31, , or Other Tax Year 2015

What is the 31, , Or Other Tax Year

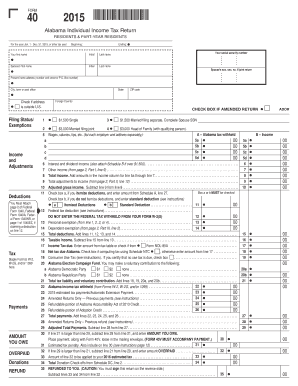

The 31, , Or Other Tax Year form is a critical document used primarily for tax reporting purposes in the United States. This form allows taxpayers to report income, deductions, and credits for a specific tax year, which may differ from the standard calendar year. Understanding this form is essential for individuals and businesses to ensure compliance with IRS regulations and to accurately reflect their financial activities during the specified period.

Steps to complete the 31, , Or Other Tax Year

Completing the 31, , Or Other Tax Year form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax forms. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. It is important to double-check calculations and verify that all required fields are filled. Once completed, review the form for any errors before submission.

Legal use of the 31, , Or Other Tax Year

The legal use of the 31, , Or Other Tax Year form is governed by IRS regulations, which stipulate that the form must be filled out accurately and submitted by the appropriate deadlines. This form serves as a formal declaration of income and tax obligations, making it essential for maintaining compliance with federal tax laws. Failure to use the form correctly can result in penalties or audits, underscoring the importance of understanding its legal implications.

Filing Deadlines / Important Dates

Filing deadlines for the 31, , Or Other Tax Year form can vary based on the specific tax year being reported. Typically, individual taxpayers must submit their forms by April 15 of the following year, while businesses may have different deadlines depending on their structure. It is crucial to stay informed about these dates to avoid late fees and ensure timely processing of tax returns.

Required Documents

To complete the 31, , Or Other Tax Year form, certain documents are required. Taxpayers should have W-2 forms from employers, 1099 forms for any freelance or contract work, and documentation for any deductions or credits claimed. Additionally, records of any estimated tax payments made throughout the year should be included. Collecting these documents in advance can streamline the filing process and ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The 31, , Or Other Tax Year form can be submitted through various methods, providing flexibility for taxpayers. Online submission is available through the IRS e-file system, which is often the fastest and most efficient option. Alternatively, forms can be mailed to the appropriate IRS address, or in some cases, submitted in person at local IRS offices. Each method has its own processing times and requirements, so it is important to choose the one that best suits individual needs.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 31, , Or Other Tax Year form. These guidelines outline the necessary information to include, the format for reporting income and deductions, and the penalties for non-compliance. Familiarizing oneself with these guidelines is essential for ensuring that the form is completed correctly and submitted on time, thereby minimizing the risk of errors and potential audits.

Quick guide on how to complete 31 2015 or other tax year

Effortlessly Prepare 31, , Or Other Tax Year on Any Device

Online document management has gained popularity among both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to quickly create, edit, and eSign your documents without delays. Manage 31, , Or Other Tax Year on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Modify and eSign 31, , Or Other Tax Year without Stress

- Locate 31, , Or Other Tax Year and click on Get Form to initiate the process.

- Utilize the tools we provide to submit your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method for delivering your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and eSign 31, , Or Other Tax Year while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 31 2015 or other tax year

Create this form in 5 minutes!

How to create an eSignature for the 31 2015 or other tax year

How to create an eSignature for your 31 2015 Or Other Tax Year in the online mode

How to make an eSignature for the 31 2015 Or Other Tax Year in Chrome

How to make an electronic signature for signing the 31 2015 Or Other Tax Year in Gmail

How to create an electronic signature for the 31 2015 Or Other Tax Year from your smart phone

How to generate an electronic signature for the 31 2015 Or Other Tax Year on iOS devices

How to create an eSignature for the 31 2015 Or Other Tax Year on Android devices

People also ask

-

What is airSlate SignNow and how does it help with document signing for the 31, , Or Other Tax Year?

airSlate SignNow is an electronic signature solution that simplifies the process of sending and signing documents. With features tailored for efficiency, it enables businesses to quickly handle essential paperwork related to the 31, , Or Other Tax Year without the delays associated with traditional methods.

-

How does airSlate SignNow's pricing model work for the 31, , Or Other Tax Year?

airSlate SignNow offers a flexible pricing structure designed to meet various business needs. You can choose plans based on the volume of documents signed, which makes it ideal for organizations preparing for the 31, , Or Other Tax Year, whether they manage just a few documents or require a high volume of transactions.

-

What features does airSlate SignNow provide to support the 31, , Or Other Tax Year?

airSlate SignNow includes features such as cloud storage, document templates, and audit trails, all crucial for managing files during the 31, , Or Other Tax Year. These functionalities ensure that your documents are organized, compliant, and easily retrievable when needed.

-

Can airSlate SignNow integrate with other software for the 31, , Or Other Tax Year?

Yes, airSlate SignNow seamlessly integrates with various business applications, including CRMs and accounting software. This allows for a streamlined workflow that can enhance productivity and ensure that all document signing processes related to the 31, , Or Other Tax Year are efficient and convenient.

-

How secure is my data with airSlate SignNow during the 31, , Or Other Tax Year?

airSlate SignNow prioritizes data security by implementing encryption and compliance with industry standards. Your documents relating to the 31, , Or Other Tax Year are protected, giving you peace of mind when handling sensitive information.

-

Is there any customer support available with airSlate SignNow for the 31, , Or Other Tax Year?

Absolutely! airSlate SignNow provides comprehensive customer support, ensuring that users can resolve any issues quickly. Whether you have questions about document signing related to the 31, , Or Other Tax Year or need technical assistance, support is readily available.

-

What benefits does airSlate SignNow offer for businesses preparing for the 31, , Or Other Tax Year?

By using airSlate SignNow, businesses can experience faster turnaround times on document approvals, which is particularly beneficial as they prepare for the 31, , Or Other Tax Year. The user-friendly interface and robust features help reduce time spent on administrative tasks, allowing teams to focus on critical operations.

Get more for 31, , Or Other Tax Year

Find out other 31, , Or Other Tax Year

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free