110 Insurance Form

What is the 110 Insurance

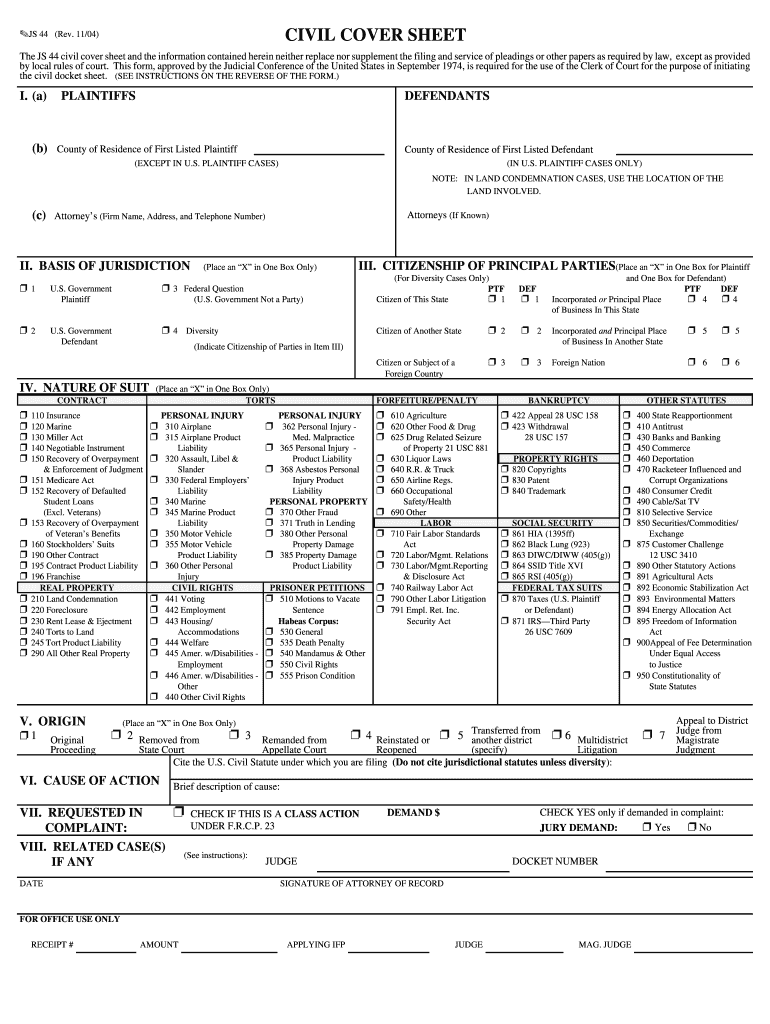

The 110 Insurance form is a crucial document used primarily in the insurance industry. It serves as a declaration of coverage and outlines the specifics of the insurance policy being applied for. This form is essential for both individuals and businesses seeking to secure insurance coverage, as it provides necessary information to insurers for underwriting and policy issuance. Understanding the purpose and contents of the 110 Insurance form is vital for ensuring that applicants meet the requirements set forth by insurance providers.

How to use the 110 Insurance

Using the 110 Insurance form involves several key steps to ensure accurate completion and submission. First, gather all relevant information, including personal details, coverage requirements, and any supporting documents. Next, carefully fill out the form, ensuring that all sections are completed accurately to avoid delays in processing. Once the form is filled out, it can be submitted electronically or via traditional mail, depending on the insurer's preferences. Utilizing digital tools can streamline this process, making it easier to manage and track submissions.

Steps to complete the 110 Insurance

Completing the 110 Insurance form requires attention to detail. Follow these steps for a successful submission:

- Gather necessary information, including identification, prior insurance details, and coverage needs.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the form according to the insurer’s guidelines, either online or by mail.

Legal use of the 110 Insurance

The legal use of the 110 Insurance form is governed by specific regulations that ensure its validity. To be legally binding, the form must be completed in accordance with state laws and insurance regulations. This includes providing accurate information and obtaining necessary signatures. Additionally, electronic submissions must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA), which establish the legality of digital signatures in the United States.

Required Documents

When completing the 110 Insurance form, several documents may be required to support your application. These typically include:

- Proof of identity, such as a driver's license or passport.

- Previous insurance policy documents, if applicable.

- Financial information to determine coverage needs.

- Any additional documentation requested by the insurer.

Form Submission Methods

The 110 Insurance form can be submitted through various methods, depending on the insurer's preferences. Common submission methods include:

- Online submission through the insurer's website or a secure digital platform.

- Mailing a physical copy of the form to the insurer's designated address.

- In-person submission at local insurance offices, if available.

Eligibility Criteria

Eligibility for the 110 Insurance form varies based on the type of insurance being applied for. Generally, applicants must meet specific criteria, which may include:

- Age requirements, typically being at least eighteen years old.

- Residency in the state where the insurance is being sought.

- Meeting financial criteria based on the type of coverage requested.

Quick guide on how to complete 110 insurance

Effortlessly Prepare 110 Insurance on Any Device

Web-based document management has become increasingly popular among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can find the appropriate template and securely keep it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly without complications. Manage 110 Insurance on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Easily Edit and Electronically Sign 110 Insurance

- Find 110 Insurance and click on Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specially provides for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Select your preferred way to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and eSign 110 Insurance and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is 110 Insurance?

110 Insurance is a specialized insurance product tailored to provide comprehensive coverage for businesses. It is designed to meet the unique needs of various industries, ensuring peace of mind and financial security for your operations.

-

How does airSlate SignNow simplify the 110 Insurance process?

airSlate SignNow streamlines the 110 Insurance process by allowing businesses to securely send and eSign important documents online. This reduces the time and hassle involved in managing paperwork and ensures that contracts and policies are processed efficiently.

-

What are the key features of airSlate SignNow for handling 110 Insurance documents?

AirSlate SignNow offers features such as customizable templates, document sharing, and secure eSigning to enhance the management of 110 Insurance documents. These tools facilitate quicker transactions and ensure compliance with regulatory requirements.

-

Is airSlate SignNow cost-effective for managing 110 Insurance?

Yes, airSlate SignNow provides a cost-effective solution for managing 110 Insurance documents. With competitive pricing plans, businesses can access powerful features without overstretching their budgets, making it an ideal choice for companies looking to streamline their processes.

-

What benefits does airSlate SignNow offer for 110 Insurance professionals?

With airSlate SignNow, 110 Insurance professionals can enjoy benefits such as increased productivity, reduced errors, and enhanced security of sensitive information. The platform's intuitive interface allows users to focus on their core tasks rather than administrative burdens.

-

Can airSlate SignNow integrate with other tools used for 110 Insurance?

Absolutely! airSlate SignNow easily integrates with various CRM systems, document management software, and other tools commonly used in the 110 Insurance industry. This integration helps create a seamless workflow, enhancing efficiency and collaboration.

-

How secure is airSlate SignNow for handling 110 Insurance documents?

AirSlate SignNow prioritizes security, ensuring that all 110 Insurance documents are protected through encryption and secure storage. The platform complies with industry standards and regulations, providing a safe environment for sensitive information.

Get more for 110 Insurance

- Accessible formnet visualfill

- Npfc user reference guide united states coast guard form

- Standard form 1098 schedule of canceled or gsa

- Important disclosure verabank form

- Using ssnvs social security form

- Claim for unpaid compensation of deceased civilian opm form

- Fees and mileage of witnesses form

- Us government transportation request gtr part i form

Find out other 110 Insurance

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple