UCC Financing Statement Addendum UCC Financing Statement Addendum Form

What is the UCC Financing Statement Addendum

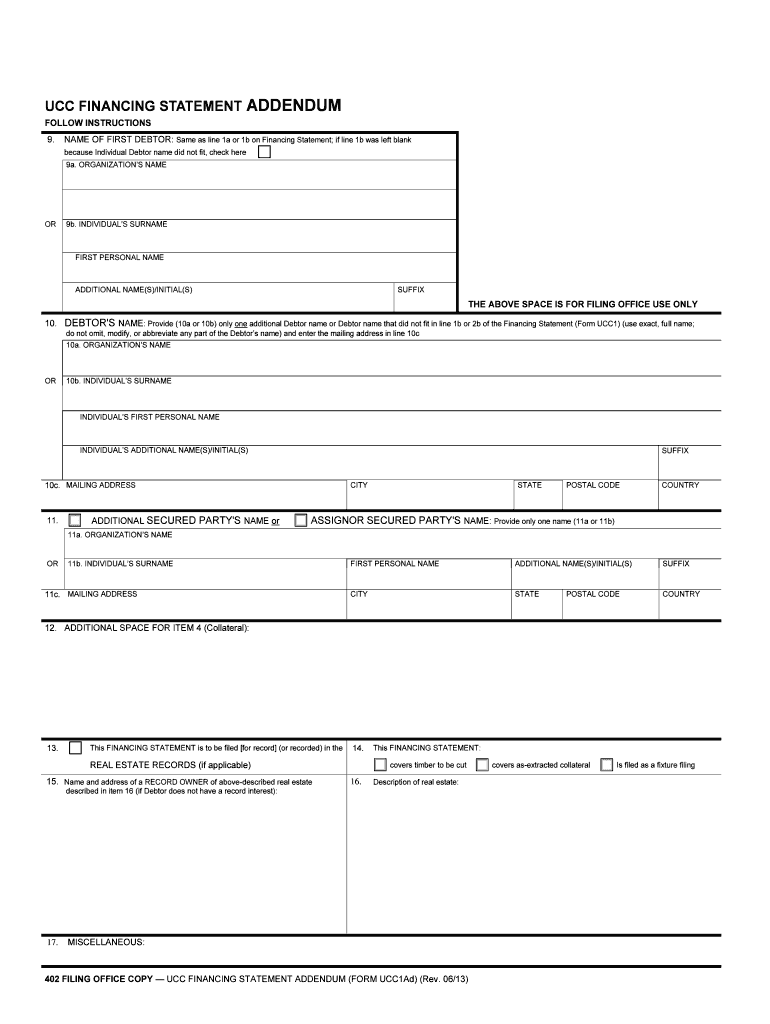

The UCC Financing Statement Addendum is a legal document used in the United States to provide additional information related to a UCC financing statement. This addendum is essential for creditors to secure their interests in collateral by clarifying details that may not be fully captured in the primary financing statement. It allows for the inclusion of specific information about the collateral, such as descriptions or additional parties involved in the transaction. Understanding the purpose and function of this addendum is crucial for businesses and individuals involved in secured transactions.

Key Elements of the UCC Financing Statement Addendum

Several key elements are necessary for a UCC Financing Statement Addendum to be effective. These elements include:

- Debtor Information: Full legal name and address of the debtor.

- Secured Party Information: Name and address of the secured party or creditor.

- Description of Collateral: Detailed description of the collateral that is being secured.

- Additional Information: Any other relevant information that clarifies the security interest.

Each of these elements plays a vital role in ensuring that the addendum is legally binding and enforceable.

Steps to Complete the UCC Financing Statement Addendum

Completing the UCC Financing Statement Addendum involves a series of steps to ensure accuracy and compliance. Follow these steps for proper completion:

- Gather necessary information about the debtor and secured party.

- Clearly describe the collateral involved in the transaction.

- Fill out the addendum form, ensuring all required fields are completed.

- Review the document for accuracy and completeness.

- Sign the addendum electronically or in person, as required.

- File the addendum with the appropriate state authority, along with any required fees.

By following these steps, individuals and businesses can ensure that their UCC Financing Statement Addendum is properly executed and filed.

Legal Use of the UCC Financing Statement Addendum

The UCC Financing Statement Addendum serves a critical legal function in secured transactions. It provides a framework for creditors to establish their rights over collateral in the event of debtor default. The addendum must comply with the Uniform Commercial Code (UCC) regulations to be enforceable. This includes adhering to specific filing requirements and ensuring that the information provided is accurate and complete. Legal professionals often recommend using this addendum to protect interests in various types of collateral, such as inventory, equipment, or accounts receivable.

State-Specific Rules for the UCC Financing Statement Addendum

Each state in the U.S. may have specific rules and requirements regarding the UCC Financing Statement Addendum. These variations can include:

- Different filing fees and procedures.

- Unique requirements for additional information or documentation.

- Variations in the acceptable formats for the addendum.

It is essential for individuals and businesses to familiarize themselves with their state's regulations to ensure compliance and avoid potential legal issues.

Examples of Using the UCC Financing Statement Addendum

Practical examples of using the UCC Financing Statement Addendum can provide clarity on its application. For instance:

- A business seeking a loan may use the addendum to describe specific equipment as collateral.

- A lender may include additional parties involved in a transaction to clarify their rights over shared collateral.

- In a partnership, the addendum can specify the interests of each partner in the collateral.

These examples illustrate how the addendum can be tailored to fit various scenarios, ensuring that all parties' interests are adequately protected.

Quick guide on how to complete ucc financing statement addendum ucc financing statement addendum

Effortlessly Prepare UCC Financing Statement Addendum UCC Financing Statement Addendum on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage UCC Financing Statement Addendum UCC Financing Statement Addendum on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and eSign UCC Financing Statement Addendum UCC Financing Statement Addendum with Ease

- Locate UCC Financing Statement Addendum UCC Financing Statement Addendum and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes moments and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign UCC Financing Statement Addendum UCC Financing Statement Addendum to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a UCC financing statement addendum?

A UCC financing statement addendum is a legal form that is filed with a UCC financing statement to provide additional information about the secured party or collateral. This addendum ensures that all relevant details are properly documented and allows for greater clarity in the secured transactions. It is essential for individuals and businesses involved in loans secured by personal property.

-

How can airSlate SignNow help with UCC financing statement addendums?

airSlate SignNow streamlines the process of creating and signing UCC financing statement addendums. Our user-friendly platform enables you to prepare these documents quickly, ensuring compliance and accuracy. By using airSlate SignNow, you can expedite your secured transactions and enhance productivity.

-

What are the pricing options for using airSlate SignNow for UCC financing statement addendums?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes. Our subscription models include various features for eSigning, document management, and collaboration, allowing for efficient handling of UCC financing statement addendums. Check our website for detailed pricing information and choose the best plan for your needs.

-

Can I integrate airSlate SignNow with other software for managing UCC financing statement addendums?

Yes, airSlate SignNow offers seamless integrations with numerous third-party applications and software platforms. This allows you to incorporate eSigning capabilities directly within your existing systems, making it easier to manage UCC financing statement addendums alongside other business processes. Explore our integration options to enhance your workflow.

-

What are the benefits of using airSlate SignNow for UCC financing statement addendums?

Using airSlate SignNow for UCC financing statement addendums offers various benefits, including reduced turnaround times, enhanced document security, and increased compliance. Our platform's intuitive interface ensures that users can navigate easily and efficiently. This results in faster processing of financial transactions and improved overall operations.

-

Is electronic signing of UCC financing statement addendums legally binding?

Yes, electronic signatures on UCC financing statement addendums are legally binding and recognized by law in many jurisdictions. airSlate SignNow adheres to the electronic signature laws, ensuring that your documents are valid and enforceable. This provides peace of mind when handling important legal and financial documents.

-

What support does airSlate SignNow provide for creating UCC financing statement addendums?

airSlate SignNow offers comprehensive customer support to assist you in creating UCC financing statement addendums. Our resources include guided tutorials, FAQs, and a responsive support team available to answer your queries. We aim to ensure that you have all the necessary tools and knowledge for successful document management.

Get more for UCC Financing Statement Addendum UCC Financing Statement Addendum

- Form tsp 70 a late request for full withdrawal withdrawal

- Never send your social security form

- Form for report on test and maintenance of containment backflow prevention assembly

- Note this report is authorized by the federal employees compensation act 5 usc 8103a the black lung benefits act 30 usc 901 form

- Individual flight record and flight certificate army da form 759 jan 2016 apd army

- Application for statement of ownership application for statement of ownership form

- Nc mvr 615 2008 form

- Mn uniform reappointment application revised 10 2016

Find out other UCC Financing Statement Addendum UCC Financing Statement Addendum

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple