Certificate under Section 203 of the Income Tax Act 961 for Tax Deductd of Selary Form

What is the Certificate Under Section 203 Of The Income Tax Act 961 For Tax Deducted Of Salary

The Certificate Under Section 203 of the Income Tax Act 961 is an important document for individuals subject to tax deductions from their salary. This certificate serves as proof that tax has been deducted at source by the employer and provides details about the amount deducted. It is crucial for employees to retain this certificate for their records, as it can be used when filing annual tax returns. The certificate typically includes information such as the employee's name, tax identification number, the amount of salary, and the total tax deducted.

How to use the Certificate Under Section 203 Of The Income Tax Act 961 For Tax Deducted Of Salary

Using the Certificate Under Section 203 is straightforward. Employees should include this certificate when preparing their income tax returns. The information contained within the certificate helps in accurately reporting income and tax paid, which is essential for calculating any additional tax liability or refunds due. It is advisable to keep the certificate alongside other financial documents to ensure a smooth filing process.

Steps to complete the Certificate Under Section 203 Of The Income Tax Act 961 For Tax Deducted Of Salary

Completing the Certificate Under Section 203 involves several steps:

- Gather necessary information, including your name, tax identification number, and salary details.

- Ensure that your employer has accurately deducted the tax from your salary.

- Request the certificate from your employer if it has not been provided automatically.

- Review the certificate for accuracy before using it for tax filing.

Legal use of the Certificate Under Section 203 Of The Income Tax Act 961 For Tax Deducted Of Salary

The legal use of the Certificate Under Section 203 is significant as it serves as evidence of tax compliance. This certificate can be presented during tax assessments or audits to demonstrate that the appropriate taxes have been withheld and remitted to the government. It is essential to ensure that all information on the certificate is correct to avoid any legal complications.

Key elements of the Certificate Under Section 203 Of The Income Tax Act 961 For Tax Deducted Of Salary

Key elements of the Certificate Under Section 203 include:

- Employee's Name: The full name of the employee receiving the salary.

- Tax Identification Number: A unique number assigned to the employee for tax purposes.

- Salary Amount: The total salary paid during the financial year.

- Tax Deducted: The total amount of tax deducted at source.

- Employer's Details: Information about the employer, including name and address.

IRS Guidelines

The IRS provides guidelines on how to properly use the Certificate Under Section 203 for tax purposes. Employees should refer to these guidelines to ensure compliance with federal tax regulations. Understanding these guidelines can help in accurately reporting income and tax deductions, minimizing the risk of errors during tax filing.

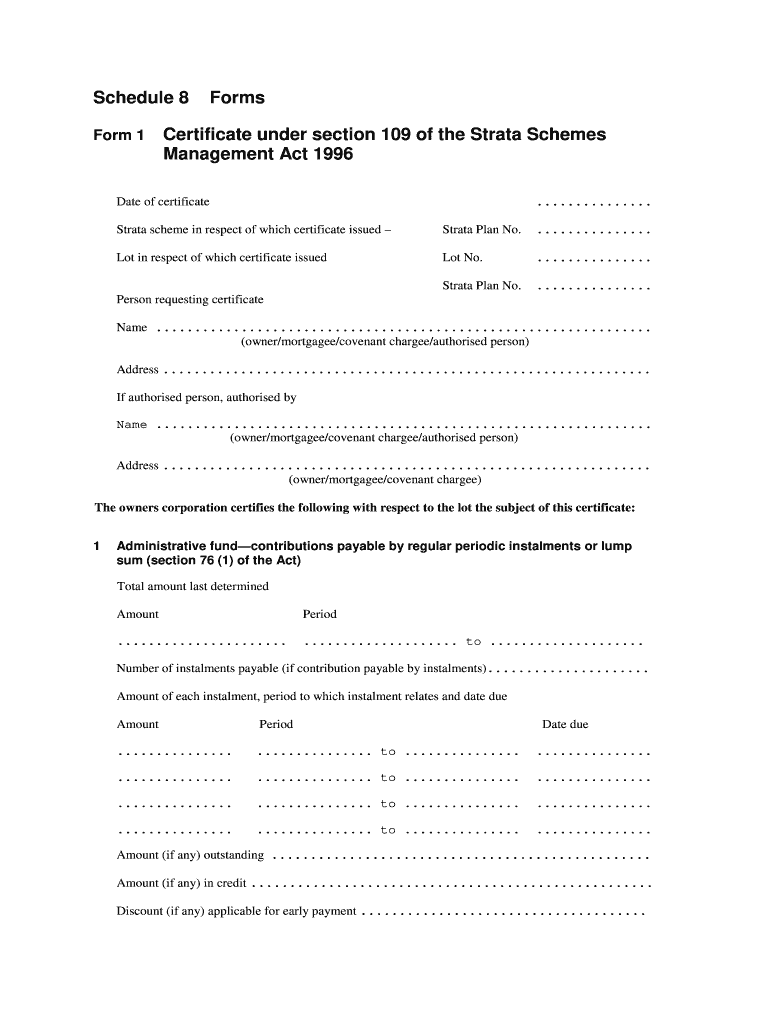

Quick guide on how to complete certificate 109 form

Learn how to effortlessly navigate the Certificate Under Section 203 Of The Income Tax Act 961 For Tax Deducted Of Salary completion with these straightforward instructions

Submitting and authenticating forms online is becoming more and more prevalent and the preferred choice for many users. It offers numerous advantages over traditional printed documents, such as convenience, efficiency, heightened precision, and security.

With tools like airSlate SignNow, you can locate, modify, authenticate, and enhance and transmit your Certificate Under Section 203 Of The Income Tax Act 961 For Tax Deductd Of Selary without the hassle of endless printing and scanning. Follow this concise guide to begin and complete your form.

Follow these steps to obtain and complete Certificate Under Section 203 Of The Income Tax Act 961 For Tax Deductd Of Selary

- Begin by clicking the Get Form button to access your form in our editor.

- Pay attention to the green label on the left that highlights essential fields to ensure you don’t miss them.

- Utilize our professional tools to comment, adjust, sign, secure, and refine your document.

- Protect your document or convert it into a fillable form utilizing the appropriate tab features.

- Review the form and verify it for errors or inconsistencies.

- Hit DONE to complete your edits.

- Rename your document or keep it as is.

- Choose the storage service to save your document, send it via USPS, or click the Download Now button to obtain your file.

If Certificate Under Section 203 Of The Income Tax Act 961 For Tax Deductd Of Selary isn’t what you were looking for, you can explore our extensive selection of pre-filled forms that you can complete with ease. Discover our solution today!

Create this form in 5 minutes or less

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

Where can I get the form for migration certificate?

Migration is issued by the Universities themselves.The best way is to inquire your college they will guide you further.In case you happen to be from A.P.J Abdul Kalam Technical Universityhere is the link to get it issued online.Hope it helpsStudent Service (Dashboard) Dr. A.P.J. Abdul Kalam Technical University (Lucknow)Regards

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

Create this form in 5 minutes!

How to create an eSignature for the certificate 109 form

How to make an eSignature for the Certificate 109 Form in the online mode

How to create an eSignature for your Certificate 109 Form in Google Chrome

How to generate an electronic signature for putting it on the Certificate 109 Form in Gmail

How to make an electronic signature for the Certificate 109 Form straight from your smartphone

How to create an eSignature for the Certificate 109 Form on iOS

How to create an electronic signature for the Certificate 109 Form on Android devices

People also ask

-

What is the 'amount name strata' feature in airSlate SignNow?

The 'amount name strata' feature in airSlate SignNow allows users to customize document fields to include specific monetary amounts or naming conventions. This helps streamline the document signing process by ensuring accurate information is captured. Businesses can easily manage and identify various amounts linked to specific strata.

-

How can airSlate SignNow improve my document management regarding 'amount name strata'?

With airSlate SignNow, managing documents related to 'amount name strata' becomes more efficient. The platform's customizable templates allow for easy integration of amounts and names into legal documents. This enhances organization and ensures that all necessary details are included in important agreements.

-

What pricing plans does airSlate SignNow offer for handling 'amount name strata'?

airSlate SignNow offers various pricing plans tailored to different business needs, including options for handling 'amount name strata' effectively. Each plan comes with features that ensure document security, integrations, and customizable templates, allowing you to choose what suits your organization best. Pricing is straightforward and is designed to be cost-effective.

-

Can I integrate airSlate SignNow with other software to manage 'amount name strata' effectively?

Yes, airSlate SignNow integrates seamlessly with various software applications that can help manage 'amount name strata.' These integrations allow for efficient data flow and synchronization, ensuring that all necessary amounts and names are captured across platforms. This improves overall productivity and reduces errors in documentation.

-

What are the benefits of using airSlate SignNow for 'amount name strata' documentation?

Using airSlate SignNow for 'amount name strata' documentation offers numerous benefits, including increased efficiency and improved accuracy. The platform allows for real-time editing and easy collaboration, which means multiple stakeholders can contribute to documents. Additionally, the electronic signing feature facilitates faster approvals, saving time for all parties involved.

-

Is airSlate SignNow secure for handling sensitive 'amount name strata' data?

Absolutely! airSlate SignNow employs advanced security protocols to ensure the protection of sensitive 'amount name strata' data. This includes encryption, secure storage, and stringent access controls. Users can confidently manage their documents knowing that their information is safe from unauthorized access.

-

How user-friendly is airSlate SignNow for new users dealing with 'amount name strata'?

airSlate SignNow is designed to be highly user-friendly, even for new users managing 'amount name strata.' The intuitive interface and straightforward navigation mean that businesses can quickly adopt the solution without extensive training. Tutorials and customer support are also available to assist users in getting started efficiently.

Get more for Certificate Under Section 203 Of The Income Tax Act 961 For Tax Deductd Of Selary

- Ap 102 notice of appeal 1 12 appeal forms

- In an administrative appeal request alaska form

- Designation of transcript shs ap 140 alaska court system form

- Ap 140 response to request alaska form

- Notice of appeal from administrative agency to superior form

- How to write up a bill of sale when giving it away for freeit form

- Know all men by these presents that a form

- Verification of matrixlist of creditors creditors form mailing

Find out other Certificate Under Section 203 Of The Income Tax Act 961 For Tax Deductd Of Selary

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors