Although No Definite Rule Exists for Determining Whether One is an Independent Contractor or an Employee, Certain Indicia of the Form

Understanding the Independent Contractor vs. Employee Distinction

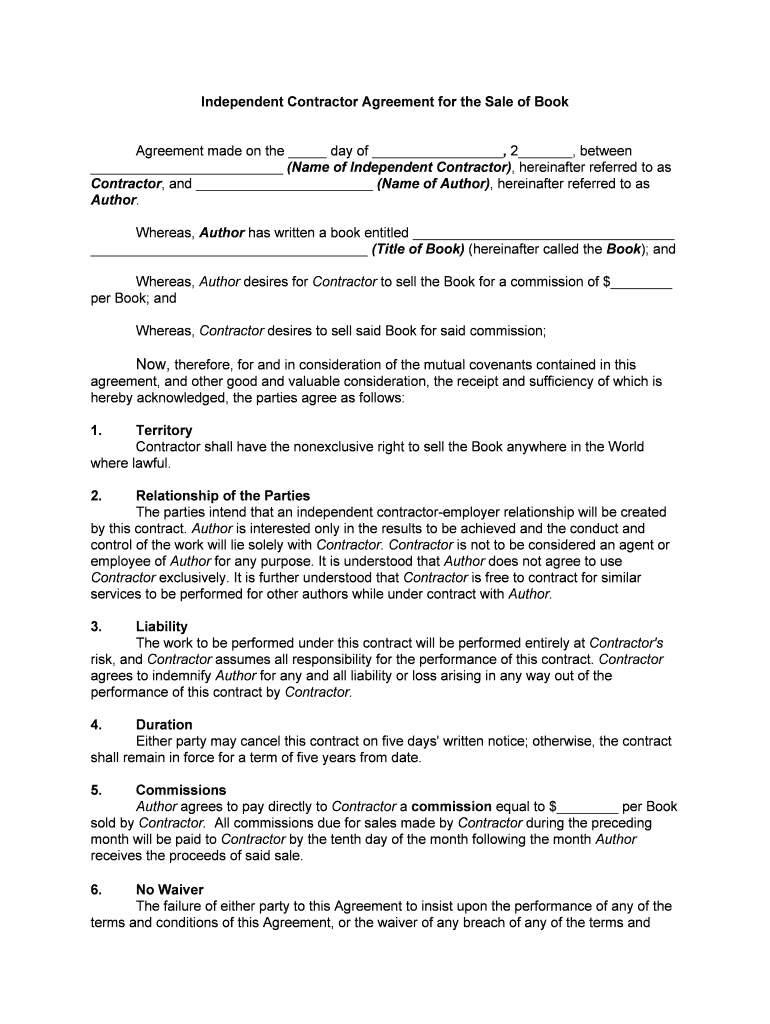

The classification of a worker as either an independent contractor or an employee is crucial for various legal and tax implications. Although no definite rule exists for determining this status, certain indicia are recognized. These include the degree of control the employer has over the work performed, the worker's investment in equipment, and the opportunity for profit or loss. Understanding these factors can help both parties navigate their rights and responsibilities.

Steps to Complete the Form

Completing the form requires careful attention to detail. Start by gathering all necessary information, such as personal identification and business details. Fill out each section accurately, ensuring that you provide clear and concise information. Review the completed form to check for errors before submission. This process helps ensure that the form is legally valid and that all necessary provisions are included.

Legal Use of the Form

The form serves a significant legal purpose, particularly in establishing the nature of the working relationship. It is essential to insert provisions that embody the indicia of independent contractor status. This may include clauses that outline the scope of work, payment terms, and the independence of the contractor. Proper legal use of the form can protect both parties in case of disputes or audits.

Key Elements to Include

When filling out the form, certain key elements must be included to ensure its effectiveness. These elements typically consist of the names and addresses of both parties, the specific services to be provided, and the payment structure. Additionally, including a clause that specifies the contractor's independence can further clarify the relationship and reduce potential legal issues.

IRS Guidelines

Understanding IRS guidelines is essential for compliance. The IRS provides criteria to help determine whether a worker is an independent contractor or an employee. Key factors include behavioral control, financial control, and the type of relationship. Familiarizing yourself with these guidelines can help ensure that the form aligns with federal regulations and reduces the risk of misclassification.

State-Specific Rules

In addition to federal guidelines, state-specific rules may also apply. Each state has its own regulations regarding the classification of workers, which can affect tax obligations and legal rights. It is important to research the applicable laws in your state to ensure compliance and to understand any additional requirements that may be necessary when completing the form.

Examples of Usage

Real-world examples can illustrate how the form is utilized in various scenarios. For instance, a freelance graphic designer may use the form to establish their status as an independent contractor when working with a marketing agency. This helps clarify the terms of their engagement and protects their rights as a contractor. Understanding these examples can provide insight into the practical application of the form.

Quick guide on how to complete although no definite rule exists for determining whether one is an independent contractor or an employee certain indicia of the

Complete Although No Definite Rule Exists For Determining Whether One Is An Independent Contractor Or An Employee, Certain Indicia Of The easily on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Although No Definite Rule Exists For Determining Whether One Is An Independent Contractor Or An Employee, Certain Indicia Of The on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

Steps to modify and eSign Although No Definite Rule Exists For Determining Whether One Is An Independent Contractor Or An Employee, Certain Indicia Of The effortlessly

- Find Although No Definite Rule Exists For Determining Whether One Is An Independent Contractor Or An Employee, Certain Indicia Of The and click Get Form to initiate.

- Utilize the tools we offer to submit your document.

- Emphasize important parts of your documents or redact sensitive information using the specific tools that airSlate SignNow provides for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sharing your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require new document prints. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Modify and eSign Although No Definite Rule Exists For Determining Whether One Is An Independent Contractor Or An Employee, Certain Indicia Of The and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the relationship between independent contractors and employees?

Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized. Understanding these differences can help businesses make informed decisions about hiring and managing their workforce.

-

How does airSlate SignNow facilitate the signing of documents for independent contractors?

airSlate SignNow offers a streamlined platform for eSigning documents, allowing businesses to easily manage contracts with independent contractors. This is important because, although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized when it comes to contract management.

-

What features does airSlate SignNow provide that benefit independent contractors?

The platform includes features such as customizable templates, secure storage, and real-time tracking of document statuses. These tools are especially useful for independent contractors negotiating their terms, as although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor can be highlighted through these features.

-

Is pricing flexible for businesses using airSlate SignNow for independent contractor agreements?

Yes, airSlate SignNow offers various pricing plans designed to suit businesses of all sizes. This flexibility is beneficial because, although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor can impact how contracts are managed and enforced.

-

Can I integrate airSlate SignNow with other business tools?

Absolutely! airSlate SignNow integrates smoothly with various business applications, enhancing its functionality for independent contractor management. This is particularly important since, although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor may require different document handling tools.

-

What are the security measures in place for documents signed using airSlate SignNow?

airSlate SignNow prioritizes document security through encryption and authentication protocols. This is essential in ensuring compliance, especially because, although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor's documentation must be safeguarded.

-

How can airSlate SignNow help with compliance issues related to independent contractors?

By providing templates and compliance checks within its eSigning platform, airSlate SignNow helps ensure that all necessary criteria are met. This is particularly relevant considering that, although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor must be correctly addressed in contracts.

Get more for Although No Definite Rule Exists For Determining Whether One Is An Independent Contractor Or An Employee, Certain Indicia Of The

Find out other Although No Definite Rule Exists For Determining Whether One Is An Independent Contractor Or An Employee, Certain Indicia Of The

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free