Form 540

What is the Form 540

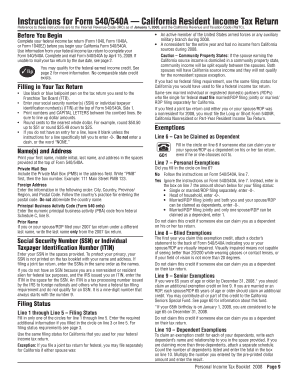

The 2008 Form 540 is a California state income tax return used by residents to report their income and calculate their tax liability. This form is essential for individuals who earned income in California during the tax year. It allows taxpayers to claim various deductions and credits, ultimately determining the amount of tax owed or refund due. Understanding the purpose of this form is crucial for compliance with state tax laws.

How to use the Form 540

Using the 2008 Form 540 involves several steps. First, gather all necessary documentation, including W-2s, 1099s, and any relevant receipts for deductions. Next, accurately fill out the form, ensuring that all income sources are reported. It is important to follow the instructions carefully, as errors can lead to delays or penalties. Once completed, the form can be submitted either electronically or through traditional mail, depending on the taxpayer's preference.

Steps to complete the Form 540

Completing the 2008 Form 540 requires a systematic approach. Begin by entering personal information, including your name, address, and Social Security number. Next, report all sources of income, such as wages, interest, and dividends. After that, calculate adjustments to income, followed by deductions and credits applicable to your situation. Finally, determine your total tax liability and any payments made throughout the year. Review the form for accuracy before submission.

Legal use of the Form 540

The legal use of the 2008 Form 540 is governed by California state tax laws. To ensure compliance, taxpayers must accurately report their income and claim only eligible deductions and credits. The form must be signed and dated, affirming that the information provided is true and complete. Failing to adhere to legal requirements can result in penalties, interest on unpaid taxes, or even legal action from the state tax authority.

Filing Deadlines / Important Dates

For the 2008 tax year, the filing deadline for the Form 540 typically falls on April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential for taxpayers to be aware of these dates to avoid late filing penalties. Additionally, extensions may be available, but they require separate applications and do not extend the time to pay any taxes owed.

Required Documents

To complete the 2008 Form 540, taxpayers need several documents. Key documents include W-2 forms from employers, 1099 forms for freelance or contract work, and any documentation supporting deductions, such as mortgage interest statements or medical expenses. Having all necessary documents organized and readily available simplifies the process and helps ensure accurate reporting.

Form Submission Methods (Online / Mail / In-Person)

The 2008 Form 540 can be submitted through various methods. Taxpayers may choose to file electronically using approved software, which often simplifies the process and allows for quicker refunds. Alternatively, the form can be mailed to the appropriate state tax office. Some individuals may also opt to file in person at designated locations, although this method is less common. Each submission method has its own advantages, including speed and convenience.

Quick guide on how to complete form 540 103021

Complete Form 540 effortlessly on any device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Form 540 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

A seamless way to edit and eSign Form 540 with ease

- Locate Form 540 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark signNow sections of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for that function.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements within a few clicks from any device of your choice. Modify and eSign Form 540 and ensure excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 540 103021

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2008 form 540 and how is it used?

The 2008 form 540 is a California state income tax return form used by residents to report their income and calculate taxes owed. This form is crucial for individuals filing their state taxes, ensuring compliance with California tax laws.

-

How can airSlate SignNow help with the 2008 form 540?

airSlate SignNow provides a seamless way to eSign the 2008 form 540 and other documents electronically. Users can complete their forms quickly, ensuring they meet tax deadline requirements without the hassle of printing and mailing documents.

-

Is airSlate SignNow a cost-effective solution for signing the 2008 form 540?

Yes, airSlate SignNow offers competitive pricing plans, making it a cost-effective solution for individuals and businesses needing to sign the 2008 form 540. By using our service, you eliminate printing costs and streamline the signing process.

-

What features does airSlate SignNow offer for eSigning the 2008 form 540?

airSlate SignNow includes features like customizable templates, status tracking, and compliance management specifically for the 2008 form 540. These features enhance the document signing experience while ensuring all signatures are legally binding.

-

Can I integrate airSlate SignNow with my accounting software for the 2008 form 540?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to manage the 2008 form 540 within your existing workflow. This integration ensures you can access and sign documents efficiently alongside your financial records.

-

What are the benefits of using airSlate SignNow for the 2008 form 540?

Using airSlate SignNow for the 2008 form 540 provides numerous benefits, including increased efficiency, reduced turnaround time for signatures, and enhanced security for your sensitive information. It simplifies the tax filing process signNowly.

-

Is there a limit to the number of 2008 form 540 documents I can eSign?

No, there is no limit to the number of 2008 form 540 documents you can eSign with airSlate SignNow. This flexibility allows users to handle multiple document signing needs without any restrictions or additional costs.

Get more for Form 540

Find out other Form 540

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure