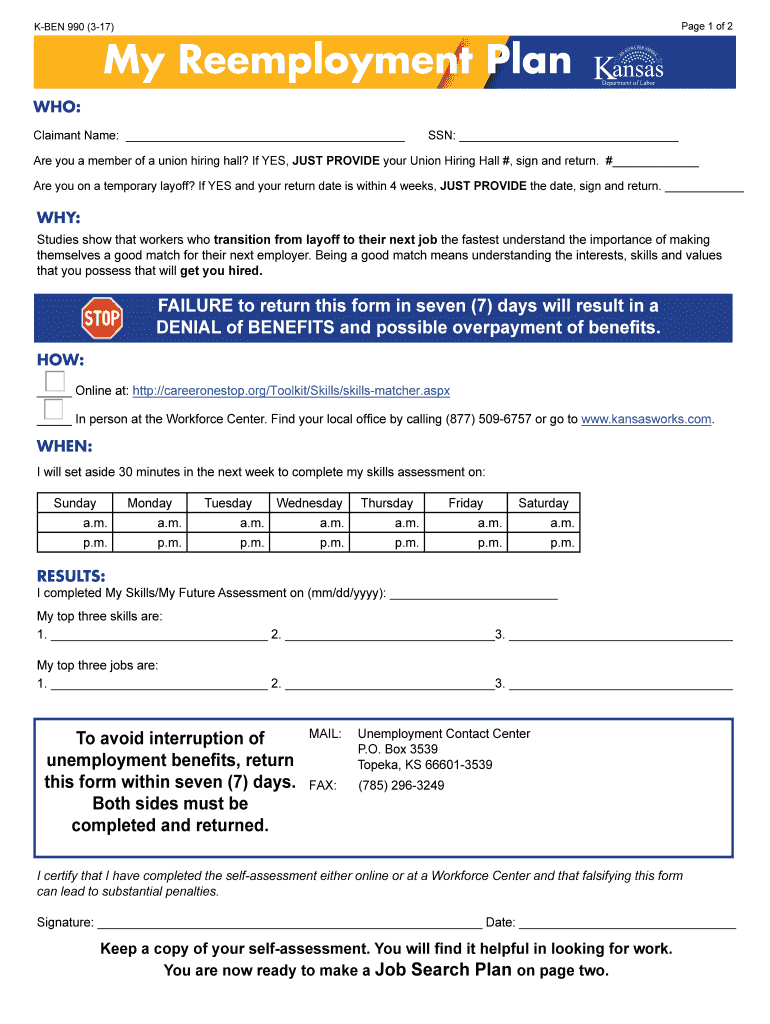

K Ben 990 Form 2017

What is the K Ben 990 Form

The K Ben 990 Form is a tax document used primarily by certain tax-exempt organizations in the United States. It serves as an informational return to the Internal Revenue Service (IRS) and is designed to provide details about the organization's financial activities, governance, and compliance with tax regulations. This form is essential for maintaining tax-exempt status and ensuring transparency in financial reporting.

How to use the K Ben 990 Form

Using the K Ben 990 Form involves accurately completing all required sections to reflect the organization's financial status and activities for the tax year. Organizations must report income, expenses, assets, and liabilities, along with information about their governance structure. It is important to ensure that all figures are accurate and that the form is signed by an authorized individual to validate the information provided.

Steps to complete the K Ben 990 Form

Completing the K Ben 990 Form requires careful attention to detail. Here are the key steps:

- Gather financial statements, including income and expense reports.

- Identify all sources of revenue and categorize them appropriately.

- Document all expenses and ensure they align with reported income.

- Provide information about the organization's governance and board members.

- Review the form for accuracy and completeness before submission.

Legal use of the K Ben 990 Form

The K Ben 990 Form is legally required for organizations seeking to maintain their tax-exempt status. Filing this form ensures compliance with IRS regulations and helps organizations avoid penalties. It is crucial that the form is submitted by the specified deadline and that all information is truthful and complete to uphold the organization's legal standing.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the K Ben 990 Form to avoid penalties. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. For example, if the fiscal year ends on December 31, the form would be due by May 15 of the following year. Extensions may be available, but they must be requested in advance.

Who Issues the Form

The K Ben 990 Form is issued by the Internal Revenue Service (IRS). Organizations must obtain the form directly from the IRS or through authorized tax preparation software. It is important to ensure that the most current version of the form is used to comply with any updates in tax regulations.

Penalties for Non-Compliance

Failure to file the K Ben 990 Form or filing it late can result in significant penalties. The IRS may impose fines based on the organization's gross receipts and the length of the delay. Additionally, non-compliance can jeopardize the organization's tax-exempt status, leading to further financial and legal repercussions. It is essential for organizations to prioritize timely and accurate filing to avoid these risks.

Quick guide on how to complete k ben 990 2017 form

Complete K Ben 990 Form effortlessly on any device

Online document management has gained signNow traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly, without any delays. Manage K Ben 990 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign K Ben 990 Form without hassle

- Obtain K Ben 990 Form and then click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign K Ben 990 Form to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k ben 990 2017 form

Create this form in 5 minutes!

How to create an eSignature for the k ben 990 2017 form

How to create an eSignature for the K Ben 990 2017 Form online

How to make an electronic signature for the K Ben 990 2017 Form in Google Chrome

How to create an electronic signature for signing the K Ben 990 2017 Form in Gmail

How to create an electronic signature for the K Ben 990 2017 Form straight from your mobile device

How to make an electronic signature for the K Ben 990 2017 Form on iOS

How to create an eSignature for the K Ben 990 2017 Form on Android

People also ask

-

What is the K Ben 990 Form and why is it important?

The K Ben 990 Form is a crucial document used by organizations to report their financial activities to the IRS. Completing this form accurately is essential for compliance and transparency in financial reporting. Understanding how to fill out the K Ben 990 Form correctly can help avoid penalties and ensure your organization maintains its tax-exempt status.

-

How can airSlate SignNow help with the K Ben 990 Form?

airSlate SignNow streamlines the process of preparing and eSigning the K Ben 990 Form, making it simple for organizations to manage their documentation. With our user-friendly interface, you can upload, fill out, and send the K Ben 990 Form for electronic signatures in just a few clicks. This not only saves time but also enhances accuracy and compliance.

-

What features does airSlate SignNow offer for managing the K Ben 990 Form?

airSlate SignNow offers features such as customizable templates, collaborative editing, and secure storage specifically designed for documents like the K Ben 990 Form. Our platform allows users to track the status of the form and receive real-time notifications when it's signed. Additionally, you can integrate our solution with your existing systems for seamless workflow management.

-

Is airSlate SignNow cost-effective for managing the K Ben 990 Form?

Yes, airSlate SignNow provides a cost-effective solution for managing the K Ben 990 Form, allowing organizations to save on printing and mailing costs. Our subscription plans are designed to fit various budgets, ensuring you can access essential document management features without breaking the bank. Plus, the efficiency gained can lead to signNow time savings.

-

Can I integrate airSlate SignNow with other tools for the K Ben 990 Form?

Absolutely! airSlate SignNow offers integrations with various software tools, allowing you to streamline the process of managing the K Ben 990 Form. Whether you use accounting software or project management tools, our platform can connect seamlessly to enhance your document workflow and ensure data consistency.

-

What security measures does airSlate SignNow have for the K Ben 990 Form?

Security is a top priority at airSlate SignNow. When handling sensitive documents like the K Ben 990 Form, we employ advanced encryption methods and secure data storage to protect your information. Our platform complies with industry standards, ensuring that your documents remain confidential and secure throughout the signing process.

-

How can I get started with airSlate SignNow for the K Ben 990 Form?

Getting started with airSlate SignNow for the K Ben 990 Form is easy! Simply sign up for an account, and you can begin uploading and managing your documents right away. Our user-friendly interface provides helpful resources and tutorials to guide you through the process of eSigning and sending your K Ben 990 Form efficiently.

Get more for K Ben 990 Form

- Instructions for form f 11075 prior authorization 2011

- How to fill out a north carolina appendix b building code summary form

- Tennessee fae 172 form

- Aspire job offer j 1 form

- Aws visual acuity form

- Nj medical license re activation application form

- Individual service plan wisconsin form

- New york state exclusive right to sell listing agreement form

Find out other K Ben 990 Form

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy