Comprehensive Equipment Lease with Provision Regarding Investment Tax Credit Form

What is the Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit

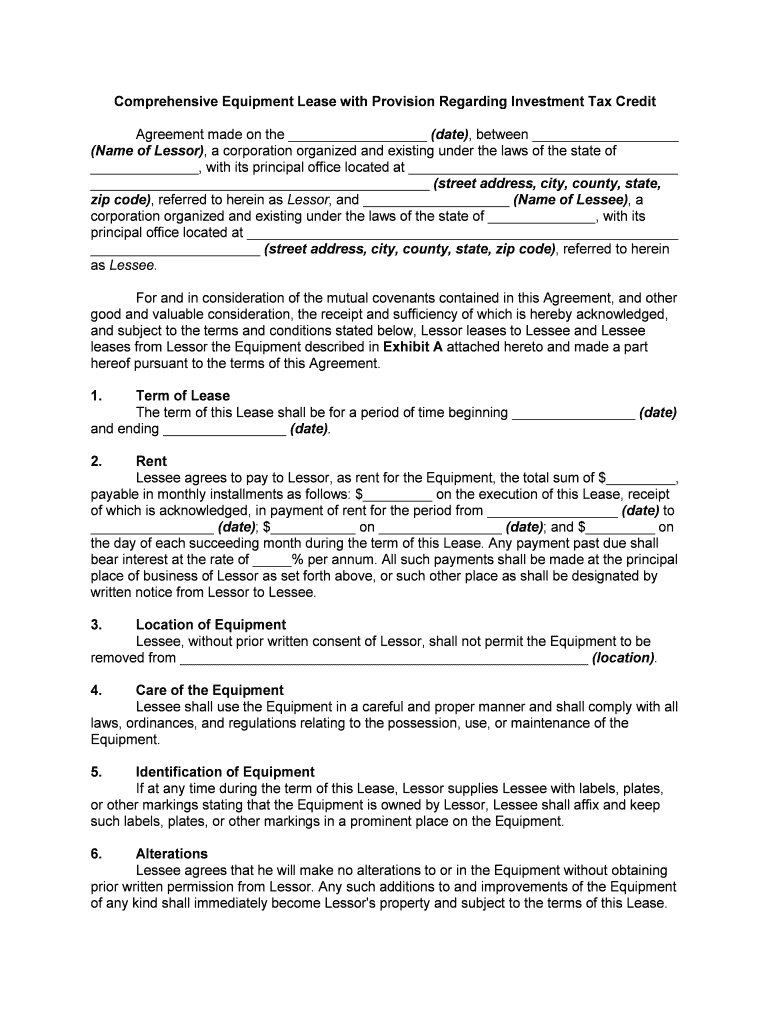

The Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit is a specialized legal document that outlines the terms under which equipment is leased, while also incorporating provisions for claiming investment tax credits. This lease is crucial for businesses looking to maximize their tax benefits while acquiring necessary equipment. By specifying the conditions related to the investment tax credit, this lease ensures that both lessors and lessees understand their rights and obligations regarding tax incentives associated with the leased equipment.

Key elements of the Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit

Several essential components make up the Comprehensive Equipment Lease. These include:

- Lease Terms: Duration of the lease, payment schedule, and conditions for renewal or termination.

- Tax Credit Provisions: Specific clauses detailing how the investment tax credit can be utilized by the lessee.

- Equipment Description: Detailed information about the equipment being leased, including specifications and intended use.

- Responsibilities: Clear delineation of responsibilities for maintenance, insurance, and liability between the lessor and lessee.

- Compliance Clauses: Requirements for adherence to federal and state regulations regarding tax credits and leasing.

Steps to complete the Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit

Completing the Comprehensive Equipment Lease involves several key steps:

- Gather Information: Collect necessary details about the equipment, leasing terms, and tax credit eligibility.

- Draft the Lease: Utilize a template or legal guidance to draft the lease, ensuring all critical elements are included.

- Review Legal Compliance: Ensure the lease complies with relevant laws and regulations, including tax laws.

- Obtain Signatures: Both parties should sign the lease electronically or physically, depending on preference and legal requirements.

- Store the Document: Keep a secure copy of the signed lease for future reference and tax purposes.

Legal use of the Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit

The legal use of the Comprehensive Equipment Lease is contingent upon adherence to specific regulations. For the lease to be considered valid, it must comply with the Uniform Commercial Code (UCC) and relevant federal tax laws. This includes ensuring that the terms are clear and that both parties understand their rights regarding the investment tax credit. Additionally, using a reliable eSignature platform can enhance the legal standing of the document by providing an audit trail and ensuring compliance with eSignature laws.

Examples of using the Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit

Businesses across various sectors utilize the Comprehensive Equipment Lease to optimize their tax benefits. For instance:

- A manufacturing company leases machinery and incorporates tax credit provisions to reduce its taxable income.

- A technology firm leases computer equipment and takes advantage of the investment tax credit to offset capital expenditures.

- A healthcare provider leases medical equipment, ensuring that the lease terms allow for claiming tax credits associated with the leased assets.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of investment tax credits in leases. It is essential for businesses to familiarize themselves with these guidelines to ensure compliance and maximize tax benefits. Key points include understanding eligibility criteria, the percentage of the credit available, and the reporting requirements on tax returns. Consulting with a tax professional can provide clarity on how to navigate these regulations effectively.

Quick guide on how to complete comprehensive equipment lease with provision regarding investment tax credit

Complete Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Manage Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related procedures today.

How to modify and eSign Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit with ease

- Obtain Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Select important parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method to send your form—by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit?

A Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit is a lease that allows businesses to acquire equipment while benefiting from tax credits related to their investments. This type of lease facilitates cash flow management and enables companies to make strategic financial decisions by leveraging tax incentives.

-

How does airSlate SignNow support Comprehensive Equipment Leases?

airSlate SignNow provides a user-friendly platform that simplifies the process of creating and managing Comprehensive Equipment Leases. By enabling electronic signatures and document management, it ensures that all legal and compliance aspects of leasing are efficiently handled, ultimately enhancing the user experience.

-

What are the pricing options for using airSlate SignNow with Comprehensive Equipment Leases?

airSlate SignNow offers flexible pricing plans that cater to various business needs, ensuring that accessing Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit is affordable. You can choose from different tiers based on your expected usage and the features you require for optimal lease management.

-

What benefits does a Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit provide?

A Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit offers signNow tax benefits, allowing businesses to reduce their taxable income while acquiring essential equipment. This arrangement also frees up capital, enabling companies to invest in growth and operational enhancements.

-

Can airSlate SignNow integrate with other software for equipment leasing?

Yes, airSlate SignNow seamlessly integrates with various third-party applications to enhance the management of Comprehensive Equipment Leases. By integrating with accounting, CRM, and project management tools, businesses can streamline workflows, improve efficiency, and maintain accurate records.

-

Is it easy to create a Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit using airSlate SignNow?

Absolutely! With airSlate SignNow, creating a Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit is straightforward and quick. The platform provides templates and customization options, allowing users to tailor leases that meet their specific equipment financing needs.

-

What factors should I consider when drafting a Comprehensive Equipment Lease?

When drafting a Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit, it’s essential to consider factors such as the lease term, payment structure, maintenance responsibilities, and the details of the tax credit provision. Ensuring clarity on these aspects can help prevent misunderstandings and protect both parties' interests.

Get more for Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit

- Tr 54 form

- Tceq form when you send letter to customers for violations

- Notice of lien form ny

- Texas international registration plan apportioned application schedule a form

- Ltc70 form

- Michigan llc form 700

- Certificate of waiver medical test site mts application packet form

- Order on motion to change venue utah courts form

Find out other Comprehensive Equipment Lease With Provision Regarding Investment Tax Credit

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free