Restricted and Unrestricted Funds for a Nonprofit Form

Understanding Restricted and Unrestricted Funds for a Nonprofit

Restricted and unrestricted funds are essential concepts for nonprofits, defining how financial resources can be used. Restricted funds are donations that must be used for specific purposes as stipulated by the donor. For example, a donor may provide funds intended solely for a particular program or project. Unrestricted funds, on the other hand, can be used at the discretion of the nonprofit for any operational needs, such as administrative costs or general program expenses. Understanding these distinctions is crucial for effective financial management and compliance with donor expectations.

Steps to Complete the Restricted and Unrestricted Funds for a Nonprofit Form

Completing the form for restricted and unrestricted funds involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including your nonprofit's budget and any relevant donor agreements. Next, clearly categorize each fund as restricted or unrestricted based on donor specifications. Fill out the form by providing detailed descriptions of how each fund will be utilized. Ensure that all entries are clear and precise to avoid any misunderstandings. Finally, review the form for completeness and accuracy before submission.

Legal Use of the Restricted and Unrestricted Funds for a Nonprofit

The legal use of restricted and unrestricted funds is governed by both donor agreements and nonprofit regulations. Nonprofits must adhere to the terms set forth by donors regarding restricted funds, as failure to comply can lead to legal repercussions. Additionally, nonprofits are required to maintain transparency in their financial reporting, ensuring that funds are used according to their designated purposes. Unrestricted funds offer more flexibility, but nonprofits should still use these funds responsibly to support their mission and operational needs.

Key Elements of the Restricted and Unrestricted Funds for a Nonprofit

Several key elements define restricted and unrestricted funds for nonprofits. These include:

- Donor Intent: The specific purpose for which restricted funds are given must be honored.

- Financial Reporting: Nonprofits must accurately report the use of both types of funds in their financial statements.

- Compliance: Adhering to legal requirements and donor agreements is essential for maintaining trust and accountability.

- Flexibility: Unrestricted funds provide the organization with the ability to allocate resources as needed, enhancing operational efficiency.

Examples of Using the Restricted and Unrestricted Funds for a Nonprofit

Examples of how nonprofits utilize restricted and unrestricted funds can illustrate their importance. For instance, a nonprofit may receive a restricted grant for a specific community outreach program, requiring them to allocate those funds exclusively for that initiative. Conversely, unrestricted funds might be used to cover general operating expenses, such as salaries or office supplies. This flexibility allows nonprofits to adapt to changing needs while fulfilling donor obligations.

IRS Guidelines for Restricted and Unrestricted Funds

The IRS provides guidelines that govern how nonprofits manage restricted and unrestricted funds. Nonprofits must accurately classify and report these funds in their annual Form 990 filings. Restricted funds must be disclosed separately from unrestricted funds, ensuring clarity in financial reporting. Additionally, nonprofits should maintain detailed records of how restricted funds are spent to demonstrate compliance with donor requirements and IRS regulations.

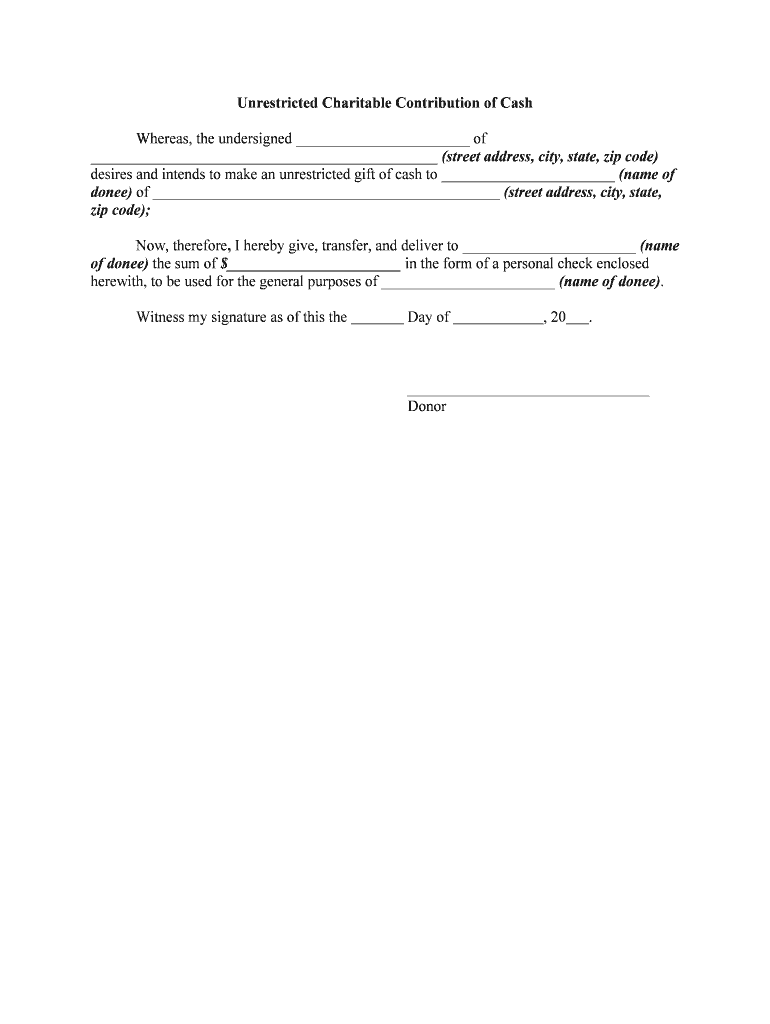

Quick guide on how to complete restricted and unrestricted funds for a nonprofit

Prepare Restricted And Unrestricted Funds For A Nonprofit easily on any device

Web-based document management has become favored by both companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow provides all the tools you require to create, amend, and eSign your documents swiftly without delays. Handle Restricted And Unrestricted Funds For A Nonprofit on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Restricted And Unrestricted Funds For A Nonprofit with ease

- Obtain Restricted And Unrestricted Funds For A Nonprofit and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with features that airSlate SignNow supplies for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and hit the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Restricted And Unrestricted Funds For A Nonprofit and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are restricted and unrestricted funds for a nonprofit?

Restricted funds for a nonprofit are donations that come with specific conditions on how they can be used, while unrestricted funds can be used for any purpose the organization sees fit. Understanding the difference is crucial for nonprofit financial management, as it impacts budgeting and spending.

-

How can airSlate SignNow help with managing restricted and unrestricted funds for a nonprofit?

airSlate SignNow provides a seamless way to manage important documents related to restricted and unrestricted funds for a nonprofit. Whether it's contracts, donation forms, or grant agreements, our platform allows for efficient eSigning and document tracking to enhance financial transparency and compliance.

-

What are the benefits of using airSlate SignNow for nonprofit organizations?

Using airSlate SignNow empowers nonprofits to streamline their document workflows, ensuring timely processing of restricted and unrestricted funds. Benefits include cost savings, improved operational efficiency, and the ability to maintain accurate records of donor intents and allocations.

-

Is airSlate SignNow suitable for small and large nonprofits alike?

Yes, airSlate SignNow is designed to cater to nonprofits of all sizes, offering features that support both small operations and large organizations. The flexibility of our platform makes it easy to manage documents related to restricted and unrestricted funds for a nonprofit, regardless of scale.

-

What integrations does airSlate SignNow offer for nonprofits?

airSlate SignNow integrates seamlessly with various tools commonly used by nonprofits, including CRM systems and financial management software. This allows organizations to efficiently track and manage restricted and unrestricted funds for a nonprofit while ensuring data consistency across platforms.

-

How does airSlate SignNow ensure document security?

Security is a top priority for airSlate SignNow, particularly for sensitive documents related to restricted and unrestricted funds for a nonprofit. Our platform employs industry-standard encryption, secure cloud storage, and compliance with data protection regulations to safeguard your records.

-

What pricing options does airSlate SignNow offer for nonprofits?

airSlate SignNow provides affordable pricing plans specifically tailored for nonprofits. These options ensure that organizations can access powerful tools to manage their restricted and unrestricted funds for a nonprofit without breaking their budget.

Get more for Restricted And Unrestricted Funds For A Nonprofit

Find out other Restricted And Unrestricted Funds For A Nonprofit

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now