start with 10,000 rupees and fetch 1 lakh every year?

you have made a smart decision by choosing to invest in Mutual Funds. Welcome to new world of Mutual funds. Investing in MF and equities is a good idea these days since the returns obtained and the tax benefits are generally greater than in investing in mutual funds then investing in traditional avenues such as fixed deposit and PPF. Investing in mutual funds is easy done then said. SEBI who is regulator of financial services industry has already simplified the process. However, most of us are unaware of the process of investing in MF. We have tried to detail out the process in simple manner which can guide a layman investor to start investing in Mutual funds-1. Understand your Profile: There are multiple investment products with different risk and return. When it comes to investing, first step should be to know personal risk profile. Investor should first understand his or her risk profile for investing. Generally higher the age and financial obligations lower the risk profile. However, one can learn risk profiling through various free online tools.(Link to Risk profiling).Knowing the risk profile helps in knowing the products one should not invest in. The below helps understanding the basic categories of profiles and meaning- Conservative The primary objective of this class of investors is to protect the capital from loss. Conservative Investors want a stable growth over large returns but without taking any risk on capital. Generally investors in Higher age bracket or with high financial obligations fall into this category. Moderate These kinds of investors look for capital growth along with decent protection of capital. Investors who lie in this class can tolerate some fluctuations in short term in the value of their investments in the anticipation of higher returns, in long term. Moderately aggressive The primary objective of this class of investors is capital growth with calculated risk in capital. Moderately aggressive Investors are able to accept fluctuations if long term expected result is positive and can deliver return higher than fixed deposits. Aggressive Aggressive investors can take high risk for super natural returns. These investors can meet their financial obligations in spite of losses in their investments . 2. Know your Financial Goals: Every individual has certain financial goals in life. Some gaols are mandatory like retirement expenses, House purchase, kid’s education etc. whereas other can be aspirational one like buying a luxury car, overseas vacation etc. Each Goal has some value and one has the choice to invest a lump sum amount or open regular savings account for meeting the goal. a) List down all the financial goals of life b) Knowing the amount of money required to meet those goalsc) Defining how much money should one invest today to achieve those goals3. SIP or Lump Sum- Knowing the value of goals, one can know how much money one is require to save for meeting those goals. Suppose one needs Rs 50 lacs after 25 years for kid’s marriage, one has to invest Rs 5.80 lacs with expected return of 9%. However, one can start investing in SIP with just Rs 5000 investment per month for 25 years and meet the goal.Depending on the financial capability one can take this decision. 4. Choose the Category of Funds: There are multiple kinds of funds- equity funds, Balanced funds, Income funds, Sectoral funds etc. Each fund is not right for each investor. Now, you have already identified the risk appetite and goal preference, the next important step is to choose the right product. 5. Right Mutual fund Scheme- There are 100s of equity funds in India. Once you know that you have to invest in equity funds, now the next step is to identify the right scheme in it. One can take help of advisor for the same or make an effort to do it on his own. The following steps will lead to selection of right type of product:Expense Ratio: The Expense ratio is declared as a percentage of basic overall business expenses of mutual fund company ( Known as Asset management company- AMC) necessary to keep the fund operational , over the total investment of mutual fund ( Known as asset under management- AUM ). It tells how much charges customer pays to the mutual fund company to get the money managed by them. This expense ratio change for each mutual fund company. It varies for varied mutual fund categories.Historical Performance: Historical performance aids in anticipating the future performance of the fund and hence is looked in during the selection process. The schemes usually with a track record of consistent out-performance vis-a-vis their benchmarks ( usually BSE SENSEX and NSE NIFTY indices in case of Equity Funds), are considered to be good for future too.Mutual fund Scheme Age - Markets have lots of cycles- Bull or bear or stagnant. Funds that perform in all cycles are generally better than others. But cycles come generally in 5-8 year period of time. So it is advised that schemes with 5-8 years of history are generally better than others.The size of the mutual fund corpus- Investors generally invest in the schemes which are good in all aspects- Performance, Ratios, Fundamentals, etc. So one easiest way to judge a mutual fund is to know its corpus and compared with the competition. In case it is on the high side, it can denote that investors trust the particular fund and one can invest. One can easily track the past return from Mutual fund Company’s website or newspapers. However, it is advised to check all above 4 things before investing in mutual funds. 6. Start transacting through online mode or offline mode: Benefits of online investing1. Single place for scheme info, buy/sell, NAV check, portfolio track, online, anytime, anywhere. 2. Hassle free, real-time buy/sell -no filling forms every time 3. Easy enabling of Systematic Investment Plans (SIPs) 4. You can also transfer in your holdings from other accounts5. Transparent process 7. Sleep: If you have invested in mutual funds with proper plan, you should not track them on a regular basis. Mutual funds should be brought for long term investing and not for timing the market. Therefore, one should forget about the mutual funds investment and not worry about them in the near future after bringing them. 8. Monitor: It is advisable that one should try to monitor MF account once in every six months. It is said so because by doing so one can know about the status of the funds accumulated through mutual fund and how much more time will be needed to accumulate enough funds to meet the desired goals. http://www.advisesure.com

-

What is the best way to start an sip?

As a matter of fact, the most difficult part about saving money is getting started. It gets hard for people to determine simple plans to invest money and how to start saving in those plans to meet their financial goals. If you are in a similar situation, you must consider some money saving tips and then make your decision.HOW TO SAVE MONEY EVERY MONTH?You do not need to have huge sums of money to start investing. There are other simpler ways for you. This is where SIP comes in. SIP or a Systematic Investment Plan is one of the best ways of investing your money. SIP's start the process of wealth creation where a small amount of money is invested over regular intervals of time and this investment being invested in the stock market generates returns over time. The amount of starting a SIP is as low as INR 500, thus making SIP’s a great tool for smart investments, where one can start investing small amount from a young age. Now, you must be thinking how to save money by investing in a Systematic Investment Plan? Read below!HOW TO SAVE MONEY VIA A SIP?Generally, there are certain goals according to which people start investing. Some of the basic goals are mentioned below.How to Save Money by Investing in a SIPTAX SAVINGAs you start earning, the first thing you want to know is how to save money from tax deductions. Though there are many ways to save tax, SIP is one of the most convenient ones. By investing through SIP the money gets deducted at regular intervals, so there is no burden of a limp sum investment. Also, the SIP investments are liable for deductions under section 80C of the Income Tax Act. So, all your questions about how to save money from taxes have a solution. By investing in a SIP, one can save somewhere between INR 15,000 to INR 45,000 in taxes per year.CHILDREN’S EDUCATION OR FUTURESince the birth of yourchildrenyou should start planning for their future, that includes education, marriage etc. But how to save money for making investments is your question, right? The solution is simple and quite convenient. One of the most convenient ones is investing in Mutual Funds through a SIP. As you know, SIPs invest a small amount for regular intervals, it very convenient for people. Additionally, SIPs work the best for long-term investments, that further makes it beneficial for you to save money for your child. So, don’t just linger on how to save money, just invest in a SIP and you are done.RETIREMENTPlanning for retirement is the one of an essential part of financial goals. Appropriate retirement planning is when you know how to save money and where to invest your savings. There are various investing options that help you on how to save money. These plans include Provident Fund (PF), National Pension Scheme (NPS) etc. But, one of the best money saving plans is a Systematic Investment Plan. It invests your money in growth assets and helps you create a powerful corpus for your retirement. For example, let's suppose you earn INR 30,000 per month at the age of 25 and invest INR 2500 per month in a SIP, increasing it by 10% every year, your savings would be the following-At the age of 60, with the balanced return of 12% per annum you will earn INR 4.12 croresAt the age of 60, with the balanced return of 15% per annum you will earn INR 7.2 croresTherefore, when deciding how to save money for your retirement, make sure you invest in SIP.To know how to invest in SIP, read the article SIP Investment | ELSS Mutual Fund, Balanced Funds, Large-Cap Funds

-

How can I fill out a KYC form online for SBI?

Fill out ? If you want to update your kyc, you can just write up a formal letter with your cif/ac details and attach photo copies of the proofs, self attested by you and send them by post to your home branch or you can do it yourself, if you have online banking facility.

-

How do I open an NRO / NRE account when I am abroad?

You can open an NRO/NRE account through the following steps:Open the bank’s website in which you want to open the account and explore the NRI section. Download the application form. Some banks also allow you to open the account online by providing requisite documents and by finally sending the printed application with all the documents to bank’s address.You need to submit the documents like proof of NRI/PIO status, identity proof, address proof, etc.The bank may ask for attested documents either from the consulate or in a self-attested format.The requisite KYC declaration and documents may be asked while filling the application.You need to dispatch all the documents to the address of the bank.The bank normally requires a certain minimum amount to be deposited into your account that you can provide along with the application form. Once the account is opened, you’ll get the confirmation on your registered email/mobile.Check out these links for more information on this subject:NRE vs NRO: What’s The Difference?Difference Between NRE and NRO FDs | Fixed DepositIf you have any other Personal Finance queries, you can follow and tweet out and I'll be happy to answer them for you - Adhil Shetty (@adhilshetty) | Twitter

-

How do I open a PPF account online?

you can partly open your PPF account online because you can only download the application form online. and you will need to go to the bank at least one time for the submittion of your application form.You can download the PPF form either from your Net account account or by simply search the google for PPF form along with bank name.For example- HDFC bank PPF application form.download the form, take a print out of it & fill the form. But after that you will need to go to the bank for the submittion of you application form. If you don’t want to visit the bank again, take all the documents like PAN card, Adhaar card & photograph. Bank may also ask you to fill the KYC form.Do you Want to know more about PPF?, Here is Full guide PPF Investment ( Everything You Should Know) - Invest Buddy

Create this form in 5 minutes!

How to create an eSignature for the kyc application form

How to make an eSignature for the Kyc Application Form online

How to make an electronic signature for your Kyc Application Form in Chrome

How to make an eSignature for putting it on the Kyc Application Form in Gmail

How to create an electronic signature for the Kyc Application Form straight from your smartphone

How to generate an electronic signature for the Kyc Application Form on iOS

How to create an eSignature for the Kyc Application Form on Android devices

People also ask

-

What is the process to Paytm Kyc Online Apply?

To Paytm Kyc Online Apply, you need to log into your Paytm account and navigate to the KYC section. The process typically involves submitting your identification documents and a selfie for verification. Once submitted, Paytm will review your application and notify you of the status.

-

Is there a fee to Paytm Kyc Online Apply?

No, there is no fee associated with the Paytm Kyc Online Apply process. The service is offered free of charge, allowing users to complete their KYC verification without any financial burden. This makes it a cost-effective solution for users needing KYC compliance.

-

What documents are required for Paytm Kyc Online Apply?

When you Paytm Kyc Online Apply, you generally need to provide an identity proof (like Aadhar or PAN card) and a recent photograph. These documents help verify your identity and ensure compliance with regulatory standards. Make sure to have clear scans or images of these documents ready for submission.

-

How long does the Paytm Kyc Online Apply process take?

The Paytm Kyc Online Apply process usually takes a few minutes to complete your application. However, verification can take anywhere from a few hours to a few days, depending on the volume of applications. You will be notified via the app once your KYC is successfully processed.

-

What are the benefits of completing Paytm Kyc Online Apply?

Completing the Paytm Kyc Online Apply enhances your account's security and unlocks additional features such as higher transaction limits and access to various financial services. It also ensures compliance with regulations, making your transactions safer and more reliable. Overall, it contributes to a seamless user experience.

-

Can I use Paytm services without completing KYC?

Yes, you can use Paytm services without completing KYC, but your access will be limited. Without KYC verification, you may face restrictions on transaction amounts and features. Therefore, completing Paytm Kyc Online Apply is essential for full access to all services and benefits offered by Paytm.

-

Is the Paytm Kyc Online Apply process secure?

Yes, the Paytm Kyc Online Apply process is designed with security in mind. Paytm employs advanced encryption and security measures to protect your personal information during the KYC verification process. Your data is handled with care and is kept confidential, ensuring a safe experience.

Get more for Paytm Kyc Online Apply

Find out other Paytm Kyc Online Apply

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors