Authorization for Direct Debit Form

What is the Authorization for Direct Debit

The Authorization for Direct Debit is a legal document that allows a business or organization to withdraw funds directly from a bank account on a recurring basis. This form is commonly used for payments such as subscriptions, utility bills, and loan repayments. By signing this authorization, the account holder grants permission for the specified amount to be debited from their account at regular intervals. This process streamlines payments and ensures timely transactions without the need for manual intervention.

How to Use the Authorization for Direct Debit

To use the Authorization for Direct Debit, follow these steps:

- Obtain the direct debit form from the organization requiring payment.

- Fill out the form with accurate bank account details, including the account number and routing number.

- Specify the amount to be debited and the frequency of the payments.

- Sign and date the form to indicate your consent.

- Submit the completed form to the organization, either online or via mail, as instructed.

Steps to Complete the Authorization for Direct Debit

Completing the Authorization for Direct Debit involves several key steps:

- Review the form for any specific requirements set by the organization.

- Provide your personal information, including your name, address, and contact details.

- Enter your bank account information accurately to avoid any errors in processing.

- Carefully read the terms and conditions associated with the direct debit authorization.

- Ensure you keep a copy of the signed form for your records.

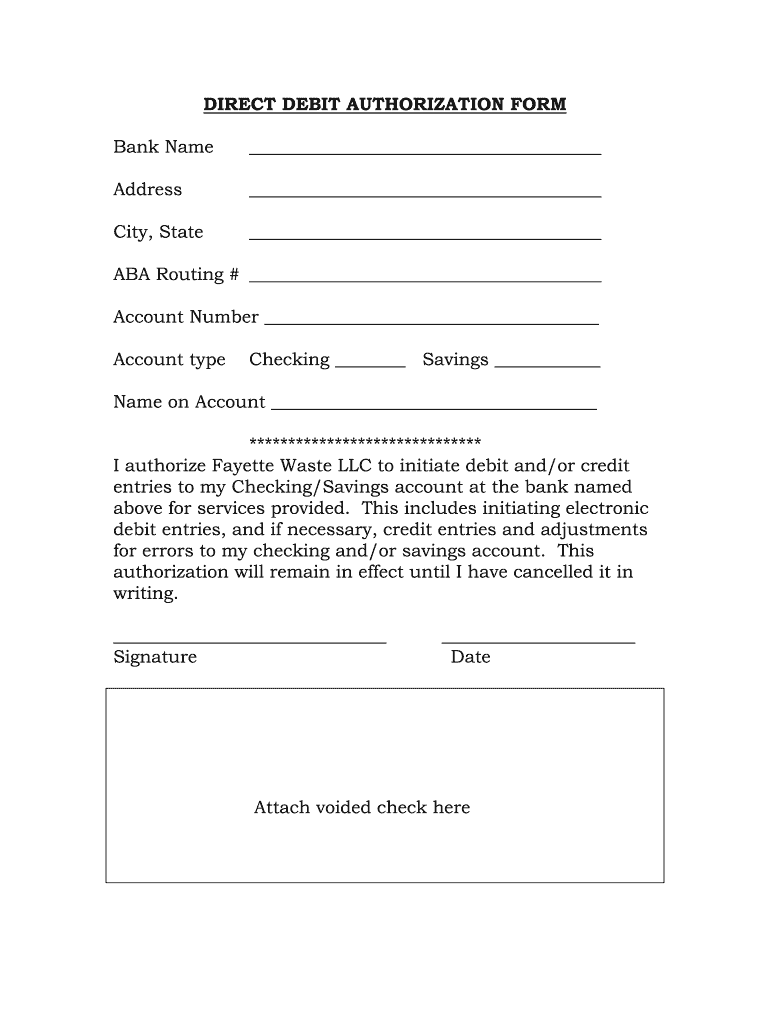

Key Elements of the Authorization for Direct Debit

Several key elements must be included in the Authorization for Direct Debit to ensure its validity:

- The account holder's name and address.

- The bank account number and routing number.

- The amount and frequency of the debit.

- The signature of the account holder, indicating consent.

- The date of authorization.

Legal Use of the Authorization for Direct Debit

The legal use of the Authorization for Direct Debit is governed by federal regulations, including the Electronic Fund Transfer Act (EFTA). This act ensures that consumers are protected when authorizing electronic payments. Organizations must provide clear disclosures about the terms of the debits, including any fees that may apply. Additionally, account holders have the right to revoke the authorization at any time, which must be honored by the organization.

Examples of Using the Authorization for Direct Debit

Common examples of situations where the Authorization for Direct Debit is utilized include:

- Monthly utility payments, such as electricity or water bills.

- Recurring subscription services, like streaming platforms or gym memberships.

- Loan repayments for personal or auto loans.

- Insurance premium payments.

Quick guide on how to complete direct debit authorization form bank name address

The simplest method to locate and sign Authorization For Direct Debit

At the level of an entire organization, ineffective procedures surrounding document approval can consume a signNow amount of working hours. Signing documents such as Authorization For Direct Debit is an inherent aspect of operations in any enterprise, which is why the efficiency of each contract’s lifecycle signNowly impacts the organization’s overall effectiveness. With airSlate SignNow, signing your Authorization For Direct Debit is as straightforward and rapid as possible. This platform provides you with the latest version of virtually any form. Even better, you can sign it instantly without needing to install external software on your computer or print anything as physical copies.

How to acquire and sign your Authorization For Direct Debit

- Explore our collection by category or use the search bar to find the document you require.

- View the form preview by clicking on Learn more to confirm it’s the correct one.

- Click Get form to start editing immediately.

- Fill out your form and insert any essential information using the toolbar.

- Once completed, click the Sign tool to sign your Authorization For Direct Debit.

- Select the signature method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finish editing and proceed to document-sharing options as necessary.

With airSlate SignNow, you possess everything you need to manage your documents effectively. You can search for, complete, modify, and even send your Authorization For Direct Debit all within a single tab without any hassle. Enhance your workflows with one, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

Is it safe to give all my details: name, address, credit card number and CVV, when filling in a credit card authorization form?

Safety is relative.Ecommerce is safe as long as you know what to look for. If the site doesn't feel safe, go with your gut. Here are reasons why you have to fill out all of the information requested like name, address, CVV and full card number.1. When you are purchasing goods from a merchant, that merchant needs certain information to verify you are the valid cardholder. The merchant is assuming the real risk in assuming you aren't a fraudster using a stolen card. Put yourself in the merchant's position. Would you just take a card number and expiration date from some random cardholder and hope it's not a stolen card?2. Information such as Address and ZIP and CVV/CVC (Visa/MC) or CID (Amex/Disc) are tools to verify the card is valid. They mitigate risk for the merchant. Address and ZIP in a Card Not Present (CNP) situation also allow the merchant to get the best possible processing rates for that transaction. 3. A legitimate merchant will have a secure website (if this is the scenario to which you're referring). Look for 2 things when entering your payment information on the site.Secure Connection in the URL Address denoted by HTTPS:A Privacy and Security Statement that includes their Compliance and Security Assessor:4. Credit card numbers are created by a sophisticated algorithm which is why you can't simply input the last 4 digits into a form. There are sites that will allow you to enter the lat 4 digits once you have already registered with them to verify the choice of card, but this is after they have your card on file. There are billions of debit/credit cards in the world with different expiration dates, CVV values and different 11/12 beginning digits so the chances that your card is the only one with a unique 4 digit ending are pretty slim.What is not safe 1. Filling out a paper form with this same data and mailing it to someone. Imagine if it got lost and someone got this info. Shopping spree on the internet for them. It still amazes me that my water bill allows this info to be paid in this manner. I would never fill out a form with my credit card data an mail or fax it. A big no-no. 2. Never email you credit card data to anyone. This communication can be easily intercepted and go into the wrong hands. Email is a safe mode of transmitting sensitive card data..

-

How can we edit the company name & address after completely filling out the Police Clearance Certificate form?

In the USA? I believe you can edit it, but the logical question from police will be”Why?”Hope that helps!ADR

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

I need to sue someone in small claims court. How do I find out someone's address if all I have is their name and bank account number?

Why do you need their address? Is it for service purposes? For privacy and anti-stalking reasons, you're not likely to get the person's address from a third party (e.g. bank, etc). Depending on your state's rules, you can probably just serve the person in person (meaning you don't need to know their address) instead of mailing it to them. Most people have used their address in some way in interacting with the public (e.g. Registrar of Voters, etc) so that's one way. Hiring a private investigator is one way too. I've done that and it does work, but it can be very expensive. Jon's point is a good one -- you do need to make sure the defendant has assets upon which you can collect. It depends on the state, but most collections laws are written so that it is exceptionally difficult for the average person to be completely exempt. Most prevailing plaintiffs in small claims court I've seen are so glad they win that they never bother collecting at all. I do quite a bit of collections work and the debtors are often surprised that I found them. Most pay up really quickly after that. Andy

-

Can I change my address proof document from a bank passbook to gas connection for an Indian passport? I have filled out the online form already.

Actually, it totally depends on official present at the passport office you would visit. Mostly, they are very cooperative. They are there to help us. They do allow to submit other documents. Sometimes, they themselves suggest you to change and give some other proof(document) to streamline your process

-

How do I make an online payment check out form directly to my bank if I do not like PayPal?

I cannot tell if you are a developer creating an online payment form or a consumer asking about the check-out and payment process in general. I will answer for the consumer's perspective: Short answer: debit cards issued by your bank offer the best compromise between directness, convenience, and security when paying online. If the website doesn't offer fields to input bank account and routing information, you cannot directly charge your bank account for a purchase from an online check out form. This is usually a good thing. Do not provide your bank account information to arbitrary merchants online. You may compromise your security by doing so because many banks have little protection against fraud from direct withdrawals. If you must pay using your bank account, try calling the company. Their phone representatives might have access to payment methods that are unavailable online, and they can process your order over the phone. Again, do this only if you trust the company. Although PayPal enables you to "connect" your bank account, you never directly pay from that account when you check out with PayPal. The merchant never accesses your account themselves. PayPal withdraws the order amount from your account and disburses your payment to the merchant.Similarly, debit cards provide what seems to be direct access to you bank account, but there is still a layer in between: the debit processing network. Some debit card providers offer similar protection against fraudulent transactions as the protection credit cards typically include.Arguably, payments by check (cheque) and "direct debit" can be considered indirect as well (in the US, at least), because these transactions must pass through the ACH network. Withdrawing the cash at your own bank in person would be the only true direct method. Similar wire transfer systems of payment exist as well that enable transfer of money electronically. However, ACH and wire transfers are seldom used for online payments unless the value of the product is quite large. Both offer almost no protection against fraud. Here's a quick, (very) simplified illustration of the path of these payment methods: Merchant > Check (ACH) > Your Bank

Create this form in 5 minutes!

How to create an eSignature for the direct debit authorization form bank name address

How to generate an electronic signature for your Direct Debit Authorization Form Bank Name Address online

How to make an electronic signature for your Direct Debit Authorization Form Bank Name Address in Google Chrome

How to generate an eSignature for signing the Direct Debit Authorization Form Bank Name Address in Gmail

How to create an eSignature for the Direct Debit Authorization Form Bank Name Address right from your smartphone

How to create an eSignature for the Direct Debit Authorization Form Bank Name Address on iOS devices

How to create an electronic signature for the Direct Debit Authorization Form Bank Name Address on Android

People also ask

-

What is a direct debit authorization form?

A direct debit authorization form is a document that allows a business to automatically withdraw funds from a customer's bank account. This form must be filled out and signed by the account holder to authorize regular payments. Using airSlate SignNow, you can easily create and eSign a direct debit authorization form, streamlining your payment processes.

-

How can airSlate SignNow help with direct debit authorization forms?

airSlate SignNow simplifies the creation and management of direct debit authorization forms by offering user-friendly templates. With features like eSigning and secure document storage, you can ensure that your forms are legally binding and accessible. This automation saves time and reduces the risk of errors in financial transactions.

-

Is there a cost associated with using airSlate SignNow for direct debit authorization forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business sizes and needs. The subscription typically includes unlimited access to features necessary for creating direct debit authorization forms and other essential documents. You can review our pricing page to find the plan that best suits your requirements.

-

What are the benefits of using a direct debit authorization form?

Using a direct debit authorization form can signNowly enhance the efficiency of payment processing for your business. It helps ensure timely payments while minimizing administrative workloads related to invoicing and follow-ups. By leveraging airSlate SignNow, you can quickly set up these forms and maintain clear communication with your clients.

-

Can I customize my direct debit authorization form in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize direct debit authorization forms to align with their branding and specific requirements. You can add logos, change colors, and modify text to create a professional and cohesive document that resonates with your customers.

-

What integrations does airSlate SignNow offer for managing direct debit authorization forms?

airSlate SignNow integrates seamlessly with various financial and business management tools, enhancing your workflow when handling direct debit authorization forms. Popular integrations include platforms like QuickBooks, Salesforce, and Google Workspace, enabling better data management and facilitating easy documentation access.

-

How secure is my information when using airSlate SignNow for direct debit authorization forms?

Security is a top priority for airSlate SignNow. When you create and manage direct debit authorization forms on our platform, all data is encrypted and stored securely. We adhere to strict security protocols to ensure your information remains confidential and protected from unauthorized access.

Get more for Authorization For Direct Debit

- Regional council dog registration form

- Wwwbennyscafecomdocsdental claim formdental claim form bennyscafecom

- Sample employment application please print all information

- Remittance voucher form

- Florida utility bill pdf form

- Beneficial owners form

- Park nicollet medical records form

- Cigna botox prior authorization form

Find out other Authorization For Direct Debit

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe