Fillable Form VAT484 Notifying of Changes to a VAT 2022-2026

Understanding the VAT484 Form

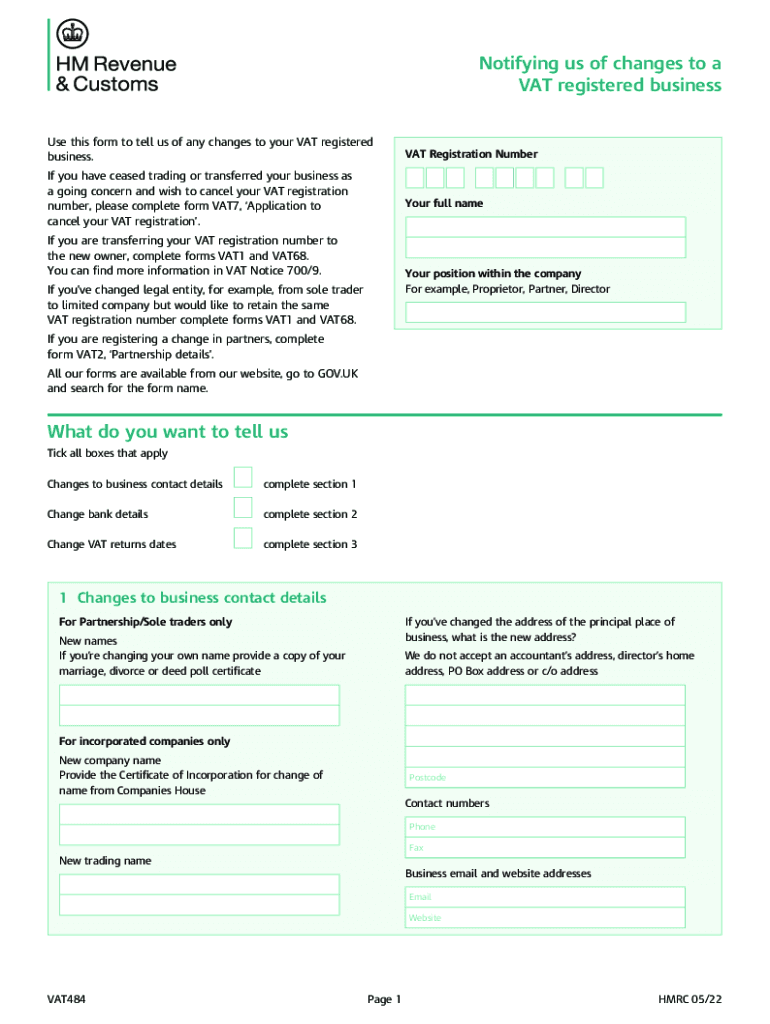

The VAT484 form, officially known as the Notifying Of Changes To A VAT, is essential for businesses to report changes related to their Value Added Tax (VAT) registration. This form is used to inform the HM Revenue and Customs (HMRC) about significant updates, such as changes in business address, ownership, or VAT registration status. Properly completing this form ensures compliance with tax regulations and helps maintain accurate records with HMRC.

Steps to Complete the VAT484 Form

Completing the VAT484 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your VAT registration number and details of the changes being reported. Follow these steps:

- Clearly state the changes in the appropriate sections of the form.

- Provide any supporting documentation required to validate the changes.

- Review the completed form for accuracy before submission.

- Submit the form to HMRC through the designated channels.

How to Obtain the VAT484 Form

The VAT484 form can be easily obtained through HMRC's official website. Users can download the form in PDF format, which is suitable for printing and filling out manually. Additionally, businesses may find the form available through various tax software platforms that facilitate electronic submissions. Ensure you have the most recent version of the form to avoid any compliance issues.

Legal Use of the VAT484 Form

The VAT484 form is legally binding when completed and submitted in accordance with HMRC regulations. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies could lead to penalties or legal ramifications. Understanding the legal implications of submitting this form helps businesses maintain compliance and avoid unnecessary complications.

Key Elements of the VAT484 Form

When filling out the VAT484 form, several key elements must be included to ensure proper processing by HMRC. These elements include:

- Your business name and VAT registration number.

- Details of the changes being reported.

- Contact information for follow-up inquiries.

- Signature of the authorized representative of the business.

Form Submission Methods

The VAT484 form can be submitted to HMRC in various ways. Businesses have the option to:

- Submit the form online through HMRC's digital services.

- Mail the completed form to the appropriate HMRC address.

- Deliver the form in person at a local HMRC office, if necessary.

Choosing the right submission method depends on your business needs and preferences for record-keeping.

Quick guide on how to complete fillable form vat484 notifying of changes to a vat

Complete Fillable Form VAT484 Notifying Of Changes To A VAT effortlessly on any device

Digital document management has become more favored among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Fillable Form VAT484 Notifying Of Changes To A VAT on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and electronically sign Fillable Form VAT484 Notifying Of Changes To A VAT with ease

- Obtain Fillable Form VAT484 Notifying Of Changes To A VAT and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Fillable Form VAT484 Notifying Of Changes To A VAT and ensure outstanding communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable form vat484 notifying of changes to a vat

Create this form in 5 minutes!

How to create an eSignature for the fillable form vat484 notifying of changes to a vat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is vat484 in the context of electronic signatures?

Vat484 refers to a specific document type that may require electronic signatures for compliance. airSlate SignNow supports the creation and management of vat484 documents, ensuring they are signed quickly and securely. Utilizing our platform simplifies the signing process while maintaining compliance with necessary regulations.

-

How does airSlate SignNow ensure the security of vat484 documents?

Security is a top priority for airSlate SignNow, especially for sensitive documents like vat484. Our platform employs advanced encryption, secure cloud storage, and multi-factor authentication to protect all your signed documents. This comprehensive security setup ensures that your vat484 documents are safe from unauthorized access.

-

What are the pricing options for signing vat484 documents with airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs for managing vat484 and other documents. Our plans include features that cater to various volumes of document signing and collaboration. Check our pricing page to find the best plan that suits your requirements for handling vat484 documents.

-

Can I integrate airSlate SignNow with other tools for managing vat484 documents?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, which enhances the management of vat484 documents. Whether you need to connect with CRM systems, cloud storage solutions, or other productivity tools, our platform makes it easy to automate processes. This integration support allows you to streamline workflows involving vat484 documents.

-

What are the main features of airSlate SignNow for handling vat484?

airSlate SignNow provides several features specifically designed for the efficient handling of vat484 documents. Key features include customizable templates, tracking of signature statuses, and automated reminders for signers. These capabilities make it easy to manage and expedite the signing process for vat484 and similar documents.

-

How can airSlate SignNow help improve my workflow for vat484 documents?

By utilizing airSlate SignNow, you can signNowly enhance your workflow for vat484 documents. Our user-friendly interface allows you to create, send, and sign documents effortlessly, leading to reduced turnaround times. Additionally, features like document templates and workflow automation help ensure that your vat484 documents are processed efficiently.

-

What benefits does airSlate SignNow provide for businesses managing vat484?

Businesses managing vat484 documents can enjoy a range of benefits by using airSlate SignNow. These include increased productivity through quicker turnaround times, enhanced document security, and compliance with regulatory standards. Our platform empowers you to manage vat484 effectively, saving you both time and money.

Get more for Fillable Form VAT484 Notifying Of Changes To A VAT

- Child care fire drill log form

- Osap password reset form

- Release of medical information bayview physicians group

- Newsword com form

- Thank you again for agreeing to serve on the program committee form

- Form oel expv 05 the mississippi department of education

- Front of transfer amp bill of sale form haflinger half blood registry

- Sale consulting agreement template form

Find out other Fillable Form VAT484 Notifying Of Changes To A VAT

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe