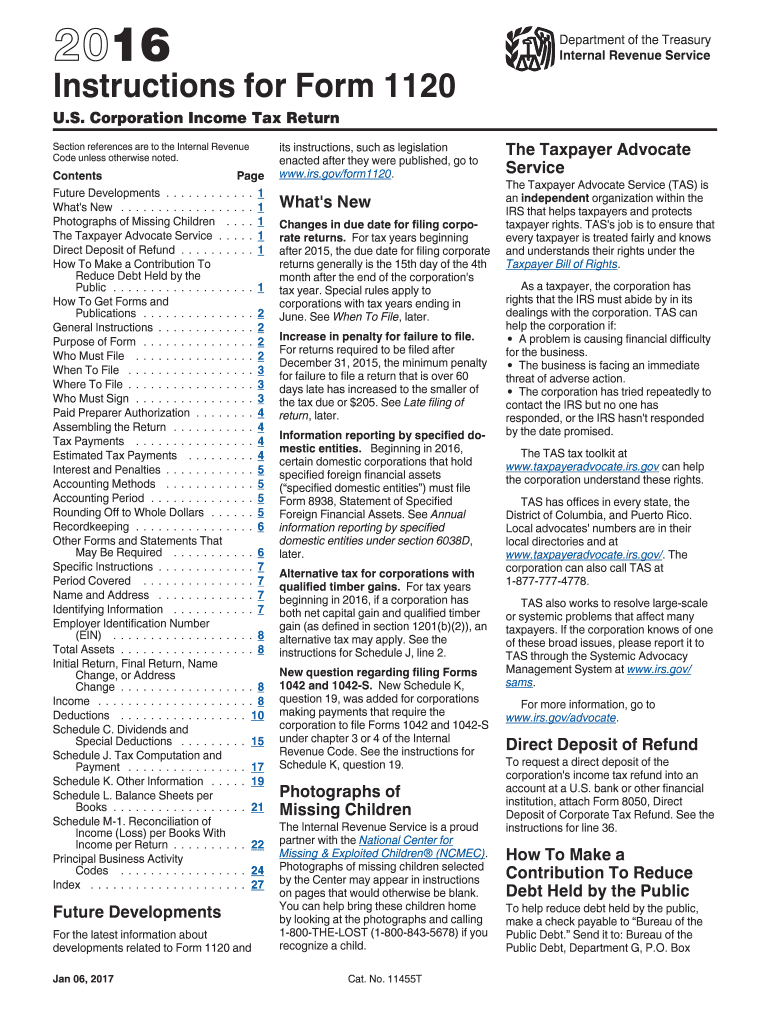

Irs Form 1120 Instructions 2016

What is the IRS Form 1120 Instructions

The IRS Form 1120 Instructions provide detailed guidance for corporations filing their income tax returns. This form is essential for C corporations, which are taxed separately from their owners. The instructions outline the necessary steps to complete the form accurately, ensuring compliance with federal tax regulations. Understanding these instructions is crucial for corporations to report their income, deductions, and tax liabilities correctly.

Steps to Complete the IRS Form 1120 Instructions

Completing the IRS Form 1120 involves several key steps:

- Gather financial records, including income statements and balance sheets.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report income by providing details on gross receipts and sales.

- List allowable deductions, such as operating expenses, salaries, and taxes paid.

- Calculate the taxable income by subtracting total deductions from total income.

- Determine the tax liability based on the applicable corporate tax rate.

- Review the completed form for accuracy before submission.

How to Obtain the IRS Form 1120 Instructions

The IRS Form 1120 Instructions can be obtained directly from the IRS website. They are available as a downloadable PDF, which can be printed for convenience. Additionally, physical copies may be available at local IRS offices or through tax professionals. It is essential to ensure that you are using the most current version of the instructions, as tax laws and regulations may change annually.

Legal Use of the IRS Form 1120 Instructions

The IRS Form 1120 Instructions are legally binding documents that guide corporations in fulfilling their tax obligations. Proper adherence to these instructions ensures that the corporation complies with federal tax laws, avoiding potential penalties for inaccuracies or non-compliance. It is important to note that electronic submissions are accepted, provided that they meet the IRS's e-filing standards.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the IRS Form 1120. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically means the deadline is April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Corporations may also request an automatic six-month extension for filing, but any taxes owed must be paid by the original deadline to avoid penalties.

Form Submission Methods

The IRS Form 1120 can be submitted through various methods, including:

- Electronic filing via approved e-file providers, which is often faster and more efficient.

- Mailing a paper form to the appropriate IRS address based on the corporation's location and whether a payment is included.

- In-person submission at designated IRS offices, although this method is less common.

Quick guide on how to complete irs form 1120 instructions 2016

Effortlessly prepare Irs Form 1120 Instructions on any gadget

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the necessary template and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and without delays. Handle Irs Form 1120 Instructions on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to change and electronically sign Irs Form 1120 Instructions with ease

- Find Irs Form 1120 Instructions and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight key sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming searches for forms, or mistakes that require new copies to be printed. airSlate SignNow manages all your document administration needs in just a few clicks from your preferred device. Edit and electronically sign Irs Form 1120 Instructions and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 1120 instructions 2016

Create this form in 5 minutes!

How to create an eSignature for the irs form 1120 instructions 2016

How to generate an eSignature for your Irs Form 1120 Instructions 2016 online

How to generate an eSignature for the Irs Form 1120 Instructions 2016 in Chrome

How to make an eSignature for signing the Irs Form 1120 Instructions 2016 in Gmail

How to create an electronic signature for the Irs Form 1120 Instructions 2016 from your smartphone

How to create an electronic signature for the Irs Form 1120 Instructions 2016 on iOS devices

How to make an electronic signature for the Irs Form 1120 Instructions 2016 on Android

People also ask

-

What are the Irs Form 1120 instructions?

The Irs Form 1120 instructions provide detailed guidance on how to complete the corporate income tax return for U.S. corporations. This includes information on the necessary documents, tax rates, and filing deadlines to ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with Irs Form 1120 instructions?

airSlate SignNow can streamline the signing and submission process for your Irs Form 1120. Our platform allows you to eSign documents securely, making it easy to adhere to the Irs Form 1120 instructions without needing to print or scan paper forms.

-

Are there any integrations available to help with Irs Form 1120 instructions?

Yes, airSlate SignNow integrates with various accounting and tax software to simplify your workflow related to Irs Form 1120 instructions. These integrations can ensure that data is accurate and reduce the risk of errors when filing your corporate tax return.

-

What are the pricing options for using airSlate SignNow for Irs Form 1120 instructions?

airSlate SignNow offers competitive pricing plans tailored to suit different business needs. You can choose a plan that enables easy management of documents related to Irs Form 1120 instructions, allowing you to focus on your business while staying compliant with tax regulations.

-

Can I access Irs Form 1120 instructions using airSlate SignNow from anywhere?

Absolutely! airSlate SignNow is a cloud-based solution, meaning you can access Irs Form 1120 instructions from anywhere, as long as you have an internet connection. This flexibility ensures that you can manage and sign documents on-the-go, enhancing productivity.

-

What features does airSlate SignNow offer for managing Irs Form 1120 instructions?

airSlate SignNow provides features such as document templates, automated workflows, and in-platform eSigning, all designed to assist with Irs Form 1120 instructions. These tools help ensure that your document handling is efficient and aligns with IRS requirements.

-

Is airSlate SignNow secure for handling sensitive Irs Form 1120 instructions?

Yes, airSlate SignNow prioritizes security with industry-standard encryption and compliance measures. This makes our platform a safe environment for managing sensitive information related to your Irs Form 1120 instructions.

Get more for Irs Form 1120 Instructions

Find out other Irs Form 1120 Instructions

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF