The Trustors Are Married and Parents of the Following Living Children Form

Understanding the Trustors Are Married and Parents of the Following Living Children Form

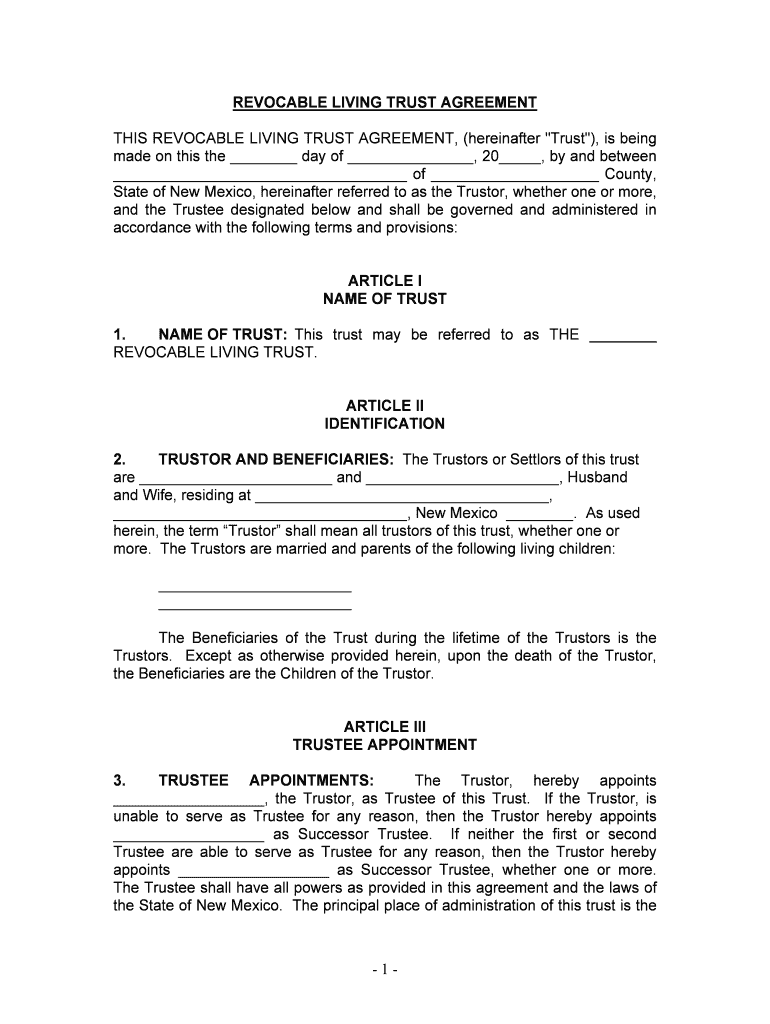

The Trustors Are Married and Parents of the Following Living Children form is a legal document that outlines the details regarding the trustors' marital status and their children. This form is essential in various legal and financial contexts, particularly in estate planning and trust management. It ensures that all relevant parties are informed about the family structure, which can affect the distribution of assets and responsibilities within a trust.

Steps to Complete the Trustors Are Married and Parents of the Following Living Children Form

Completing the Trustors Are Married and Parents of the Following Living Children form involves several key steps:

- Gather necessary information about both trustors, including full names, dates of birth, and marital status.

- List the names and birthdates of all living children to ensure accurate representation.

- Review any relevant legal requirements or state-specific regulations that may apply to the form.

- Utilize a reliable electronic signing platform to fill out and sign the document securely.

Legal Use of the Trustors Are Married and Parents of the Following Living Children Form

This form serves a crucial role in legal contexts, particularly in establishing the identity of trustors and their familial relationships. It is often used in estate planning, where clarity on family structure can influence decisions regarding asset distribution. The form must comply with state laws to ensure its validity and enforceability in legal matters.

Key Elements of the Trustors Are Married and Parents of the Following Living Children Form

Several key elements should be included in the Trustors Are Married and Parents of the Following Living Children form:

- Trustors' Information: Full names, addresses, and marital status.

- Children's Information: Names and birthdates of all living children.

- Signatures: Signatures of both trustors, confirming the accuracy of the information provided.

- Date of Execution: The date on which the form is signed.

State-Specific Rules for the Trustors Are Married and Parents of the Following Living Children Form

It is important to note that the requirements for the Trustors Are Married and Parents of the Following Living Children form can vary by state. Some states may have additional requirements for notarization or witness signatures. Always check local laws to ensure compliance and validity.

Examples of Using the Trustors Are Married and Parents of the Following Living Children Form

This form can be utilized in various scenarios, such as:

- Establishing a trust for the benefit of the children.

- Updating estate plans after significant life events, such as marriage or the birth of a child.

- Clarifying family relationships in legal proceedings, such as divorce or custody cases.

Quick guide on how to complete the trustors are married and parents of the following living children

Complete The Trustors Are Married And Parents Of The Following Living Children effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly and without delays. Manage The Trustors Are Married And Parents Of The Following Living Children on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign The Trustors Are Married And Parents Of The Following Living Children with ease

- Locate The Trustors Are Married And Parents Of The Following Living Children and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, exhausting form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign The Trustors Are Married And Parents Of The Following Living Children and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it benefit The Trustors Are Married And Parents Of The Following Living Children?

airSlate SignNow is an intuitive eSignature solution that allows users, including The Trustors Are Married And Parents Of The Following Living Children, to streamline document signing and management. It provides a secure platform for executing contracts, agreements, and other paperwork, making it ideal for parents managing their family affairs.

-

How much does airSlate SignNow cost for families like The Trustors Are Married And Parents Of The Following Living Children?

airSlate SignNow offers various pricing plans suitable for different user needs, including families such as The Trustors Are Married And Parents Of The Following Living Children. These plans can accommodate occasional users or those requiring more frequent document management, ensuring affordability and flexibility.

-

What features can The Trustors Are Married And Parents Of The Following Living Children expect from airSlate SignNow?

airSlate SignNow provides features like customizable templates, real-time tracking, and automated reminders for users like The Trustors Are Married And Parents Of The Following Living Children. These tools enhance document workflow efficiency and ensure that important agreements are executed promptly.

-

Is airSlate SignNow easy to integrate with other applications for The Trustors Are Married And Parents Of The Following Living Children?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM systems, making it ideal for families like The Trustors Are Married And Parents Of The Following Living Children. This facilitates a smoother document management process catered to their unique needs.

-

How secure is airSlate SignNow for families like The Trustors Are Married And Parents Of The Following Living Children?

Security is a top priority for airSlate SignNow, with advanced encryption protocols in place to protect documents. For The Trustors Are Married And Parents Of The Following Living Children, this means their sensitive information remains confidential and secure during the signing process.

-

Can The Trustors Are Married And Parents Of The Following Living Children use airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow provides a mobile-friendly platform, allowing The Trustors Are Married And Parents Of The Following Living Children to sign documents anytime, anywhere. This flexibility is crucial for busy families managing multiple responsibilities.

-

What support options are available for The Trustors Are Married And Parents Of The Following Living Children using airSlate SignNow?

airSlate SignNow offers extensive support options, including a knowledge base, video tutorials, and customer service representatives ready to assist. For families like The Trustors Are Married And Parents Of The Following Living Children, this ensures they have help when needed.

Get more for The Trustors Are Married And Parents Of The Following Living Children

Find out other The Trustors Are Married And Parents Of The Following Living Children

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online