Of Church Nonprofit Corporation Form

What is the Of Church Nonprofit Corporation

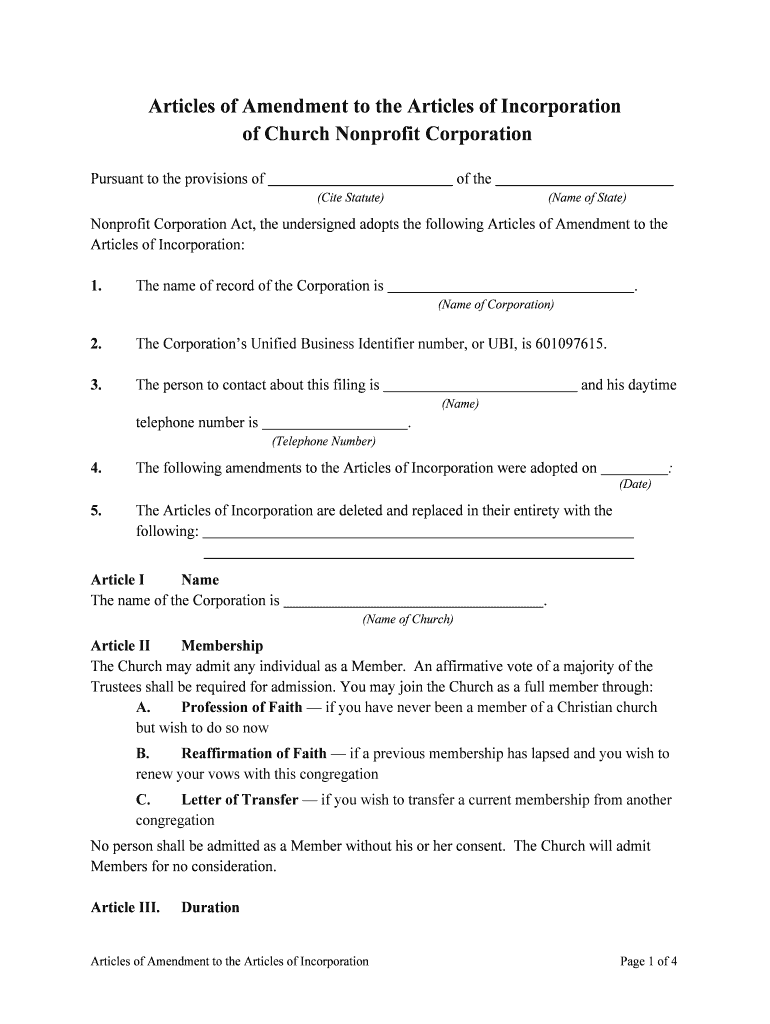

The Of Church Nonprofit Corporation is a legal entity formed to operate a church or religious organization under nonprofit status. This structure allows the organization to engage in religious, educational, and charitable activities without the intention of generating profit for owners or shareholders. By establishing itself as a nonprofit corporation, a church can benefit from tax-exempt status, enabling it to receive donations and grants while providing transparency and accountability to its members and the public.

How to use the Of Church Nonprofit Corporation

Using the Of Church Nonprofit Corporation involves several key steps. First, the organization must clearly define its mission and purpose, ensuring alignment with nonprofit regulations. Next, it must draft and file articles of incorporation with the appropriate state authority, which typically includes details such as the church's name, address, and purpose. Following this, the organization should apply for an Employer Identification Number (EIN) from the IRS, which is essential for tax purposes. Finally, maintaining compliance with state and federal regulations is crucial for ongoing operations and tax-exempt status.

Steps to complete the Of Church Nonprofit Corporation

Completing the Of Church Nonprofit Corporation requires a systematic approach:

- Define the church's mission and objectives.

- Draft articles of incorporation, including the church's name and purpose.

- File the articles with the state and pay any associated fees.

- Obtain an EIN from the IRS.

- Apply for 501(c)(3) status to gain federal tax-exempt status.

- Establish bylaws that govern the church's operations.

- Hold an initial meeting to adopt the bylaws and elect a board of directors.

Legal use of the Of Church Nonprofit Corporation

The legal use of the Of Church Nonprofit Corporation is governed by both state and federal laws. This structure allows churches to operate as separate legal entities, providing liability protection for members and leaders. To maintain compliance, the organization must adhere to regulations regarding fundraising, financial reporting, and governance. Additionally, churches must ensure that their activities align with their stated purpose to retain their nonprofit status and avoid penalties.

Required Documents

To establish the Of Church Nonprofit Corporation, several documents are necessary:

- Articles of incorporation, detailing the church's name, purpose, and structure.

- Bylaws that outline the governance and operational procedures of the church.

- Employer Identification Number (EIN) application.

- Form 1023 or Form 1023-EZ for applying for 501(c)(3) status.

- Meeting minutes from the initial organizational meeting.

Form Submission Methods

The Of Church Nonprofit Corporation can be submitted through various methods, depending on state requirements. Typically, organizations can file their articles of incorporation online, by mail, or in person at the appropriate state office. When applying for federal tax-exempt status, Form 1023 can be submitted electronically through the IRS website or mailed directly to the IRS. It is important to follow the specific guidelines provided by each regulatory body to ensure proper submission.

Quick guide on how to complete of church nonprofit corporation

Complete Of Church Nonprofit Corporation effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Of Church Nonprofit Corporation on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Of Church Nonprofit Corporation without hassle

- Locate Of Church Nonprofit Corporation and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, an invitation link, or by downloading it to your PC.

Forget about lost or misplaced documents, the tedious search for forms, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Of Church Nonprofit Corporation and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Of Church Nonprofit Corporation?

An Of Church Nonprofit Corporation is a legal entity specifically formed for religious organizations that operate without the intent of generating profit. This type of corporation allows churches to engage in various activities while enjoying tax-exempt status and limited liability. Registering as an Of Church Nonprofit Corporation can provide your organization with the necessary legal protections and benefits.

-

How can airSlate SignNow support an Of Church Nonprofit Corporation?

airSlate SignNow offers a seamless solution for an Of Church Nonprofit Corporation to eSign important documents such as membership agreements, donation receipts, and fund management forms. With its user-friendly interface and robust features, airSlate SignNow simplifies the signing process, making it efficient for church leaders and stakeholders. This helps ensure the smooth operation of your nonprofit activities.

-

What are the pricing options for airSlate SignNow for nonprofits?

airSlate SignNow provides special pricing structures geared towards nonprofits, including Of Church Nonprofit Corporations. Depending on your organization's size and needs, we offer various plans that are cost-effective and tailored for budget-conscious entities. These pricing options make it affordable for your church to leverage the power of electronic signatures.

-

What features does airSlate SignNow offer to nonprofits?

With airSlate SignNow, an Of Church Nonprofit Corporation can take advantage of features like custom branding, document templates, and advanced security options. The platform also integrates easily with other tools, facilitating document management and collaboration within your organization. This feature set enhances productivity while maintaining compliance with nonprofit regulations.

-

Can airSlate SignNow integrate with other software commonly used by nonprofits?

Yes, airSlate SignNow can seamlessly integrate with popular software that Of Church Nonprofit Corporations often use, including CRM systems, Google Workspace, and Microsoft Office. These integrations allow for streamlined workflows, ensuring that your church’s administrative tasks are executed smoothly. This connectivity promotes efficiency in document handling and enhances overall organizational effectiveness.

-

What are the legal benefits of using airSlate SignNow for an Of Church Nonprofit Corporation?

Using airSlate SignNow provides an Of Church Nonprofit Corporation with secure and legally binding electronic signatures. This ensures your documents hold up in court and comply with relevant legal standards. The platform also tracks all signed documents, providing an audit trail that can be vital for compliance and accountability within your religious organization.

-

How does airSlate SignNow enhance donor engagement for nonprofits?

airSlate SignNow allows Of Church Nonprofit Corporations to easily send and sign donation agreements, making the donor experience more engaging. The electronic signing process is quick and convenient, encouraging contributions to your church. Enhanced communication and timely document management can also boost your nonprofit's reputation and foster lasting relationships with donors.

Get more for Of Church Nonprofit Corporation

Find out other Of Church Nonprofit Corporation

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist