This Agreement Gives Up the Protection of Your Bankruptcy Discharge for This Debt Form

Understanding This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt

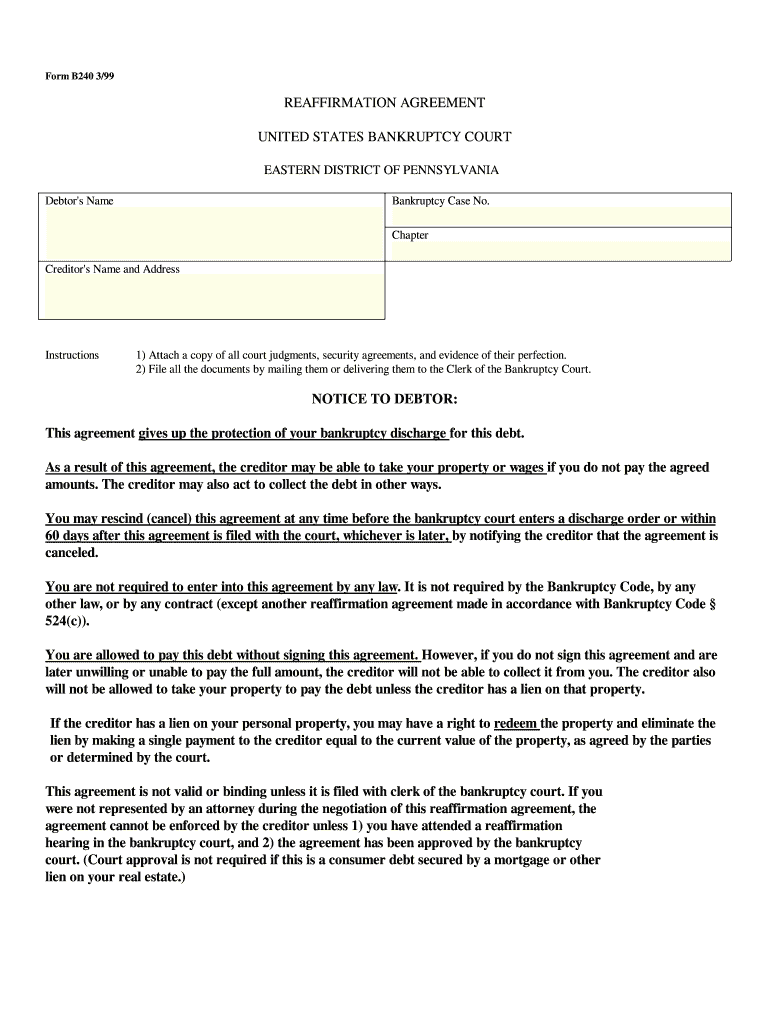

This agreement is a legal document that signifies a debtor's decision to relinquish the protections typically afforded by a bankruptcy discharge for a specific debt. When a bankruptcy discharge is granted, it generally eliminates the debtor's personal liability for certain debts, providing a fresh financial start. However, this agreement indicates that the debtor is choosing to accept responsibility for the debt and waives the protections that come with a bankruptcy discharge. It is crucial to understand the implications of this decision, as it can affect financial stability and future creditworthiness.

Steps to Complete This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt

Completing this agreement requires careful attention to detail to ensure its validity. Here are the essential steps:

- Review the terms of the agreement thoroughly to understand your obligations.

- Fill in your personal information, including your name and address.

- Clearly specify the debt for which you are waiving the bankruptcy discharge protection.

- Sign and date the document in the designated areas.

- Consider having the agreement notarized to enhance its legal standing.

Legal Use of This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt

This agreement is legally binding, provided it meets certain criteria. It must be executed voluntarily, without coercion, and both parties must have the legal capacity to enter into the agreement. Additionally, it should comply with state laws governing contracts. The document serves as a formal acknowledgment that the debtor understands the consequences of giving up the protections offered by a bankruptcy discharge and agrees to be held liable for the specified debt.

Key Elements of This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt

Several key elements are essential for this agreement to be effective:

- Identification of Parties: Clearly identify the debtor and the creditor involved in the agreement.

- Debt Description: Provide a detailed description of the debt being addressed.

- Waiver Clause: Include a clause that explicitly states the debtor is waiving the protections of the bankruptcy discharge.

- Signatures: Ensure that both parties sign the document, indicating their consent to the terms.

How to Use This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt

This agreement should be used when a debtor is willing to take on the responsibility for a debt that would otherwise be discharged in bankruptcy. It is often employed in negotiations with creditors who may be willing to accept a settlement or payment plan in exchange for the debtor's assurance of repayment. By executing this agreement, the debtor acknowledges their commitment to repay the debt, which may help in negotiating more favorable terms with the creditor.

State-Specific Rules for This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt

It's important to note that the enforceability and requirements of this agreement can vary by state. Some states may have specific laws that govern the waiving of bankruptcy protections, including required disclosures or the need for notarization. Always consult with a legal professional familiar with your state's laws to ensure compliance and to understand the potential implications of entering into this agreement.

Quick guide on how to complete this agreement gives up the protection of your bankruptcy discharge for this debt

Complete This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt seamlessly on any device

Managing documents online has become increasingly common among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly and efficiently. Handle This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt effortlessly

- Obtain This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save the changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt' mean?

This phrase indicates that by signing the agreement, you are waiving the legal protection typically provided by a bankruptcy discharge specific to that debt. It means you can be held liable for repayment despite your bankruptcy status. Understanding this can be crucial when making financial decisions or entering into agreements.

-

How can airSlate SignNow help with documents that include the phrase 'This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt'?

airSlate SignNow offers a secure and efficient platform for electronically signing documents that include critical phrases like 'This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt'. Our intuitive interface simplifies the signing process, ensuring that you can manage your agreements quickly and effectively.

-

Are there any costs associated with using airSlate SignNow for documents related to bankruptcy agreements?

Yes, airSlate SignNow offers various pricing plans, allowing you to select the one that fits your needs. Regardless of the plan, you will have access to features for handling sensitive documents, including those referring to 'This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt'. Evaluate our options to find a plan suited to your business requirements.

-

What features does airSlate SignNow provide for handling legal documents?

Our platform includes electronic signatures, document templates, and secure cloud storage. These features make it easy to manage documents containing sensitive terms like 'This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt', while ensuring compliance with legal standards and providing an audit trail.

-

Can I integrate airSlate SignNow with other tools?

Absolutely! airSlate SignNow supports integration with various popular business tools and software, enhancing your workflow efficiency. By linking tools you already use with airSlate SignNow, you can seamlessly manage documents that may include phrases such as 'This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt'.

-

Is airSlate SignNow secure for managing sensitive documents?

Yes, security is a top priority for airSlate SignNow. We use state-of-the-art encryption and compliance protocols to protect your documents, including those that contain critical protections like 'This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt'. Your data is safe with us.

-

How can airSlate SignNow benefit my business when dealing with bankruptcy-related documents?

By using airSlate SignNow, businesses can streamline the process of obtaining electronic signatures for all documents, including those concerning bankruptcy. This can save time, improve efficiency, and reduce errors in handling sensitive agreements like 'This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt'.

Get more for This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt

Find out other This Agreement Gives Up The Protection Of Your Bankruptcy Discharge For This Debt

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now