458 A,458 B, 458 C Form

What is the 458 a, 458 b, 458 c

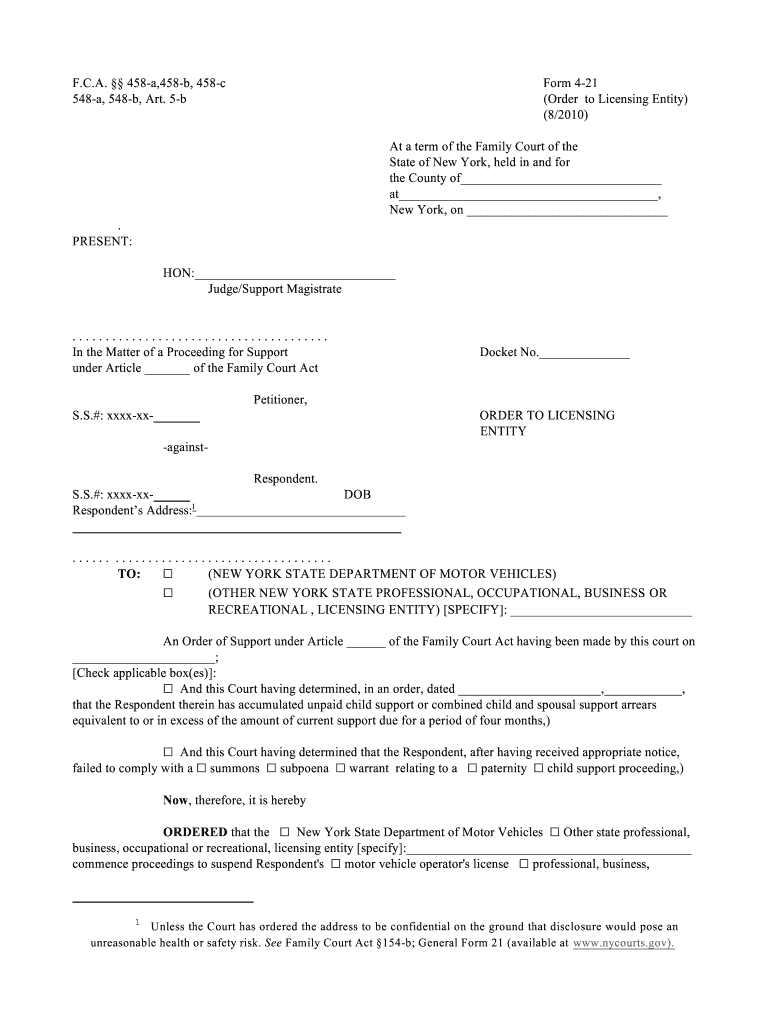

The 458 a, 458 b, 458 c forms are important documents used primarily in specific financial and legal contexts. These forms serve various purposes, including reporting income, deductions, or other financial information as required by regulatory authorities. Understanding the specific function of each form is crucial for compliance and accurate reporting.

How to use the 458 a, 458 b, 458 c

Using the 458 a, 458 b, 458 c forms involves several steps to ensure proper completion and submission. First, gather all necessary information and documents relevant to the form's purpose. Next, fill out the forms accurately, ensuring that all required fields are completed. Review the forms for any errors before submission to avoid delays or penalties.

Steps to complete the 458 a, 458 b, 458 c

Completing the 458 a, 458 b, 458 c forms requires careful attention to detail. Follow these steps:

- Collect all required information, including personal details and financial data.

- Access the forms through the appropriate channels, whether online or in print.

- Fill in the forms, ensuring accuracy in all entries.

- Review the completed forms for any mistakes or missing information.

- Submit the forms according to the specified submission methods.

Legal use of the 458 a, 458 b, 458 c

The legal use of the 458 a, 458 b, 458 c forms is governed by various regulations that ensure their validity. These forms must be completed in accordance with applicable laws to be considered legally binding. Proper execution, including signatures and dates, is essential to meet legal requirements.

Filing Deadlines / Important Dates

It is vital to be aware of the filing deadlines associated with the 458 a, 458 b, 458 c forms. Missing these deadlines can result in penalties or other legal consequences. Typically, deadlines may vary based on the specific form and the context in which it is used, so it is important to check for any updates or changes each tax year.

Required Documents

When preparing to complete the 458 a, 458 b, 458 c forms, certain documents are typically required. These may include:

- Identification documents, such as a driver's license or Social Security number.

- Financial statements or records relevant to the information being reported.

- Previous years' forms, if applicable, for reference.

Examples of using the 458 a, 458 b, 458 c

Examples of how the 458 a, 458 b, 458 c forms are used can provide clarity on their application. For instance, a business may use these forms to report income and expenses during tax season. Individuals may also use them to claim deductions or credits based on their financial activities. Understanding these examples can help users navigate their own form completion more effectively.

Quick guide on how to complete 458 a458 b 458 c

Effortlessly prepare 458 a,458 b, 458 c on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without delays. Manage 458 a,458 b, 458 c on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and eSign 458 a,458 b, 458 c with ease

- Find 458 a,458 b, 458 c and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to store your modifications.

- Select how you want to share your form: via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, and mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 458 a,458 b, 458 c and guarantee seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow for 458 a, 458 b, and 458 c users?

airSlate SignNow offers a range of features tailored for 458 a, 458 b, and 458 c users, including easy document eSigning, template management, and real-time collaboration. These features streamline the signing process and enhance productivity for businesses. Additionally, users benefit from mobile accessibility and robust security options ensuring document safety.

-

How does airSlate SignNow support integrations for 458 a, 458 b, and 458 c?

airSlate SignNow provides seamless integrations with popular third-party applications, making it ideal for 458 a, 458 b, and 458 c users. Whether you're using CRM, HR, or project management tools, our integrations simplify workflows. This connectivity allows for efficient document management and enhances overall user experience.

-

What pricing plans does airSlate SignNow offer for 458 a, 458 b, and 458 c?

airSlate SignNow offers competitive pricing plans tailored for 458 a, 458 b, and 458 c users. Plans are designed to meet the needs of individuals and businesses of all sizes, ensuring accessibility to eSigning features. By choosing the right plan, users can maximize their efficiency while enjoying cost savings.

-

What security measures are implemented in airSlate SignNow for 458 a, 458 b, and 458 c documents?

Security is a top priority at airSlate SignNow for 458 a, 458 b, and 458 c documents. Our platform utilizes industry-standard encryption, multi-factor authentication, and secure cloud storage to protect sensitive data. Users can confidently send and store documents, knowing their information is safeguarded.

-

How can airSlate SignNow enhance productivity for businesses using 458 a, 458 b, and 458 c?

airSlate SignNow signNowly enhances productivity for businesses utilizing 458 a, 458 b, and 458 c by simplifying the document signing process. With easy setup, quick sharing, and automated workflows, businesses can reduce turnaround times dramatically. This efficiency allows teams to focus on core tasks, improving overall operational effectiveness.

-

Can airSlate SignNow be used for mobile signing for 458 a, 458 b, and 458 c?

Yes, airSlate SignNow supports mobile signing, making it convenient for 458 a, 458 b, and 458 c users. With a user-friendly mobile app, you can send, sign, and manage documents on-the-go. This flexibility ensures that your signing process is not limited by location, enhancing accessibility and efficiency.

-

What advantages does airSlate SignNow provide for remote teams working with 458 a, 458 b, and 458 c?

For remote teams using 458 a, 458 b, and 458 c, airSlate SignNow offers signNow advantages such as real-time collaboration and easy-to-use eSigning capabilities. Teams can access and sign documents from any location, fostering better communication and faster project completion. This adaptability ensures that remote work is as efficient as possible.

Get more for 458 a,458 b, 458 c

- Form 941 pr rev january 2017 employers quarterly federal tax return puerto rican version ftp irs

- Access control and photo id badge application form

- Dma 5199 iapdf medicaid renewal request for information notice

- Hfa 1500 form 2016 2019

- Figure 7 tac 84809b motor vehicle retail installment form

- Patient registration form fastmed urgent care

- Da form 3023 1 july 1965 gage record apd army

- Af form 978

Find out other 458 a,458 b, 458 c

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application