1040 Individual Tax Return Engagement Letter Lawrence Tax Form

What is the 1040 Individual Tax Return Engagement Letter Lawrence Tax

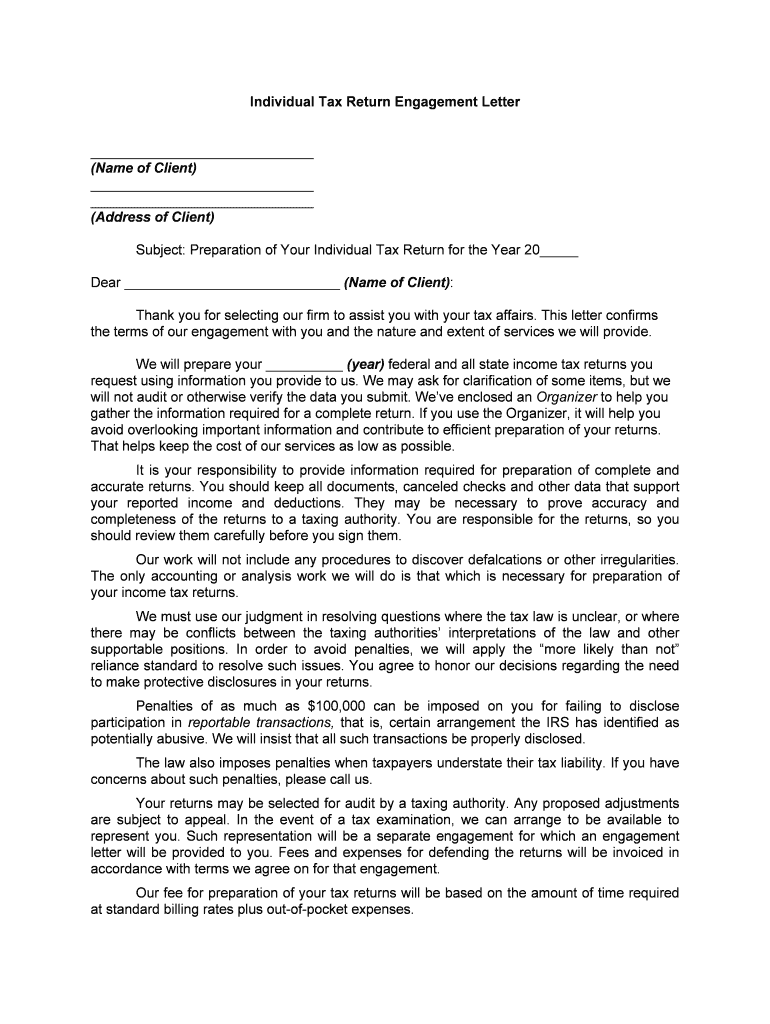

The 1040 Individual Tax Return Engagement Letter Lawrence Tax is a formal document that outlines the agreement between a tax professional and their client regarding the preparation of the client's individual tax return. This letter serves as a crucial component in establishing the scope of services, responsibilities, and expectations for both parties involved. It ensures clarity and transparency in the tax preparation process, helping to mitigate misunderstandings and potential disputes.

Key elements of the 1040 Individual Tax Return Engagement Letter Lawrence Tax

This engagement letter typically includes several essential elements:

- Scope of Services: A detailed description of the services to be provided, including the preparation of the 1040 tax return and any related filings.

- Client Responsibilities: An outline of the information and documentation the client must provide to facilitate the tax preparation process.

- Fees and Payment Terms: A clear statement of the fees associated with the services, including any payment schedules or terms.

- Confidentiality Clause: Assurance that the client's information will be kept confidential and secure.

- Signature Section: A space for both the tax professional and the client to sign, indicating their agreement to the terms outlined in the letter.

Steps to complete the 1040 Individual Tax Return Engagement Letter Lawrence Tax

Completing the engagement letter involves several straightforward steps:

- Gather Necessary Information: Collect all relevant details about the client's tax situation, including income, deductions, and credits.

- Draft the Letter: Use a template or create a new document that includes all key elements mentioned above.

- Review with the Client: Discuss the letter with the client to ensure they understand the terms and conditions.

- Obtain Signatures: Have both parties sign the document to formalize the agreement.

- Store the Document Securely: Keep a copy of the signed engagement letter for your records and provide one to the client.

Legal use of the 1040 Individual Tax Return Engagement Letter Lawrence Tax

The engagement letter is legally binding once both parties have signed it. It serves as a contract that outlines the expectations and responsibilities of the tax professional and the client. To ensure its legal validity, it should comply with relevant laws and regulations governing tax practices in the United States. This includes adherence to ethical standards and confidentiality requirements set forth by professional organizations.

How to use the 1040 Individual Tax Return Engagement Letter Lawrence Tax

Using the engagement letter effectively involves several best practices:

- Initial Consultation: Present the letter during the initial meeting with the client to establish a professional relationship.

- Clarification of Services: Use the letter to clarify the specific services being provided, which helps manage client expectations.

- Documentation: Refer to the letter throughout the tax preparation process to ensure compliance with agreed-upon terms.

- Follow-Up: After the tax return is filed, review the engagement letter with the client to discuss any future needs or services.

Quick guide on how to complete 1040 individual tax return engagement letter lawrence tax

Complete 1040 Individual Tax Return Engagement Letter Lawrence Tax effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can acquire the correct format and securely retain it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage 1040 Individual Tax Return Engagement Letter Lawrence Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to adjust and eSign 1040 Individual Tax Return Engagement Letter Lawrence Tax effortlessly

- Obtain 1040 Individual Tax Return Engagement Letter Lawrence Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Verify all details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, burdensome form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 1040 Individual Tax Return Engagement Letter Lawrence Tax and guarantee outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a 1040 Individual Tax Return Engagement Letter Lawrence Tax?

A 1040 Individual Tax Return Engagement Letter Lawrence Tax is a formal document that establishes the terms and conditions between a tax preparer and their client regarding the preparation of the 1040 Individual Tax Return. This letter outlines responsibilities, fees, and other key details to ensure clear communication.

-

How does airSlate SignNow facilitate the signing of the 1040 Individual Tax Return Engagement Letter Lawrence Tax?

airSlate SignNow provides a secure and user-friendly platform for electronically signing the 1040 Individual Tax Return Engagement Letter Lawrence Tax. Clients can easily review and eSign documents from any device, streamlining the process for both tax preparers and their clients.

-

What are the pricing options for using airSlate SignNow for my 1040 Individual Tax Return Engagement Letter Lawrence Tax?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. Depending on the volume of documents and features required, you can choose from various plans that ensure an affordable solution for managing your 1040 Individual Tax Return Engagement Letter Lawrence Tax.

-

What features does airSlate SignNow include for managing the 1040 Individual Tax Return Engagement Letter Lawrence Tax?

Key features include legally binding eSignatures, customizable templates, real-time tracking, and secure cloud storage. These tools make it easy to manage the 1040 Individual Tax Return Engagement Letter Lawrence Tax while ensuring compliance and security.

-

Can I integrate airSlate SignNow with my existing tax preparation software when dealing with the 1040 Individual Tax Return Engagement Letter Lawrence Tax?

Yes, airSlate SignNow offers integrations with popular tax preparation software, allowing for seamless workflows. This means you can efficiently send and manage the 1040 Individual Tax Return Engagement Letter Lawrence Tax alongside your other tax-related tasks.

-

What benefits does eSigning the 1040 Individual Tax Return Engagement Letter Lawrence Tax provide?

eSigning the 1040 Individual Tax Return Engagement Letter Lawrence Tax offers various benefits, including faster processing times, reduced paper usage, and enhanced security. Clients appreciate the convenience and speed of completing their tax preparation agreement digitally.

-

Is my data safe when using airSlate SignNow for my 1040 Individual Tax Return Engagement Letter Lawrence Tax?

Absolutely! airSlate SignNow employs top-notch security measures to protect your data, including encryption and compliance with industry standards. You can rest assured that your 1040 Individual Tax Return Engagement Letter Lawrence Tax and personal information are secure.

Get more for 1040 Individual Tax Return Engagement Letter Lawrence Tax

- N 400 khmer translation 2414 form cambodian family

- Mobile coverage claim form security service ssfcu

- Scoutmasters key progress record form

- Do the math order form

- Mood assessment questionnaire form

- Commissioner fieldbook for unit service boy scouts of america form

- 32bj 401k contribution form

- Commissioner award of excellence in unit service progress record 122916 fillable format

Find out other 1040 Individual Tax Return Engagement Letter Lawrence Tax

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple