IfyouareregisteringachangeinPartners,completeform 2017

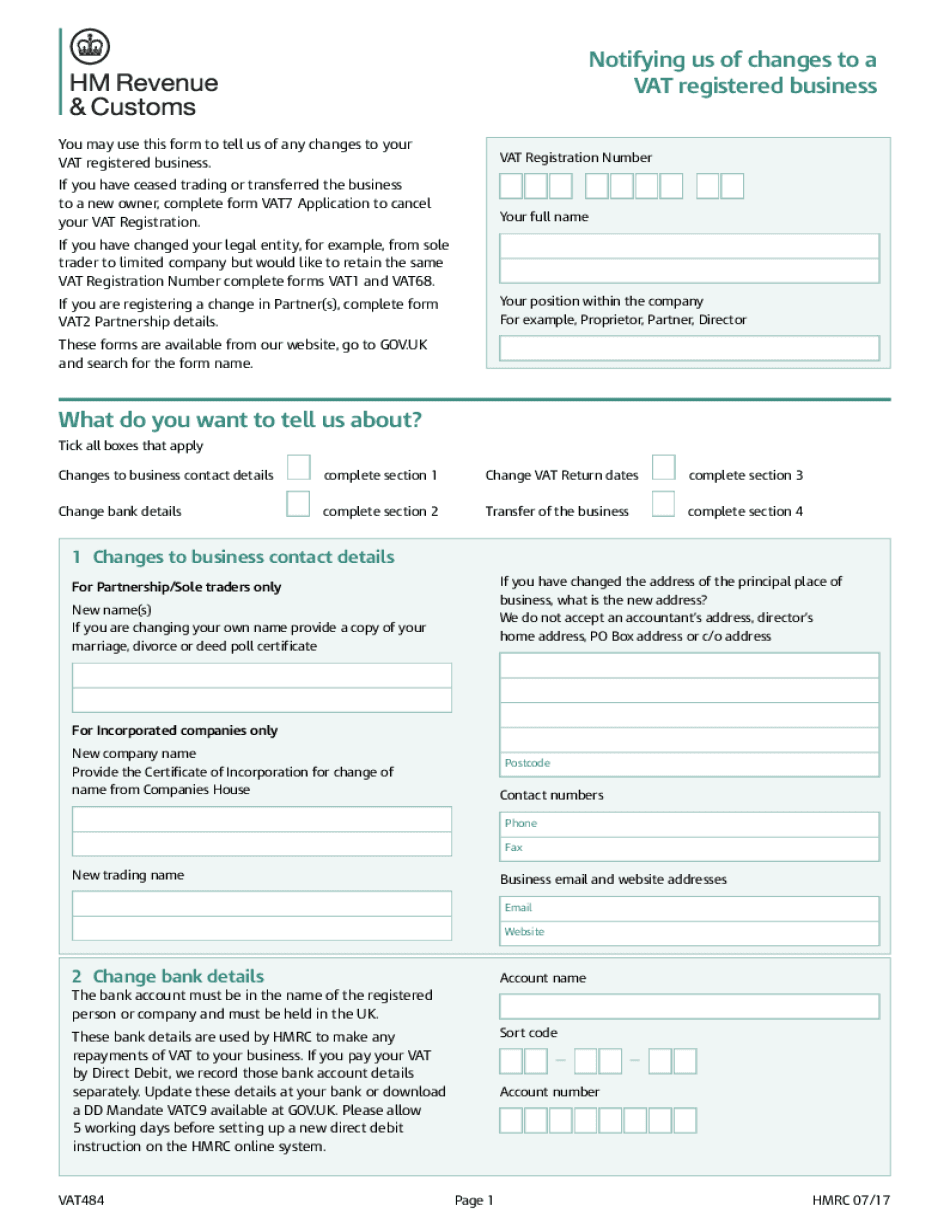

Understanding the vat484 Form

The vat484 form is essential for businesses in the United States that need to report changes in partners or ownership structures. This form is particularly relevant for partnerships and limited liability companies (LLCs) that must notify the IRS and other relevant authorities about changes in their partnership arrangements. Completing the vat484 form accurately ensures compliance with tax regulations and helps maintain the integrity of the business's tax filings.

Steps to Complete the vat484 Form

Filling out the vat484 form involves several key steps to ensure accuracy and compliance. Follow these steps for a smooth completion:

- Gather necessary information about the partnership, including names, addresses, and tax identification numbers of all partners.

- Clearly indicate the nature of the change being reported, such as adding or removing a partner.

- Provide the effective date of the change to establish when the new partnership structure takes effect.

- Review the completed form for accuracy before submission, ensuring all required fields are filled out correctly.

Legal Use of the vat484 Form

The vat484 form is legally binding when completed and submitted according to IRS guidelines. It serves as an official record of changes in partnership structure, which can be crucial during audits or legal inquiries. Ensuring that the form is filled out correctly and submitted in a timely manner helps protect the business from potential penalties or compliance issues.

Required Documents for Submission

When preparing to submit the vat484 form, certain documents may be needed to support the information provided. These documents can include:

- Partnership agreement or amendments that reflect the changes in partners.

- Tax identification numbers for all partners involved.

- Any correspondence from the IRS regarding previous filings that may be relevant.

Filing Deadlines for the vat484 Form

Timely submission of the vat484 form is critical to avoid penalties. Generally, the form should be filed within a specific period following the change in partnership. It is advisable to check the IRS guidelines for the exact deadlines, as these can vary based on the nature of the changes and the type of business entity.

Form Submission Methods

The vat484 form can be submitted through various methods, ensuring flexibility for businesses. Options typically include:

- Online submission via the IRS e-filing system, which allows for quicker processing.

- Mailing a paper version of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if preferred.

Examples of Using the vat484 Form

Understanding practical scenarios can help clarify the use of the vat484 form. For instance, if a partnership is adding a new partner, the existing partners must complete the vat484 form to officially notify the IRS of this change. Similarly, if a partner is retiring or leaving the partnership, the form must be submitted to reflect this change in ownership. Each situation requires careful attention to detail to ensure compliance with tax laws.

Quick guide on how to complete ifyouareregisteringachangeinpartnerscompleteform

Prepare IfyouareregisteringachangeinPartners,completeform effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Handle IfyouareregisteringachangeinPartners,completeform on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign IfyouareregisteringachangeinPartners,completeform with ease

- Find IfyouareregisteringachangeinPartners,completeform and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, cumbersome form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign IfyouareregisteringachangeinPartners,completeform and maintain excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ifyouareregisteringachangeinpartnerscompleteform

Create this form in 5 minutes!

How to create an eSignature for the ifyouareregisteringachangeinpartnerscompleteform

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is vat484 in relation to airSlate SignNow?

The term 'vat484' refers to a specific document format within airSlate SignNow that facilitates the efficient signing and management of VAT-related documents. By using the vat484 format, businesses can streamline their tax documentation processes, ensuring compliance and saving time. This makes airSlate SignNow an ideal solution for companies handling VAT transactions.

-

How does airSlate SignNow simplify the management of vat484 documents?

airSlate SignNow integrates powerful features designed to make the management of vat484 documents seamless. Users can easily upload, share, and eSign these documents, reducing the need for physical paperwork. This efficiency not only saves time but also enhances organization and tracking of vital tax documents.

-

Is there a cost associated with using vat484 on airSlate SignNow?

Yes, using vat484 documents incurs a standard pricing model based on the plan selected with airSlate SignNow. However, the platform offers a cost-effective solution that can greatly reduce overhead associated with traditional document management. Pricing may vary depending on the features and integrations you choose.

-

What are the key features of airSlate SignNow for managing vat484?

airSlate SignNow provides essential features for managing vat484, including document templates, customizable workflows, and automated reminders. Users can also track the status of their vat484 documents in real-time, ensuring an efficient signing process. These features signNowly enhance productivity and compliance.

-

Can I integrate airSlate SignNow with other tools for handling vat484 documents?

Absolutely! airSlate SignNow supports integrations with numerous applications, making it easy to incorporate your vat484 document workflow into existing systems. Popular integrations include CRM tools, project management software, and accounting platforms, allowing for a unified approach to document management.

-

What benefits can businesses expect from using airSlate SignNow for vat484 documents?

By utilizing airSlate SignNow for vat484 documents, businesses can enjoy improved efficiency, reduced error rates, and signNow cost savings. The platform's user-friendly interface simplifies the signing process for both senders and recipients, making it easier to maintain compliance. This ultimately enhances the overall operational flow of tax documentation.

-

Is it easy to create a vat484 document in airSlate SignNow?

Yes, creating a vat484 document in airSlate SignNow is a simple process. Users can select from customizable templates to ensure all the necessary information is captured accurately. This ease of use helps in reducing the time taken to prepare and send documents for eSigning.

Get more for IfyouareregisteringachangeinPartners,completeform

- Ri 101 request for public records foi state of michigan michigan form

- Additional copies to all attorneys of record form

- Uscis privacy release form sample

- Inz 1200 form

- Manualsdshswagovsitesdefaultchild support worksheet csf 020910 washington form

- Dd form 3150 ampquotcontractor personnel and visitor certification of

- Supportapplecomen usht201222apple security updates apple support form

- Canadian designated learning institutions listcanadian designated learning institutions listcanadian designated learning form

Find out other IfyouareregisteringachangeinPartners,completeform

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe