Instructions for Nonprofit Form

What is the Instructions For Nonprofit

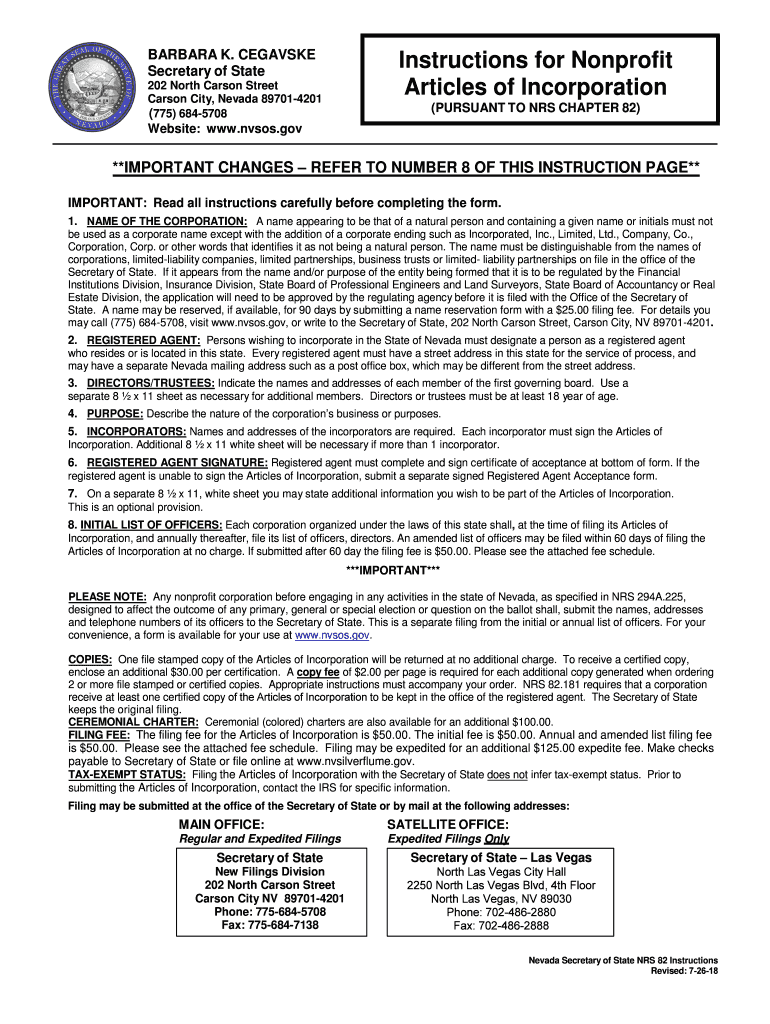

The Instructions For Nonprofit is a critical document that provides guidance on how nonprofit organizations can operate within legal frameworks. This form is essential for nonprofits seeking to comply with federal and state regulations, ensuring they maintain their tax-exempt status. It outlines the necessary steps and considerations for nonprofit management, including financial reporting, governance, and compliance with the Internal Revenue Service (IRS) requirements.

Steps to complete the Instructions For Nonprofit

Completing the Instructions For Nonprofit requires careful attention to detail. Here are the main steps to follow:

- Gather necessary information about your nonprofit, including its mission, structure, and financial data.

- Review the specific requirements outlined in the instructions, including any state-specific regulations that may apply.

- Fill out the form accurately, ensuring all sections are completed and relevant documentation is attached.

- Double-check for any errors or omissions that could delay processing.

- Submit the completed form through the appropriate channels, whether online, by mail, or in person, as specified in the instructions.

Legal use of the Instructions For Nonprofit

The legal use of the Instructions For Nonprofit is paramount for maintaining compliance with nonprofit regulations. To ensure the form is legally binding, it must be completed accurately and submitted in accordance with IRS guidelines. Additionally, organizations should be aware of the implications of non-compliance, which can include penalties or loss of tax-exempt status. Utilizing a reliable eSignature solution can further enhance the legal standing of the submitted documents.

Key elements of the Instructions For Nonprofit

Understanding the key elements of the Instructions For Nonprofit is essential for effective compliance. These elements typically include:

- Identification of the nonprofit organization, including its legal name and tax identification number.

- Details regarding the organization's mission and activities.

- Financial information, including income, expenses, and funding sources.

- Governance structure, including the board of directors and their roles.

- Compliance with state and federal regulations, including any necessary disclosures.

IRS Guidelines

The IRS provides specific guidelines that govern the Instructions For Nonprofit. These guidelines outline the requirements for maintaining tax-exempt status, including annual reporting obligations and compliance with charitable solicitation laws. It is crucial for nonprofit organizations to familiarize themselves with these guidelines to avoid potential issues with the IRS and ensure ongoing compliance.

Filing Deadlines / Important Dates

Nonprofit organizations must be aware of key filing deadlines related to the Instructions For Nonprofit. These deadlines can vary based on the organization's fiscal year and state regulations. Common deadlines include:

- Annual filing of Form 990 or its variants, typically due on the 15th day of the fifth month after the end of the fiscal year.

- State-specific filings, which may have different deadlines.

- Renewal of any necessary licenses or registrations, which may also have specific due dates.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Instructions For Nonprofit can be done through various methods, depending on the requirements set forth by the IRS and state authorities. Organizations can typically choose from the following submission methods:

- Online submission through the IRS e-file system, which can expedite processing.

- Mailing the completed form to the appropriate IRS address, ensuring it is postmarked by the due date.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete instructions for nonprofit

Easily Prepare Instructions For Nonprofit on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly option compared to traditional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any hindrances. Handle Instructions For Nonprofit on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and eSign Instructions For Nonprofit Effortlessly

- Find Instructions For Nonprofit and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and eSign Instructions For Nonprofit to ensure seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the basic Instructions For Nonprofit organizations using airSlate SignNow?

To get started with airSlate SignNow, nonprofits should first create an account on our platform. Follow the simple on-screen Instructions For Nonprofit to upload your documents, add signers, and send the documents for eSignature. Our user-friendly interface ensures that every step is straightforward, making the process quick and efficient.

-

Are there special pricing options available for nonprofits?

Yes, airSlate SignNow offers special pricing for nonprofits as part of our commitment to supporting organizations that make a positive impact. You can find tailored Instructions For Nonprofit on our pricing page that outline discounted plans specifically designed for your needs, ensuring you stay within budget while accessing essential features.

-

What features does airSlate SignNow offer specifically for nonprofits?

airSlate SignNow provides several features tailored for nonprofits, including customizable templates, workflow automation, and secure storage. These features help streamline your eSigning process, and you can find detailed Instructions For Nonprofit on how to utilize these tools effectively to improve your organization’s efficiency.

-

How can airSlate SignNow benefit our nonprofit organization?

By using airSlate SignNow, nonprofit organizations can save time and reduce paperwork while ensuring documents are signed securely. The platform allows you to track the status of documents in real-time, providing clear Instructions For Nonprofit to enhance transparency and accountability within your organization.

-

Can I integrate airSlate SignNow with other tools my nonprofit uses?

Absolutely! airSlate SignNow can be easily integrated with various applications that your nonprofit may already use, such as Google Drive, Salesforce, and more. Explore our integration Instructions For Nonprofit to learn how to connect your existing tools with SignNow to automate tasks and streamline operations.

-

What types of documents can I sign using airSlate SignNow?

You can use airSlate SignNow to sign a wide range of documents, including contracts, agreements, and consent forms relevant to your nonprofit activities. The platform provides simple Instructions For Nonprofit on how to prepare, send, and sign these documents electronically, ensuring you meet all legal requirements.

-

Is airSlate SignNow secure for sensitive nonprofit documents?

Yes, security is a top priority for airSlate SignNow. We comply with industry-standard security protocols, ensuring that your nonprofit's sensitive documents are protected. Familiarize yourself with our security Instructions For Nonprofit to understand how we safeguard your data throughout the eSigning process.

Get more for Instructions For Nonprofit

Find out other Instructions For Nonprofit

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer