Declaration of Gift over Several Year PeriodUS Legal Forms

What is the Declaration of Gift Over Several Year Period?

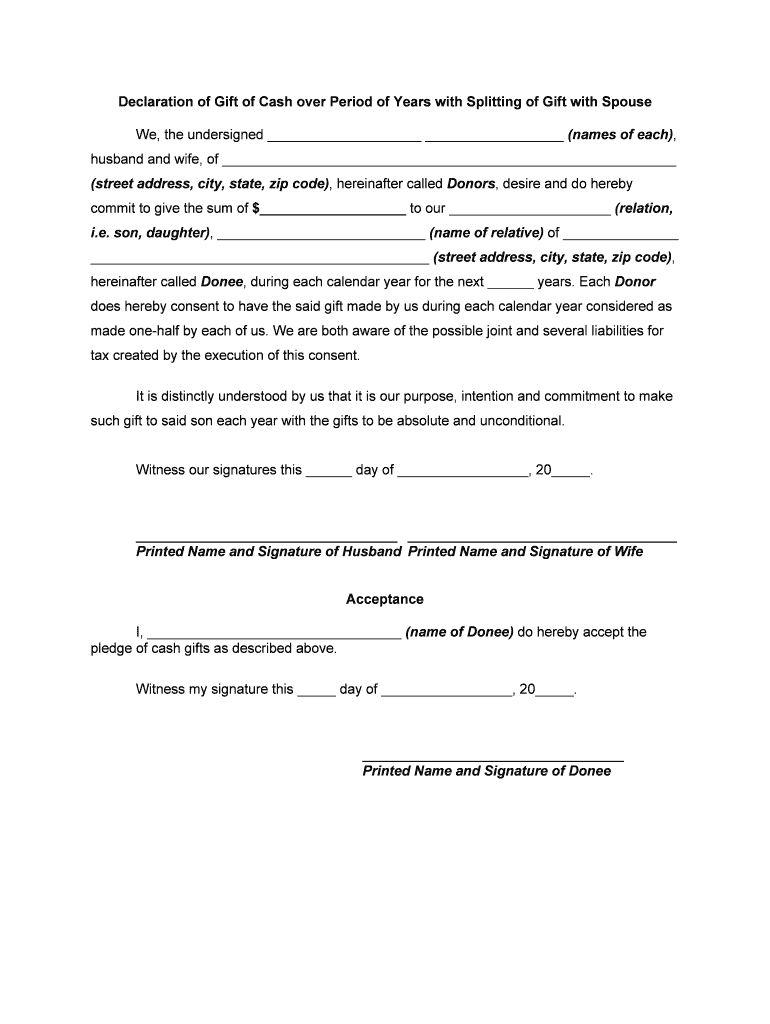

The Declaration of Gift Over Several Year Period is a legal document used to formalize the transfer of assets or property from one individual to another over an extended timeframe. This form is essential for documenting gifts that may exceed annual exclusion limits set by the IRS, ensuring compliance with tax regulations. By clearly outlining the intent to gift and the specifics of the transfer, this declaration helps prevent potential disputes and clarifies the donor's intentions.

Key Elements of the Declaration of Gift Over Several Year Period

Several critical components must be included in the Declaration of Gift Over Several Year Period to ensure its validity:

- Donor Information: Full name and address of the individual making the gift.

- Recipient Information: Full name and address of the individual receiving the gift.

- Description of the Gift: A detailed description of the assets or property being gifted.

- Value of the Gift: An estimated value of the gift at the time of transfer.

- Schedule of Transfers: A clear outline of when the gifts will be made over the specified period.

- Signatures: Signatures of both the donor and recipient, along with the date of signing.

Steps to Complete the Declaration of Gift Over Several Year Period

Completing the Declaration of Gift Over Several Year Period involves several straightforward steps:

- Gather necessary information about the donor and recipient.

- Detail the assets or property being gifted, including their estimated value.

- Outline the schedule for the transfer of gifts, specifying dates and amounts.

- Ensure both parties review the document for accuracy and completeness.

- Obtain signatures from both the donor and recipient, including the date of signing.

- Keep a copy of the completed declaration for personal records and tax purposes.

Legal Use of the Declaration of Gift Over Several Year Period

This declaration serves several legal purposes, particularly in the context of tax compliance. The IRS requires documentation for gifts that exceed the annual exclusion limit to ensure proper reporting and tax implications. By using this form, both the donor and recipient can establish a clear record of the transfer, which can be beneficial in case of audits or disputes. Additionally, it helps clarify the intent behind the gift, reducing the potential for misunderstandings.

IRS Guidelines for the Declaration of Gift Over Several Year Period

The IRS has specific guidelines regarding the Declaration of Gift Over Several Year Period. Gifts exceeding the annual exclusion limit must be reported on Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return. It is crucial to maintain accurate records of all gifts made within the year, including the declaration, to ensure compliance with IRS regulations. Failure to report gifts appropriately may result in penalties or additional taxes owed.

Examples of Using the Declaration of Gift Over Several Year Period

This declaration can be utilized in various scenarios, such as:

- Transferring family property to children over several years to minimize tax implications.

- Gifting stocks or bonds gradually to take advantage of annual exclusion limits.

- Providing financial support to a relative while maintaining control over the transfer process.

Quick guide on how to complete declaration of gift over several year periodus legal forms

Complete Declaration Of Gift Over Several Year PeriodUS Legal Forms effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without holdups. Manage Declaration Of Gift Over Several Year PeriodUS Legal Forms on any gadget using airSlate SignNow's Android or iOS applications and streamline your document-centric tasks today.

How to adjust and electronically sign Declaration Of Gift Over Several Year PeriodUS Legal Forms with ease

- Find Declaration Of Gift Over Several Year PeriodUS Legal Forms and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive data using the tools specifically designed by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form: via email, SMS, or an invitation link, or download it directly to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require new copies to be printed. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Adjust and electronically sign Declaration Of Gift Over Several Year PeriodUS Legal Forms while ensuring excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Declaration Of Gift Over Several Year PeriodUS Legal Forms?

The Declaration Of Gift Over Several Year PeriodUS Legal Forms is a legal document that allows individuals to formally declare gifts made over a span of multiple years. This form is essential for ensuring proper documentation for tax purposes and can help in avoiding potential disputes. Utilizing airSlate SignNow, you can efficiently complete and eSign this document.

-

How much does it cost to use the Declaration Of Gift Over Several Year PeriodUS Legal Forms with airSlate SignNow?

Pricing for the Declaration Of Gift Over Several Year PeriodUS Legal Forms through airSlate SignNow varies based on subscription plans. Our packages are designed to be cost-effective, ensuring you get the best value for your eSigning needs. You can choose the plan that suits your business requirements best.

-

What features does airSlate SignNow offer for the Declaration Of Gift Over Several Year PeriodUS Legal Forms?

airSlate SignNow provides a user-friendly interface for completing the Declaration Of Gift Over Several Year PeriodUS Legal Forms. Features include eSigning, document storage, and collaboration tools, enabling you to manage your gifts effectively. These capabilities ensure a smooth process from document creation to final signature.

-

Are there any benefits to using airSlate SignNow for my Declaration Of Gift Over Several Year PeriodUS Legal Forms?

Using airSlate SignNow for your Declaration Of Gift Over Several Year PeriodUS Legal Forms streamlines the document signing process, enhancing efficiency. You can save time and reduce paperwork, allowing for easier management of your gifting records. Plus, the digital format ensures that your documents are securely stored and easily retrievable.

-

Can I integrate airSlate SignNow with other software for processing my Declaration Of Gift Over Several Year PeriodUS Legal Forms?

Yes, airSlate SignNow allows for seamless integration with various other software applications. This means you can easily incorporate the Declaration Of Gift Over Several Year PeriodUS Legal Forms into your existing workflows and systems. Whether it's CRM tools or accounting software, integration helps streamline your processes.

-

How do I get started with the Declaration Of Gift Over Several Year PeriodUS Legal Forms on airSlate SignNow?

Getting started with the Declaration Of Gift Over Several Year PeriodUS Legal Forms on airSlate SignNow is simple. You can sign up for an account, select the appropriate form, and follow the prompts to fill it out. The user-friendly design ensures that you can complete the process quickly and efficiently.

-

Is the Declaration Of Gift Over Several Year PeriodUS Legal Forms legally binding?

Yes, the Declaration Of Gift Over Several Year PeriodUS Legal Forms completed through airSlate SignNow is legally binding, provided that all parties eSign and comply with applicable laws. This makes it crucial for ensuring that gifts are documented properly for tax and legal purposes. Always consult with a legal professional for specific guidance.

Get more for Declaration Of Gift Over Several Year PeriodUS Legal Forms

- D15 sheet form

- Bill nye seasons worksheet form

- Lifeguard certificate training program form

- Synthes inventory form

- Carenow authorization form

- Transfer reinstatement request pbs 8 form type or print legibly and complete entirely 145 kennedy street nw washington dc 20011

- Opioid complaint exhibits 51 111 miller law firm form

- Continuous service agreement statement english txucom form

Find out other Declaration Of Gift Over Several Year PeriodUS Legal Forms

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile