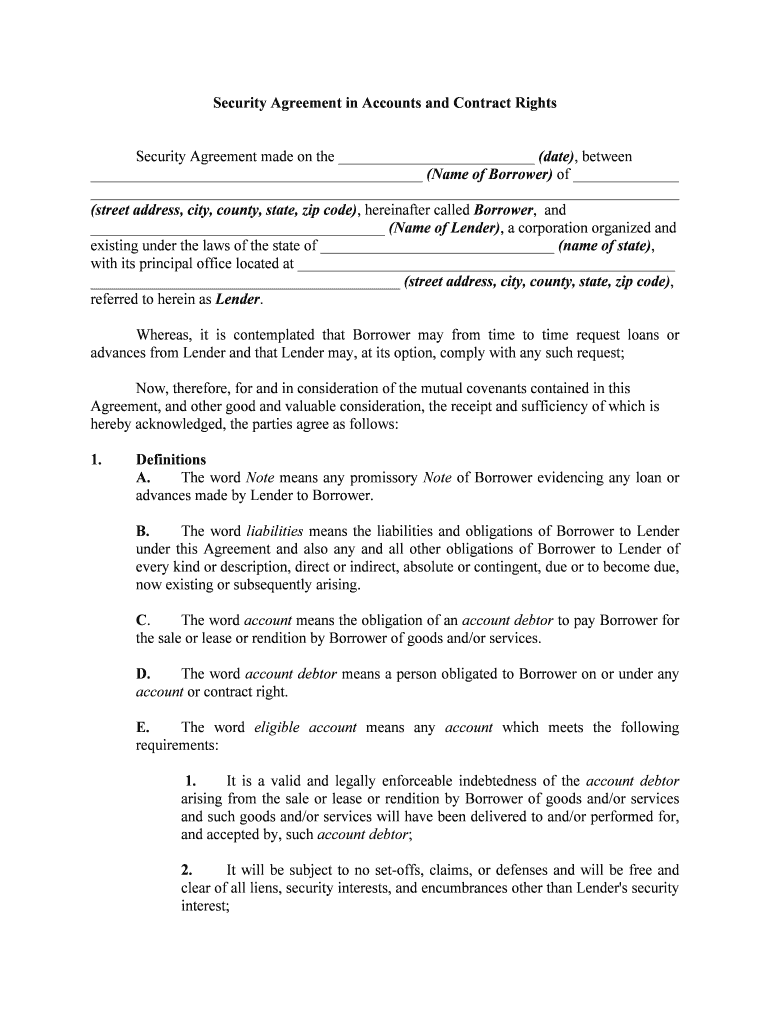

MORTGAGE WAREHOUSE LOAN and SECURITY AGREEMENT Form

What is the mortgage warehouse loan and security agreement?

The mortgage warehouse loan and security agreement is a legal document that outlines the terms and conditions under which a lender provides financing to mortgage brokers or lenders. This type of agreement facilitates the temporary funding of mortgage loans, allowing brokers to close loans quickly and efficiently. The agreement typically details the collateral involved, the responsibilities of both parties, and the repayment terms.

Key elements of the mortgage warehouse loan and security agreement

Several crucial components define the mortgage warehouse loan and security agreement, ensuring clarity and legal compliance. These elements include:

- Loan Amount: Specifies the maximum amount the lender is willing to provide.

- Interest Rate: Outlines the interest rate applicable to the loan, which can be fixed or variable.

- Collateral: Identifies the assets pledged by the borrower, usually the mortgage loans funded by the warehouse line.

- Repayment Terms: Details the schedule and method for repaying the loan.

- Default Conditions: Defines what constitutes a default and the remedies available to the lender.

Steps to complete the mortgage warehouse loan and security agreement

Completing the mortgage warehouse loan and security agreement involves several steps to ensure accuracy and compliance. Follow these steps:

- Gather Required Information: Collect all necessary details about the loan, including borrower information and collateral specifics.

- Fill Out the Agreement: Accurately complete each section of the agreement, ensuring all terms are clearly stated.

- Review the Document: Carefully review the agreement for any errors or omissions before finalizing.

- Obtain Signatures: Ensure all parties involved sign the agreement, which may require electronic signatures for efficiency.

- Store Securely: Keep a copy of the signed agreement in a secure location for future reference.

Legal use of the mortgage warehouse loan and security agreement

The mortgage warehouse loan and security agreement is legally binding when executed properly. To ensure its legality, the agreement must comply with relevant federal and state laws governing secured transactions. Additionally, both parties should retain copies of the signed document, as it serves as evidence of the terms agreed upon and can be used in case of disputes.

How to use the mortgage warehouse loan and security agreement

Utilizing the mortgage warehouse loan and security agreement effectively requires understanding its purpose and application. This document is primarily used by mortgage brokers and lenders to secure short-term financing for closing loans. By executing this agreement, brokers can access funds quickly, allowing them to operate efficiently and meet borrower needs promptly. It is essential to follow the terms outlined in the agreement to maintain compliance and avoid potential legal issues.

State-specific rules for the mortgage warehouse loan and security agreement

Each state may have its own regulations regarding the mortgage warehouse loan and security agreement. It is important to review state-specific laws to ensure compliance with local requirements. These regulations may affect aspects such as interest rates, disclosure requirements, and the enforcement of security interests. Consulting with a legal professional familiar with state laws can help navigate these complexities and ensure that the agreement adheres to all applicable rules.

Quick guide on how to complete mortgage warehouse loan and security agreement

Complete MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENT effortlessly on any gadget

Online document handling has gained traction with businesses and individuals alike. It serves as a perfect environmentally friendly alternative to conventional printed and signed papers, as you can easily find the suitable template and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without hindrances. Manage MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENT on any device using airSlate SignNow apps for Android or iOS and simplify any document-driven task today.

The simplest way to modify and eSign MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENT without any hassle

- Obtain MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENT and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Leave behind the worries of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choosing. Modify and eSign MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENT and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENT?

A MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENT is a legal document that outlines the terms and conditions under which a lender finances the purchase of mortgage loans. This agreement serves as a security for the lender, ensuring that they can reclaim their investment if necessary. Understanding this document is crucial for financial institutions involved in mortgage lending.

-

How does a MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENT benefit lenders?

The MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENT benefits lenders by providing a structured way to secure funding for mortgage loans. This allows them to maintain liquidity while minimizing risk associated with the lending process. By securing their investment, lenders can enhance their operational efficiency.

-

What features are included in a MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENT?

A comprehensive MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENT typically includes payment terms, interest rates, collateral specifics, and default clauses. It also outlines the responsibilities of both parties involved in the agreement. These features ensure clarity and legal protection for all stakeholders.

-

How can I create a MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENT using airSlate SignNow?

You can easily create a MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENT using airSlate SignNow's intuitive document builder. Our platform allows you to customize, sign, and share agreements securely and efficiently. Leverage our templates to streamline the process and ensure compliance.

-

What is the pricing model for using airSlate SignNow for MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENTS?

airSlate SignNow offers a flexible pricing model designed to cater to businesses of all sizes. You can choose from various subscription plans based on your usage needs, ensuring that you only pay for what you need for managing MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENTS. Contact us for a tailored quote.

-

Does airSlate SignNow integrate with other software for managing MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENTS?

Yes, airSlate SignNow seamlessly integrates with various CRM and financial software to enhance the management of MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENTS. This integration allows for efficient data transfer and improved workflows, reducing manual entry and errors. Check our integrations page for a complete list.

-

What are the benefits of using airSlate SignNow for MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENTS?

Using airSlate SignNow for MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENTS offers numerous benefits, including enhanced security, faster processing times, and easy access to documents from any device. Our eSigning capabilities streamline the approval process, allowing you to complete transactions efficiently while maintaining compliance.

Get more for MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENT

- Get yr rights streetwise and safe streetwiseandsafe form

- Formulario de modificacion de datos argentina copy

- Quickstart ignition interlock form

- Bus pass bus pass bus pass tantasqua form

- Auction raffle donation form

- Aed monthly inspection log form

- Suit measurements template form

- Fire system record form

Find out other MORTGAGE WAREHOUSE LOAN AND SECURITY AGREEMENT

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile