Vat484 2009

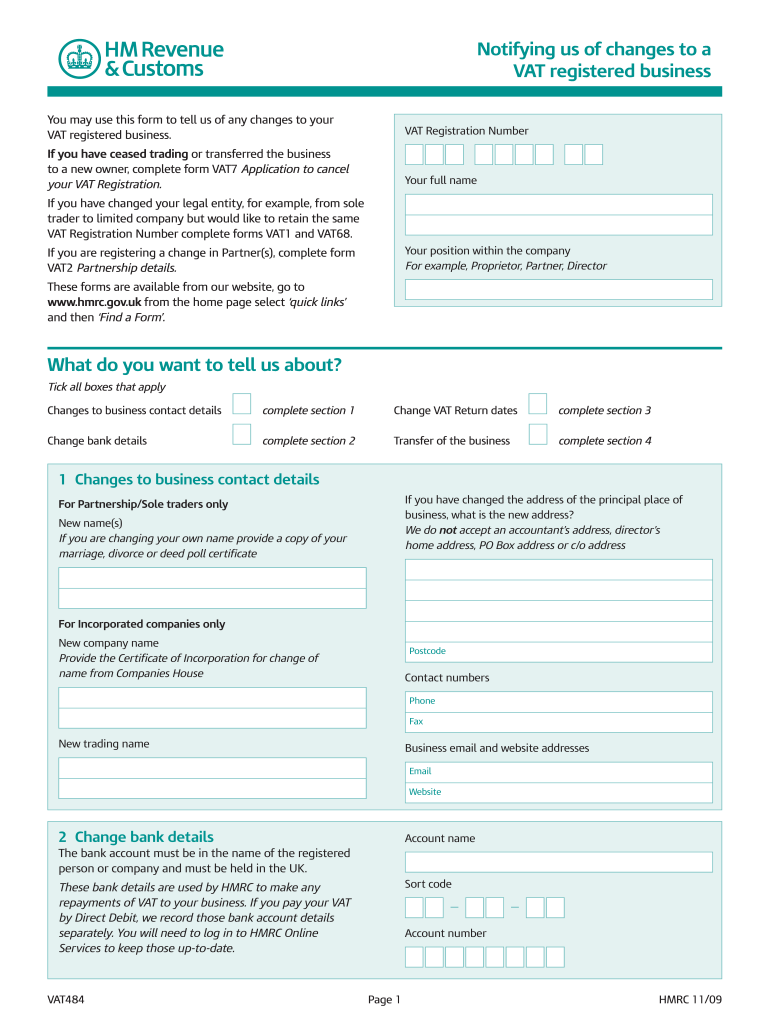

What is the VAT 484?

The VAT 484 form is a document used for Value Added Tax (VAT) purposes, specifically in relation to the HM Revenue and Customs (HMRC) in the United Kingdom. It serves as a declaration for businesses that need to report their VAT transactions, ensuring compliance with tax regulations. While primarily a UK form, understanding its structure and purpose can be beneficial for U.S. businesses engaging in international trade or dealing with UK-based clients.

Steps to Complete the VAT 484

Completing the VAT 484 form requires careful attention to detail. Here are the essential steps:

- Gather Required Information: Collect all necessary data, including your business details, VAT registration number, and transaction specifics.

- Fill Out the Form: Input the gathered information accurately in the designated fields. Ensure that all entries are correct to avoid complications.

- Review for Accuracy: Double-check all information entered on the form to confirm its accuracy and completeness.

- Submit the Form: Once verified, submit the VAT 484 form through the appropriate channels, whether online or via mail.

Legal Use of the VAT 484

The VAT 484 form is legally binding when completed correctly and submitted in accordance with HMRC guidelines. It is essential for businesses to ensure that all information is accurate, as inaccuracies can lead to penalties or legal issues. The form must be filled out with honest and precise data to maintain compliance with tax laws.

Key Elements of the VAT 484

Understanding the key elements of the VAT 484 is crucial for effective completion. These elements typically include:

- Business Information: Details about the business, including name, address, and VAT registration number.

- Transaction Details: Information regarding the nature of the transactions being reported, including amounts and dates.

- Declaration Statement: A statement confirming that the information provided is accurate and complete.

Form Submission Methods

The VAT 484 form can be submitted through various methods. Businesses can choose to file it online via the HMRC portal, which is often the most efficient option. Alternatively, the form can be mailed to the relevant HMRC address or submitted in person at designated offices. Each method has its own processing time, so it is advisable to choose one that aligns with your filing deadlines.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the VAT 484 form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to adhere to submission deadlines and ensure that all information is accurate to avoid these consequences.

Quick guide on how to complete vat 484 formpdffillercom

A Concise Manual on How to Prepare Your Vat484

Finding the appropriate template can be difficult when you require formal international paperwork. Even if you possess the necessary form, it may be cumbersome to swiftly fill it out according to all the specifications if you utilize hard copies instead of handling everything digitally. airSlate SignNow represents the online electronic signature platform that assists you in overcoming these obstacles. It enables you to acquire your Vat484 and promptly complete and sign it on-site without needing to reprint documents if you make an error.

Here are the steps you must follow to prepare your Vat484 with airSlate SignNow:

- Click the Obtain Form button to upload your document to our editor immediately.

- Begin with the first blank field, enter your information, and proceed with the Next feature.

- Complete the empty fields using the Cross and Check tools from the toolbar above.

- Select the Highlight or Line options to mark the most important details.

- Click on Image and upload one if your Vat484 requires it.

- Utilize the right-side panel to add more fields for you or others to fill out if needed.

- Review your responses and validate the form by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete modifications to the form by clicking the Finished button and selecting your file-sharing preferences.

Once your Vat484 is prepared, you can distribute it in whichever manner you prefer - send it to your recipients via email, SMS, fax, or even print directly from the editor. You can also securely keep all your completed documents in your account, organized in folders based on your preferences. Don’t squander time on manual document filling; explore airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct vat 484 formpdffillercom

FAQs

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

Which software gives me an option to fill out the VAT book in Arabic?

Which software gives me an option to fill out the VAT book in Arabic?The answer is GccVATPro softwareBook Free Demo Now: Best VAT SoftwareGenerate UAE and Saudi Arabia VAT Return on the single clickGCC VAT PRO FeaturesSales – Order to CashAccountingVATService Order to CashInventory Mgmt.PurchaseDashboard

-

Which category of VAT form do you have to fill out for mobile covers and accessories?

Here is most important point is the place(state) where you sell mobile covers & accessories. If it is gujarat, then GVAT ACT is applicable. Rate of VAT is 4% normally. Concept of VAT is varies from state to state, so we need to decide the Place Of Business.Now come to the point, If dealer is registered in gujaratFollowing Forms are use fora) Payment of VAT => Form 207b) Monthy / Quarterly Return => Form 201, 201A, 201B, 201C.c) Annual Return => Form 205, 205AWhere,Form 207 represent the payment challan,Form 201 represent the return summary (monthly),Form 201A represent List of Sales during the period,Form 201B represent List of Purchases during the period,Form 201C represent Balance of Stock (quarterly),Form 205 represent return summary (annually),Form 205A represent Additional Information of Business.With all these, my answer is complete.

-

How many times do I have to fill a VAT in the UAE?

in every 3 months click here you will find UAE official resourcse

-

Two pipes working together can fill a large vat in 35 minutes. It would take the larger pipe 55 minutes to fill the baby itself. To the nearest minute, how long would it take for the smaller pipe to fill the vat?

Let A be the larger pipe, and B be the smaller one. Then:35A+35B=1 and55A=1Then:385A+385B=11 and385A=7Then:385A+385B-385A=11–7=4385B=4385/4 B=1The smaller pipe takes 385/4 minutes to fill the tank by itself ……….

-

How does one get invited to the Quora Partner Program? What criteria do they use, or is it completely random?

I live in Germany. I got an invite to the Quora partner program the day I landed in USA for a business trip. So from what I understand, irrespective of the number of views on your answers, there is some additional eligibility criteria for you to even get an email invite.If you read the terms of service, point 1 states:Eligibility. You must be located in the United States to participate in this Program. If you are a Quora employee, you are eligible to participate and earn up to a maximum of $200 USD a month. You also agree to be bound by the Platform Terms (https://www.quora.com/about/tos) as a condition of participation.Again, if you check the FAQ section:How can other people I know .participate?The program is invite-only at this time, but we intend to open it up to more people as time goes on.So my guess is that Quora is currently targeting people based out of USA, who are active on Quora, may or may not be answering questions frequently ( I have not answered questions frequently in the past year or so) and have a certain number of consistent answer views.Edit 1: Thanks to @Anita Scotch, I got to know that the Quora partner program is now available for other countries too. Copying Anuta’s comment here:If you reside in one of the Countries, The Quora Partner Program is active in, you are eligible to participate in the program.” ( I read more will be added, at some point, but here are the countries, currently eligible at this writing,) U.S., Japan, Germany, Spain, France, United Kingdom, Italy and Australia.11/14/2018Edit 2 : Here is the latest list of countries with 3 new additions eligible for the Quora Partner program:U.S., Japan, Germany, Spain, France, United Kingdom, Italy, Canada, Australia, Indonesia, India and Brazil.Thanks to Monoswita Rez for informing me about this update.

-

How can I get more people to fill out my survey?

Make it compellingQuickly and clearly make these points:Who you are and why you are doing thisHow long it takesWhats in it for me -- why should someone help you by completing the surveyExample: "Please spend 3 minutes helping me make it easier to learn Mathematics. Answer 8 short questions for my eternal gratitude and (optional) credit on my research findings. Thank you SO MUCH for helping."Make it convenientKeep it shortShow up at the right place and time -- when people have the time and inclination to help. For example, when students are planning their schedules. Reward participationOffer gift cards, eBooks, study tips, or some other incentive for helping.Test and refineTest out different offers and even different question wording and ordering to learn which has the best response rate, then send more invitations to the offer with the highest response rate.Reward referralsIf offering a reward, increase it for referrals. Include a custom invite link that tracks referrals.

Create this form in 5 minutes!

How to create an eSignature for the vat 484 formpdffillercom

How to make an electronic signature for the Vat 484 Formpdffillercom in the online mode

How to generate an electronic signature for the Vat 484 Formpdffillercom in Google Chrome

How to create an electronic signature for putting it on the Vat 484 Formpdffillercom in Gmail

How to create an eSignature for the Vat 484 Formpdffillercom right from your mobile device

How to create an eSignature for the Vat 484 Formpdffillercom on iOS devices

How to generate an electronic signature for the Vat 484 Formpdffillercom on Android

People also ask

-

What is Vat484 and how does it relate to airSlate SignNow?

Vat484 is a specific document format that can be effectively managed using airSlate SignNow. It allows businesses to digitally sign and send necessary documents securely and efficiently. By utilizing airSlate SignNow, users can streamline their Vat484 documentation process, ensuring compliance and ease of access.

-

How can airSlate SignNow help with managing Vat484 documents?

airSlate SignNow provides robust tools for creating, signing, and storing Vat484 documents. The platform's intuitive interface makes it easy to handle these documents, ensuring that all signatures are captured correctly and securely. This helps businesses maintain compliance with VAT regulations while saving time.

-

Is there a pricing plan for airSlate SignNow that includes Vat484 functionalities?

Yes, airSlate SignNow offers various pricing plans that include full support for Vat484 functionalities. Depending on your business needs, you can choose from different tiers that provide access to advanced features tailored for efficient document management, including the handling of Vat484 documents.

-

What are the key features of airSlate SignNow for processing Vat484?

Key features of airSlate SignNow for processing Vat484 include customizable templates, secure eSignature capabilities, and automated workflows. These features help users efficiently manage their Vat484 documents, ensuring that they are signed and distributed without delays.

-

Can airSlate SignNow integrate with other software for handling Vat484?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions that can assist in the management of Vat484 documents. Popular integrations include CRMs and document management systems, allowing for a streamlined process from document creation to signing.

-

What benefits does airSlate SignNow offer for businesses dealing with Vat484?

Using airSlate SignNow for Vat484 offers numerous benefits, including enhanced document security, reduced processing time, and improved compliance. Businesses can ensure that their Vat484 documents are handled efficiently, allowing them to focus on core operations while maintaining regulatory compliance.

-

Is airSlate SignNow suitable for small businesses dealing with Vat484?

Yes, airSlate SignNow is particularly suitable for small businesses managing Vat484 documents. The platform is designed to be cost-effective and user-friendly, enabling smaller organizations to benefit from professional-grade document management without the associated high costs.

Get more for Vat484

- Jis code cis form

- Pc 593 petition for complete estate settlement michigan courts form

- Affidavit of decedents successor fill online printable pdffiller form

- Fillable online pc 639 petition for appointment of conservator andor form

- Fillable online release of child by guardian fax email print form

- Consent to adoption by parent form

- Clerkregister of deeds about any of the forms since clerks and other

- Csclcd 520 rev form

Find out other Vat484

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online