Loan Documents HUD Form

What is the Loan Documents HUD

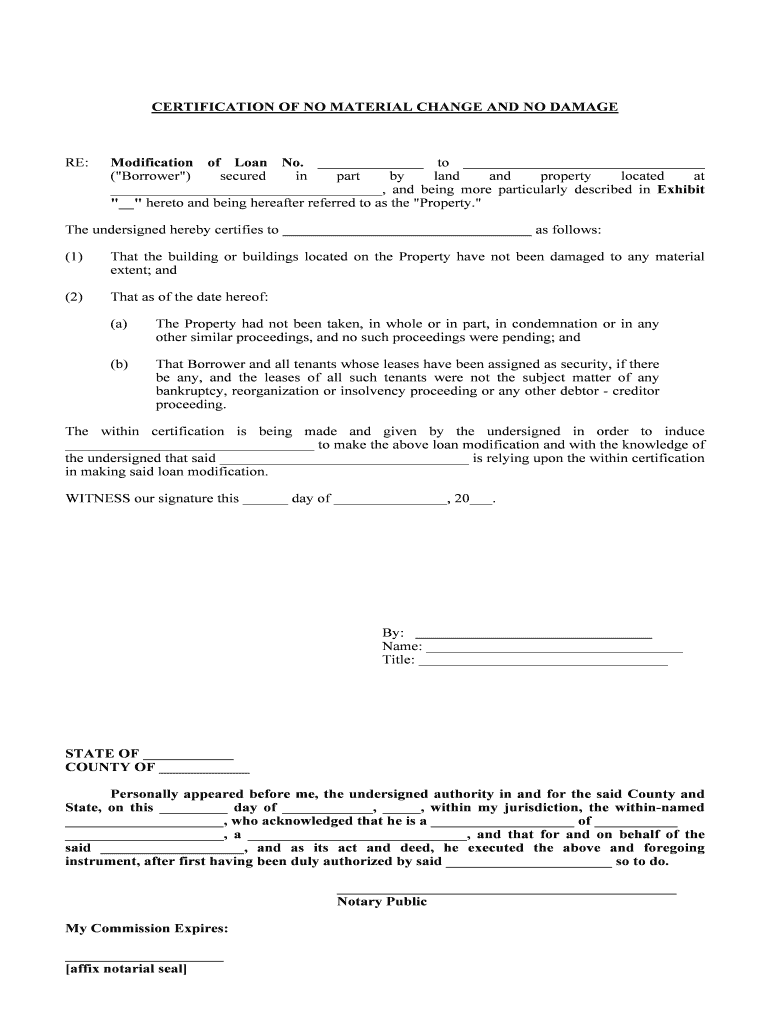

The Loan Documents HUD refers to a set of standardized forms used in the United States for various loan transactions, particularly those related to real estate. These documents are essential for ensuring transparency and compliance in the lending process. The HUD forms provide borrowers with crucial information about the terms of their loans, including interest rates, fees, and other financial obligations. They are designed to protect both lenders and borrowers by outlining the specifics of the loan agreement in a clear and accessible manner.

How to Use the Loan Documents HUD

Using the Loan Documents HUD effectively involves understanding its components and ensuring that all necessary information is accurately filled out. Borrowers should carefully review each section of the form, paying close attention to details such as loan amounts, interest rates, and repayment terms. It is also important to ensure that all required signatures are obtained. Utilizing digital tools like signNow can streamline the process, allowing users to fill out and eSign documents securely and efficiently.

Steps to Complete the Loan Documents HUD

Completing the Loan Documents HUD requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather necessary information, including personal identification and financial details.

- Access the HUD form through a reliable digital platform.

- Fill in the required fields, ensuring all information is accurate and complete.

- Review the document for any errors or omissions.

- Obtain the necessary signatures from all parties involved.

- Submit the completed form through the appropriate channels, whether online or via mail.

Legal Use of the Loan Documents HUD

The legal use of the Loan Documents HUD is governed by federal and state regulations that dictate how loan agreements must be presented and executed. To be considered legally binding, the form must be completed in accordance with the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This includes ensuring that all signatures are valid and that the document is stored securely to protect against unauthorized access.

Key Elements of the Loan Documents HUD

Key elements of the Loan Documents HUD include:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage charged on the loan amount.

- Fees: Any additional costs associated with the loan, such as closing costs.

- Repayment Terms: The schedule and conditions under which the loan must be repaid.

- Borrower Information: Details about the individual or entity taking out the loan.

Examples of Using the Loan Documents HUD

Examples of using the Loan Documents HUD can vary based on the type of loan and the specific circumstances of the borrower. Common scenarios include:

- First-time homebuyers applying for a mortgage loan.

- Real estate investors seeking financing for property purchases.

- Homeowners refinancing existing loans to secure better terms.

In each case, the Loan Documents HUD serves as a critical tool for outlining the terms of the loan and ensuring that all parties are informed and in agreement.

Quick guide on how to complete loan documents hud

Effortlessly Prepare Loan Documents HUD on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to acquire the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Handle Loan Documents HUD on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and Electronically Sign Loan Documents HUD

- Find Loan Documents HUD and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and electronically sign Loan Documents HUD and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Loan Documents HUD and why are they important?

Loan Documents HUD are essential legal documents generated for real estate transactions, particularly in the context of government-backed loans. They provide detailed information on loan terms, fees, and regulations, ensuring transparency and compliance in the lending process. Understanding these documents is crucial for borrowers and lenders alike to avoid any potential pitfalls.

-

How can airSlate SignNow help with managing Loan Documents HUD?

airSlate SignNow simplifies the process of sending and eSigning Loan Documents HUD, making it efficient and hassle-free. Our platform allows users to electronically sign documents from anywhere, ensuring that your real estate transactions are processed quickly and securely. This expedites closing times and enhances the overall user experience.

-

What features does airSlate SignNow offer for Loan Documents HUD?

With airSlate SignNow, users can create, send, and eSign Loan Documents HUD seamlessly. The platform provides customizable templates, advanced tracking, and secure storage options. These features streamline the document management process and ensure you always have access to the most up-to-date forms.

-

Is airSlate SignNow cost-effective for managing Loan Documents HUD?

Yes, airSlate SignNow is a cost-effective solution for managing Loan Documents HUD. Our pricing structure is designed to accommodate businesses of all sizes, allowing you to choose a plan that fits your needs and budget. By reducing paperwork and processing time, our platform can save you money in the long run.

-

What integrations does airSlate SignNow support for Loan Documents HUD?

airSlate SignNow supports a variety of integrations with popular software and tools that are commonly used in the real estate industry. This includes CRM systems, document management platforms, and accounting software, which can help streamline the handling of Loan Documents HUD. Our integrations ensure that you can work efficiently across multiple platforms.

-

How secure are Loan Documents HUD signed through airSlate SignNow?

Security is a top priority at airSlate SignNow. All Loan Documents HUD signed through our platform are encrypted and stored securely, ensuring the confidentiality and integrity of your data. We comply with industry standards to provide a safe and reliable environment for electronic signatures.

-

Can I track the status of my Loan Documents HUD with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Loan Documents HUD in real-time. You can see when documents are sent, viewed, and signed, providing complete visibility into the signing process and helping you manage your transactions effectively.

Get more for Loan Documents HUD

- Formulir bank mandiri pdf

- Contrato de arrendamiento puerto rico form

- Indemnification undertaking by student format

- Nursing council of namibia form

- Agrahara insurance claim application form sinhala

- Mortgage broker agreementquot keyword found websites listing form

- Ccm form iterationsingle page cdr

- 615 741 3101 form

Find out other Loan Documents HUD

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement