Amount Owed Due to Destruction of Sign Form

Understanding the Amount Owed Due To Destruction Of Sign

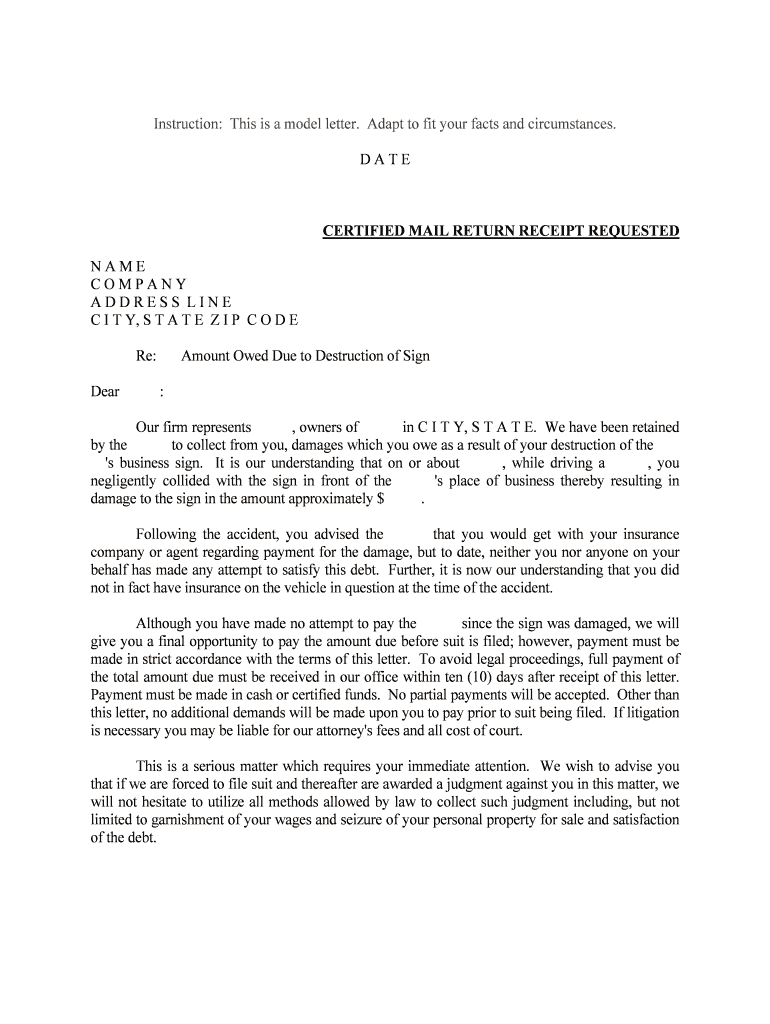

The amount owed due to destruction of sign is a formal document that outlines the financial responsibility resulting from damage to a sign. This form is crucial for businesses and individuals who need to establish accountability for repairs or replacements. It typically includes details such as the nature of the damage, the estimated costs for restoration, and the parties involved. Understanding this form is essential for ensuring compliance with legal and contractual obligations.

Steps to Complete the Amount Owed Due To Destruction Of Sign

Completing the amount owed due to destruction of sign form involves several key steps to ensure accuracy and compliance. First, gather all relevant information about the sign, including its location, condition before destruction, and the circumstances surrounding the damage. Next, document the estimated costs for repair or replacement, which may require quotes from contractors or suppliers. Once you have all the necessary data, fill out the form carefully, ensuring that all fields are completed accurately. Finally, review the document for any errors before submitting it to the appropriate party.

Legal Use of the Amount Owed Due To Destruction Of Sign

The legal use of the amount owed due to destruction of sign form is vital for enforcing accountability. This form serves as a legal record that can be used in disputes or claims related to property damage. To be legally binding, the form must meet specific requirements, including proper signatures from all involved parties. Moreover, compliance with local and state laws regarding property damage is essential to uphold the document's validity in a legal context.

Key Elements of the Amount Owed Due To Destruction Of Sign

Several key elements must be included in the amount owed due to destruction of sign form to ensure its effectiveness. These elements typically include:

- Identification of Parties: Names and contact information of the parties involved.

- Description of Damage: Detailed account of how the sign was damaged.

- Cost Estimates: Breakdown of repair or replacement costs.

- Signatures: Signatures of all parties to confirm agreement.

Inclusion of these elements helps to create a comprehensive and enforceable document.

How to Use the Amount Owed Due To Destruction Of Sign

Using the amount owed due to destruction of sign form effectively requires understanding its purpose and proper handling. Begin by identifying the need for the form, typically arising from damage to a sign owned by a business or individual. Once the form is completed, it should be submitted to the responsible party or insurance company for processing. Retaining copies of the submitted form is important for record-keeping and future reference.

State-Specific Rules for the Amount Owed Due To Destruction Of Sign

State-specific rules may apply to the amount owed due to destruction of sign form, impacting how it should be filled out and submitted. These rules can vary widely, so it is essential to consult local regulations to ensure compliance. Some states may have specific requirements regarding documentation, time limits for filing claims, or additional information that must be included. Being aware of these rules helps to avoid potential legal issues and ensures that the form is recognized in your jurisdiction.

Quick guide on how to complete amount owed due to destruction of sign

Effortlessly Prepare Amount Owed Due To Destruction Of Sign on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Manage Amount Owed Due To Destruction Of Sign on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related procedure today.

How to Edit and eSign Amount Owed Due To Destruction Of Sign with Ease

- Find Amount Owed Due To Destruction Of Sign and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using the tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Amount Owed Due To Destruction Of Sign to ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What should I do if I have an Amount Owed Due To Destruction Of Sign?

If you find yourself facing an Amount Owed Due To Destruction Of Sign, the first step is to assess the situation and document any damages. It's essential to contact your insurance provider to discuss potential coverage options. Additionally, reviewing your contract for any clauses related to sign damage can provide clarity on your obligations.

-

How can airSlate SignNow help reduce the Amount Owed Due To Destruction Of Sign?

airSlate SignNow offers a convenient eSigning solution that minimizes the necessity of physical signage. By transitioning to digital signatures, you reduce the risk of physical signs being damaged or destroyed, thus potentially lowering any Amount Owed Due To Destruction Of Sign. This cost-effective approach not only saves money but also enhances operational efficiency.

-

What pricing plans are available to help with handling Amount Owed Due To Destruction Of Sign?

airSlate SignNow provides flexible pricing plans tailored to varying business needs, allowing you to choose the option that best fits your budget. These plans can help absorb some costs that could result in an Amount Owed Due To Destruction Of Sign, providing an economical alternative to traditional methods. Explore our pricing tiers to find the most suitable package for your organization.

-

Are there features in airSlate SignNow that specifically address the risks of an Amount Owed Due To Destruction Of Sign?

Yes, airSlate SignNow includes features designed to safeguard your digital signatures and documents against loss and damage, effectively mitigating the risk of an Amount Owed Due To Destruction Of Sign. Tools such as cloud storage, audit trails, and secure access ensure that your important documents remain intact and retrievable even in the event of unforeseen circumstances.

-

Can I integrate airSlate SignNow with other software to manage Amount Owed Due To Destruction Of Sign?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications and platforms, making it easier for you to manage related processes, including those surrounding the Amount Owed Due To Destruction Of Sign. By using integrations, your business can streamline its workflow, keep all relevant data in one place, and reduce the chances of miscommunication or errors.

-

What benefits does airSlate SignNow offer that can help with an Amount Owed Due To Destruction Of Sign?

Switching to airSlate SignNow brings numerous benefits, including improved documentation processes and enhanced security. These benefits lead to fewer disputes regarding signage and less likelihood of incurring an Amount Owed Due To Destruction Of Sign. Additionally, the ease of use allows for faster turnaround times and helps maintain better client relationships.

-

What types of businesses can benefit from using airSlate SignNow to avoid an Amount Owed Due To Destruction Of Sign?

Businesses of all sizes and industries can benefit from using airSlate SignNow to avoid incurring an Amount Owed Due To Destruction Of Sign. Whether you’re in real estate, healthcare, education, or retail, digital signatures can streamline your document handling efficiently. This adaptability makes it an ideal solution for any business looking to minimize risk and handle transactions more efficiently.

Get more for Amount Owed Due To Destruction Of Sign

Find out other Amount Owed Due To Destruction Of Sign

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now