Nebraska Withholding Return 941n Form 2020

What is the Nebraska Withholding Return 941n Form

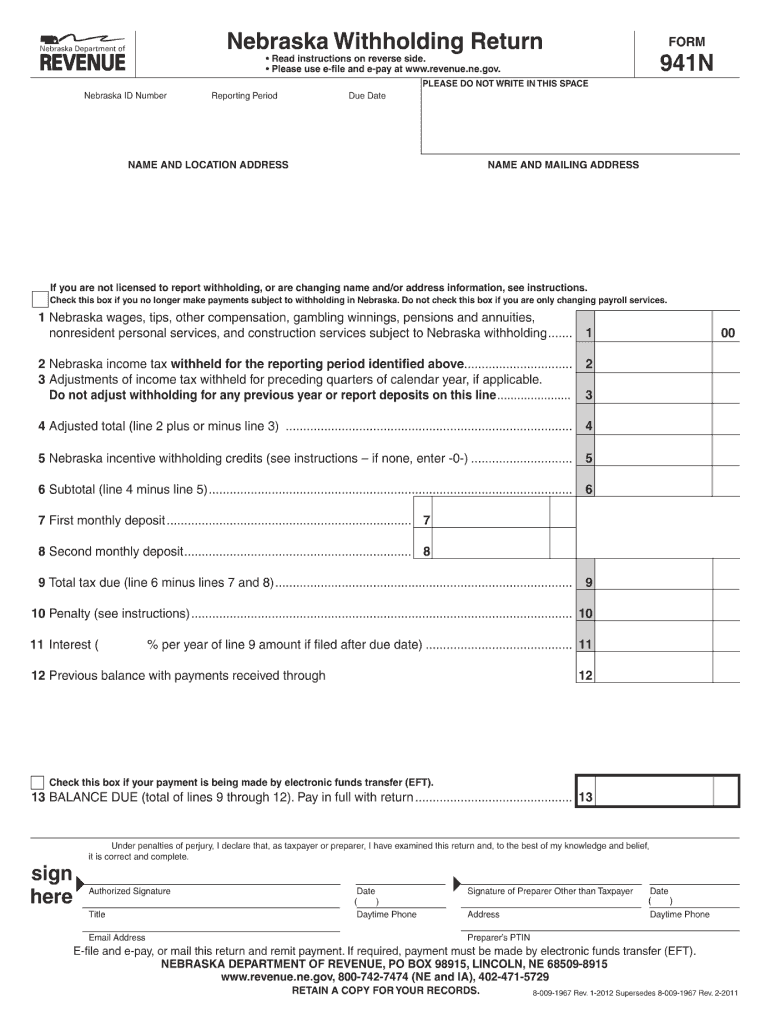

The Nebraska Withholding Return 941n Form is a tax document used by employers in Nebraska to report income tax withheld from employees’ wages. This form is essential for ensuring compliance with state tax regulations. It allows businesses to accurately report their withholding amounts and make necessary payments to the Nebraska Department of Revenue. Understanding the purpose of this form is crucial for employers to avoid penalties and maintain good standing with tax authorities.

Steps to complete the Nebraska Withholding Return 941n Form

Completing the Nebraska Withholding Return 941n Form involves several key steps:

- Gather Employee Information: Collect details such as employee names, Social Security numbers, and total wages paid.

- Calculate Withholding Amounts: Determine the total amount of state income tax withheld from employee wages during the reporting period.

- Fill Out the Form: Enter the collected data accurately into the form, ensuring all sections are completed.

- Review for Accuracy: Double-check all entries to avoid errors that could lead to penalties.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

How to obtain the Nebraska Withholding Return 941n Form

The Nebraska Withholding Return 941n Form can be obtained through various channels. Employers can download the form directly from the Nebraska Department of Revenue website. Additionally, businesses may request a physical copy by contacting the department or visiting their local office. It is important to ensure that you have the most current version of the form to comply with state regulations.

Legal use of the Nebraska Withholding Return 941n Form

Legally, the Nebraska Withholding Return 941n Form must be filed by employers who withhold state income tax from their employees. This form serves as a formal declaration of the amounts withheld and is necessary for maintaining compliance with Nebraska tax laws. Accurate and timely submission of this form helps prevent potential legal issues and penalties associated with non-compliance.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Nebraska Withholding Return 941n Form to avoid penalties. Typically, the form is due quarterly, with deadlines falling on the last day of the month following the end of each quarter. Important dates include:

- First Quarter: Due April 30

- Second Quarter: Due July 31

- Third Quarter: Due October 31

- Fourth Quarter: Due January 31

Form Submission Methods (Online / Mail / In-Person)

Employers have multiple options for submitting the Nebraska Withholding Return 941n Form. The form can be filed online through the Nebraska Department of Revenue’s e-filing system, which offers a convenient and efficient way to submit tax documents. Alternatively, employers may choose to mail the completed form to the designated address or deliver it in person to a local tax office. Each method has its own advantages, and employers should select the one that best suits their needs.

Quick guide on how to complete nebraska withholding return 941n 2012 form

Complete Nebraska Withholding Return 941n Form seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Nebraska Withholding Return 941n Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest way to modify and electronically sign Nebraska Withholding Return 941n Form with minimal effort

- Find Nebraska Withholding Return 941n Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools provided by airSlate SignNow designed specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method to submit your form—via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Nebraska Withholding Return 941n Form to guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska withholding return 941n 2012 form

Create this form in 5 minutes!

How to create an eSignature for the nebraska withholding return 941n 2012 form

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is the Nebraska Withholding Return 941n Form?

The Nebraska Withholding Return 941n Form is a tax document required for employers in Nebraska to report income tax withheld from employee wages. This form is crucial for compliance with state tax regulations and ensures that businesses properly account for withheld taxes. Using the Nebraska Withholding Return 941n Form helps you avoid penalties while keeping your payroll records organized.

-

How can airSlate SignNow assist with the Nebraska Withholding Return 941n Form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Nebraska Withholding Return 941n Form. Our solution streamlines the process, making it quick for businesses to complete and submit their forms without the hassle of paperwork. This allows you to focus more on your business operations rather than administrative tasks.

-

What features does airSlate SignNow offer for managing the Nebraska Withholding Return 941n Form?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure eSigning, all of which enhance the filing of the Nebraska Withholding Return 941n Form. These tools simplify document management, ensuring that all necessary forms are completed accurately and on time. Plus, our platform integrates easily with your existing systems for even greater efficiency.

-

Is there a cost associated with using airSlate SignNow for the Nebraska Withholding Return 941n Form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans are flexible and cater to different needs, allowing you to choose the one that best fits your budget. Investing in our solution not only helps with the Nebraska Withholding Return 941n Form but also enhances overall document management.

-

Can I integrate airSlate SignNow with other software for filing the Nebraska Withholding Return 941n Form?

Absolutely! airSlate SignNow offers robust integrations with various accounting and payroll software, making it easier to prepare and file the Nebraska Withholding Return 941n Form. This compatibility allows for seamless data transfer and enhances accuracy, ensuring that all information is correctly reflected on your tax forms.

-

What are the benefits of using airSlate SignNow for the Nebraska Withholding Return 941n Form?

Using airSlate SignNow for the Nebraska Withholding Return 941n Form offers several benefits, including time savings, improved accuracy, and secure document handling. Our platform reduces the likelihood of errors and helps you meet deadlines efficiently. Additionally, the eSigning feature enhances professionalism and convenience in your documentation process.

-

How long does it take to complete the Nebraska Withholding Return 941n Form with airSlate SignNow?

Completing the Nebraska Withholding Return 941n Form with airSlate SignNow can be achieved in a fraction of the time compared to traditional methods. Our intuitive interface allows users to easily fill out the form and obtain necessary signatures quickly. Many users report completing their forms in as little as 15 minutes.

Get more for Nebraska Withholding Return 941n Form

Find out other Nebraska Withholding Return 941n Form

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF