Pennsylvania Installments Fixed Rate Promissory Note Secured Form

What is the Pennsylvania Installments Fixed Rate Promissory Note Secured

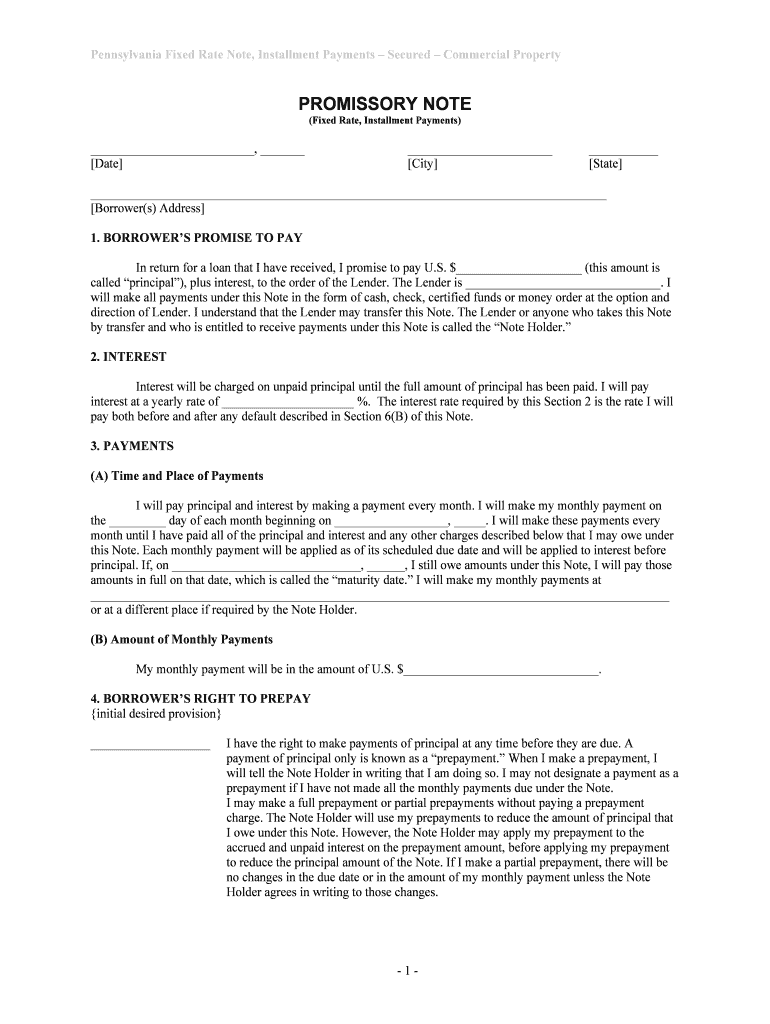

The Pennsylvania Installments Fixed Rate Promissory Note Secured is a legal document used to outline the terms of a loan agreement where the borrower agrees to repay the loan amount in fixed installments over a specified period. This note is secured by collateral, which provides additional protection to the lender in case of default. The document details the principal amount, interest rate, repayment schedule, and any consequences of non-payment, ensuring clarity for both parties involved.

Key elements of the Pennsylvania Installments Fixed Rate Promissory Note Secured

Several key elements must be included in the Pennsylvania Installments Fixed Rate Promissory Note Secured to ensure its validity and enforceability:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the borrowed amount.

- Repayment Schedule: A detailed outline of when payments are due, including the frequency (monthly, quarterly) and duration of the loan.

- Collateral Description: A clear description of the asset securing the note, which can be seized if the borrower defaults.

- Default Terms: Specific conditions under which the lender can take action if the borrower fails to make payments.

- Signatures: The signatures of both the borrower and lender, which are essential for the document's legal validity.

How to use the Pennsylvania Installments Fixed Rate Promissory Note Secured

Using the Pennsylvania Installments Fixed Rate Promissory Note Secured involves several steps to ensure that both parties understand and agree to the terms of the loan. First, the lender and borrower should discuss and agree on the loan amount, interest rate, and repayment terms. Once these details are finalized, the note should be drafted, incorporating all necessary elements. After reviewing the document for accuracy, both parties must sign it to make it legally binding. It is advisable to keep copies of the signed note for both parties' records.

Steps to complete the Pennsylvania Installments Fixed Rate Promissory Note Secured

Completing the Pennsylvania Installments Fixed Rate Promissory Note Secured involves the following steps:

- Gather necessary information, including the loan amount, interest rate, and repayment terms.

- Draft the promissory note, ensuring all key elements are included.

- Review the document with both parties to confirm agreement on all terms.

- Sign the document in the presence of a witness or notary, if required.

- Distribute copies of the signed note to both parties for their records.

Legal use of the Pennsylvania Installments Fixed Rate Promissory Note Secured

The legal use of the Pennsylvania Installments Fixed Rate Promissory Note Secured is governed by state laws, which dictate the enforceability of the document. For the note to be legally binding, it must be executed properly, with all required elements included. Additionally, both parties must have the legal capacity to enter into a contract. In the event of a dispute, the note can be presented in court as evidence of the agreed-upon terms, making it crucial for both parties to adhere to the stipulations outlined within the document.

State-specific rules for the Pennsylvania Installments Fixed Rate Promissory Note Secured

In Pennsylvania, specific rules apply to the execution and enforcement of the Installments Fixed Rate Promissory Note Secured. These include requirements for proper documentation, such as the necessity for clear terms regarding interest rates and repayment schedules. Additionally, the note must comply with state usury laws, which limit the amount of interest that can be charged. It is important for both lenders and borrowers to be aware of these regulations to ensure the note is valid and enforceable.

Quick guide on how to complete pennsylvania installments fixed rate promissory note secured

Accomplish Pennsylvania Installments Fixed Rate Promissory Note Secured with ease on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your files swiftly without holdups. Handle Pennsylvania Installments Fixed Rate Promissory Note Secured on any device using airSlate SignNow's Android or iOS applications and simplify any documentation task today.

The easiest way to modify and eSign Pennsylvania Installments Fixed Rate Promissory Note Secured effortlessly

- Obtain Pennsylvania Installments Fixed Rate Promissory Note Secured and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and has the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Pennsylvania Installments Fixed Rate Promissory Note Secured and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Pennsylvania Installments Fixed Rate Promissory Note Secured?

A Pennsylvania Installments Fixed Rate Promissory Note Secured is a legal document that outlines a borrower's promise to repay a loan in installments at a fixed interest rate. This type of note is secured by collateral, providing additional protection for the lender. It is commonly used in real estate and business transactions to formalize the terms of a loan.

-

How does a Pennsylvania Installments Fixed Rate Promissory Note Secured benefit borrowers?

Borrowers benefit from a Pennsylvania Installments Fixed Rate Promissory Note Secured by having predictable monthly payments due to the fixed interest rate. This allows for better budgeting and financial planning. Additionally, securing the note with collateral may help borrowers access larger loan amounts.

-

What are the advantages of using airSlate SignNow for Pennsylvania Installments Fixed Rate Promissory Note Secured?

Using airSlate SignNow for your Pennsylvania Installments Fixed Rate Promissory Note Secured ensures streamlined document management and eSigning capabilities. The platform is user-friendly, making it easy to create, send, and sign documents securely. Furthermore, it is a cost-effective solution that enhances the efficiency of your lending processes.

-

Are there any fees associated with creating a Pennsylvania Installments Fixed Rate Promissory Note Secured?

While creating a Pennsylvania Installments Fixed Rate Promissory Note Secured with airSlate SignNow may include a subscription fee, there are typically no hidden charges for document creation or eSignature services. Users can choose from various pricing plans, making it a budget-friendly option for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other software for managing Pennsylvania Installments Fixed Rate Promissory Note Secured?

Yes, airSlate SignNow offers seamless integrations with various other software applications, allowing users to manage their Pennsylvania Installments Fixed Rate Promissory Note Secured efficiently. Whether it's CRM systems or accounting software, the integrations enhance workflow efficiency and data management. This flexibility ensures all essential tools work together for optimal performance.

-

What types of collateral can secure a Pennsylvania Installments Fixed Rate Promissory Note Secured?

Common types of collateral in a Pennsylvania Installments Fixed Rate Promissory Note Secured can include real estate, vehicles, or other tangible assets of value. Securing the note with collateral minimizes the risk for lenders and often results in better terms for borrowers. It's important to ensure that the collateral meets any legal requirements when drafting the note.

-

How long does it take to get a Pennsylvania Installments Fixed Rate Promissory Note Secured signed and processed?

With airSlate SignNow, a Pennsylvania Installments Fixed Rate Promissory Note Secured can be signed and processed in a matter of minutes. The platform allows for quick eSigning, which is signNowly faster than traditional paper methods. Users can track the status of their documents in real-time, ensuring a smooth and efficient process.

Get more for Pennsylvania Installments Fixed Rate Promissory Note Secured

- Cpat standard location agreement company form

- Physician referral form 2014docx fcps

- Nsd volunteer affidavit volunteer affidavit form 00712267 neshaminy

- Proportional and non proportional relationship reviewpdf hms wcusd form

- 12902 f 2015 form

- Oebb use only appeal form salkeizk12orus salkeiz k12 or

- Danielson model lesson template form

- Water meter sizing per awwa m22 third edition form

Find out other Pennsylvania Installments Fixed Rate Promissory Note Secured

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online