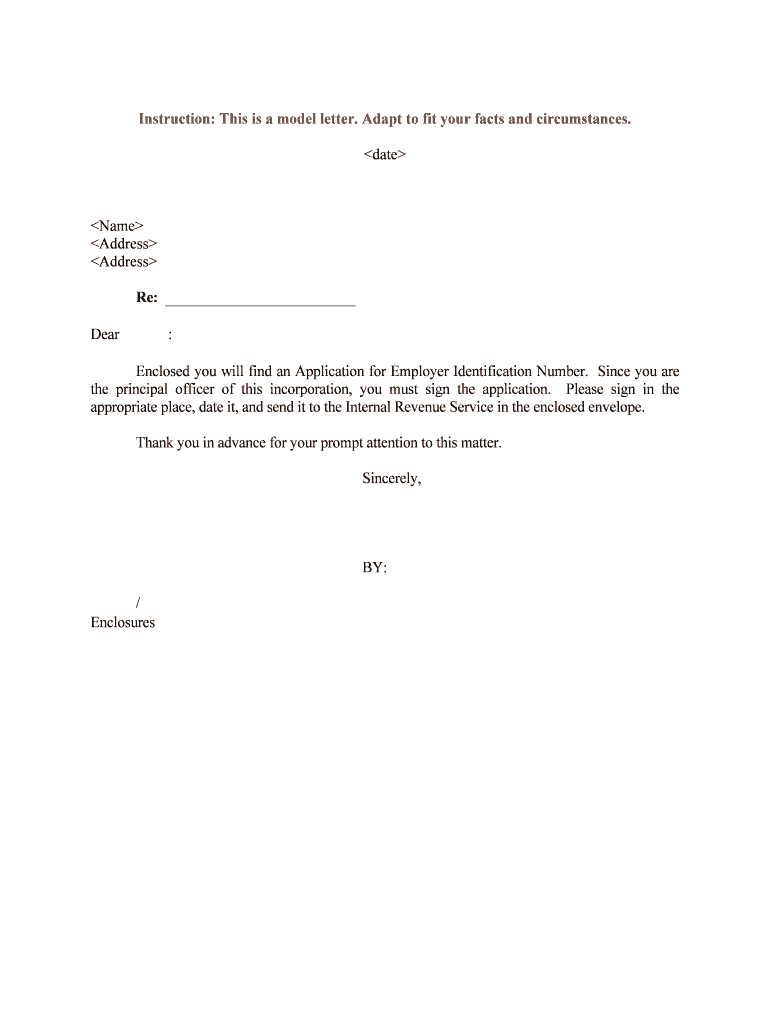

Enclosed You Will Find an Application for Employer Identification Number Form

What is the Enclosed You Will Find An Application For Employer Identification Number

The enclosed application for employer identification number (EIN) is a form used by businesses in the United States to apply for a unique nine-digit number assigned by the Internal Revenue Service (IRS). This number is essential for various business activities, including filing taxes, opening bank accounts, and hiring employees. The EIN serves as a business's federal tax identification number, similar to how a Social Security number functions for individuals.

Steps to Complete the Enclosed You Will Find An Application For Employer Identification Number

Completing the application for an employer identification number involves several straightforward steps:

- Gather necessary information, including the legal name of the business, the type of entity (e.g., LLC, corporation), and the responsible party's details.

- Access the application form, which can be completed online or printed for manual submission.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed application to the IRS via the chosen method, either online or by mail.

Legal Use of the Enclosed You Will Find An Application For Employer Identification Number

The application for an employer identification number is legally recognized as a valid document when submitted correctly. It is crucial for compliance with federal tax regulations. The EIN must be used consistently in all business-related tax filings and communications with the IRS. Failure to obtain an EIN when required can result in penalties and complications with tax obligations.

IRS Guidelines

The IRS provides specific guidelines for completing the application for an employer identification number. These guidelines include:

- Eligibility criteria for obtaining an EIN, which generally includes any business entity operating in the U.S.

- Instructions on how to fill out each section of the application accurately.

- Information on the submission process and available methods for applying.

Required Documents

When applying for an employer identification number, certain documents may be required to support the application. These documents can include:

- Proof of business formation, such as articles of incorporation or organization.

- Identification for the responsible party, such as a Social Security number or Individual Taxpayer Identification Number (ITIN).

- Any additional documentation specific to the business type, such as partnership agreements for partnerships.

Application Process & Approval Time

The application process for obtaining an employer identification number is typically straightforward. Once the application is submitted, the IRS usually processes it within a few business days if filed online. Paper applications may take longer to process. It is advisable to apply for an EIN well in advance of any business activities requiring it to avoid delays.

Quick guide on how to complete enclosed you will find an application for employer identification number

Effortlessly prepare Enclosed You Will Find An Application For Employer Identification Number on any device

The management of online documents has become increasingly favored among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to quickly create, modify, and eSign your documents without delays. Manage Enclosed You Will Find An Application For Employer Identification Number on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Enclosed You Will Find An Application For Employer Identification Number with ease

- Locate Enclosed You Will Find An Application For Employer Identification Number and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method of sharing the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from whichever device you choose. Modify and eSign Enclosed You Will Find An Application For Employer Identification Number and ensure remarkable communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'Enclosed You Will Find An Application For Employer Identification Number' mean?

The phrase 'Enclosed You Will Find An Application For Employer Identification Number' refers to the document used to apply for an EIN, which is essential for businesses operating in the U.S. This application allows you to legally manage taxes, open a business bank account, and hire employees. Utilizing airSlate SignNow simplifies the process of signing and submitting this application securely.

-

How does airSlate SignNow assist with the application for an Employer Identification Number?

With airSlate SignNow, the process of applying for an Employer Identification Number becomes seamless. You can create electronic signatures, easily send documents, and ensure everything is signed and submitted correctly. This platform allows you to efficiently manage your application for an Employer Identification Number without delays.

-

What are the pricing options available for using airSlate SignNow for document signing?

airSlate SignNow offers various pricing plans to cater to different business needs. By enrolling, you'll have access to features that help you manage documents, such as the 'Enclosed You Will Find An Application For Employer Identification Number.' Pricing is competitive and designed to provide great value for e-signature solutions.

-

What features make airSlate SignNow the best choice for signing documents?

airSlate SignNow offers an array of features, including customizable templates, secure electronic signatures, and document tracking. These features ensure that when you're processing something like 'Enclosed You Will Find An Application For Employer Identification Number,' every step is controlled and efficient. Plus, integration with other apps makes it a versatile choice.

-

Can I integrate airSlate SignNow with other applications I currently use?

Yes, airSlate SignNow offers robust integrations with several applications including CRM systems, cloud storage, and payment platforms. This means you can streamline your workflow while ensuring that your documents, such as the one referred to in 'Enclosed You Will Find An Application For Employer Identification Number,' are processed without hassle. Integration capabilities enhance efficiency signNowly.

-

What are the benefits of using airSlate SignNow for business documentation?

Using airSlate SignNow allows for faster document turnaround, reducing the time it takes to manage important applications like 'Enclosed You Will Find An Application For Employer Identification Number.' The platform offers enhanced security features and compliance with regulations, giving businesses peace of mind while handling sensitive documents.

-

Is airSlate SignNow easy to use for new users?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those new to electronic signatures. The intuitive interface ensures that you can quickly familiarize yourself with features needed for tasks such as submitting 'Enclosed You Will Find An Application For Employer Identification Number' without requiring extensive training.

Get more for Enclosed You Will Find An Application For Employer Identification Number

- Soccer camp registration form

- Sponsor eligibility form our lady of hope catholic church

- Ripon cyclones t shirt sponsorship letter 2_23_09v2 eteamz form

- Urac quality management committee meeting minutes template form

- Caps kit form

- 36 team bracket form

- Importer security filing 10 2 program form

- Enrollment information skylight

Find out other Enclosed You Will Find An Application For Employer Identification Number

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors