Criminal Tax Manual 23 00 CONSPIRACY to COMMIT OFFENSE Form

What is the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE

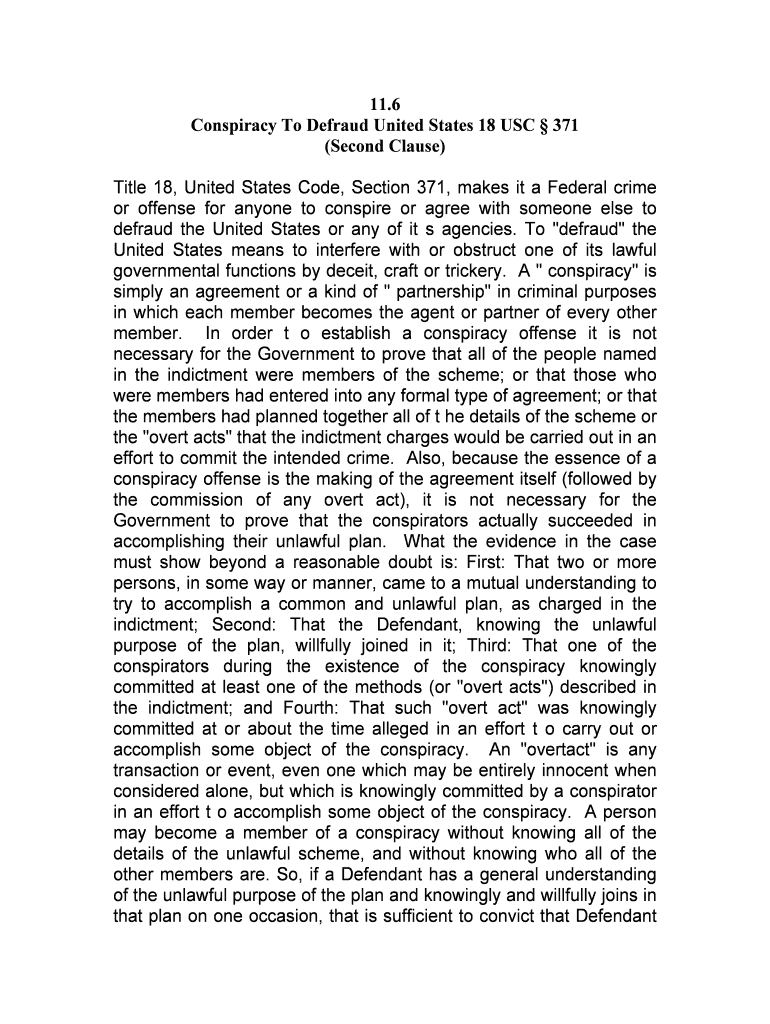

The Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE is a legal document used to address situations where individuals may be involved in conspiring to commit tax-related offenses. This manual outlines the definitions, legal implications, and potential consequences of such conspiracies, providing a framework for understanding how these offenses are prosecuted under U.S. law. It serves as a critical resource for legal professionals, tax advisors, and individuals seeking clarity on their rights and responsibilities regarding tax compliance.

Key Elements of the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE

Understanding the key elements of this manual is essential for anyone involved in tax-related matters. The main components include:

- Definition of Conspiracy: A clear explanation of what constitutes conspiracy in the context of tax offenses.

- Intent: The necessity of proving intent to commit an offense, which is a critical factor in legal proceedings.

- Overt Acts: Requirements for demonstrating that actions were taken towards the commission of the crime.

- Co-conspirators: Information on how involvement with others can impact the case and potential liabilities.

Steps to Complete the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE

Completing the Criminal Tax Manual 23 00 involves several steps to ensure accuracy and compliance. Here are the essential steps:

- Review the Manual: Familiarize yourself with the contents and legal definitions.

- Gather Necessary Information: Collect all relevant documents and details related to the case.

- Complete Required Sections: Fill out the necessary sections of the manual accurately.

- Consult Legal Counsel: Seek advice from a legal professional if needed to ensure compliance.

- Submit the Document: Follow the specified submission guidelines for the manual.

Legal Use of the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE

The legal use of the Criminal Tax Manual 23 00 is crucial for ensuring that individuals and entities comply with tax laws. This manual can be used in various legal contexts, including:

- Defense in Court: It can serve as a reference for legal arguments in cases involving conspiracy charges.

- Compliance Training: Organizations may use it to educate employees about tax-related legal responsibilities.

- Tax Planning: Tax professionals can utilize the manual to advise clients on avoiding potential legal issues.

IRS Guidelines Related to the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE

The IRS provides specific guidelines that relate to the Criminal Tax Manual 23 00. These guidelines help clarify how tax laws are enforced and interpreted. Important aspects include:

- Enforcement Policies: The IRS outlines its approach to investigating tax conspiracy cases.

- Reporting Obligations: Guidelines on what must be reported by tax professionals and individuals.

- Penalties for Non-Compliance: Information on potential penalties for failing to adhere to tax laws.

Penalties for Non-Compliance with the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE

Non-compliance with the guidelines set forth in the Criminal Tax Manual 23 00 can result in severe penalties. These may include:

- Criminal Charges: Potential for facing criminal prosecution if conspiracy is proven.

- Fines: Significant financial penalties imposed by the IRS or courts.

- Imprisonment: In severe cases, individuals may face jail time for conspiracy-related offenses.

Quick guide on how to complete criminal tax manual 2300 conspiracy to commit offense

Easily Prepare Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-conscious replacement for traditional printed and signed papers, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without complications. Manage Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related processes today.

Effortlessly Modify and Electronically Sign Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE

- Obtain Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive details with tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs within a few clicks from any device you select. Modify and electronically sign Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE while ensuring exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is included in the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE?

The Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE includes comprehensive guidelines and legal definitions regarding conspiracy offenses in the context of criminal tax law. It provides detailed explanations of legal precedents, case studies, and enforcement actions that can be critical for legal practitioners and tax professionals.

-

How can I purchase the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE?

You can purchase the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE directly through our website. We offer various pricing options to ensure accessibility for all users, including individual purchases and subscription models for law firms and organizations.

-

Are there any discounts available for the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE?

Yes, we occasionally offer promotional discounts on the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE. Be sure to subscribe to our newsletter to receive updates on special offers and discounts that can make your purchase even more cost-effective.

-

What features are available in the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE?

The Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE includes an extensive index, easy navigation tools, and cross-references to relevant statutes. These features make it user-friendly for legal professionals, allowing for quick access to critical information.

-

How can the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE benefit legal practitioners?

Legal practitioners can benefit from the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE by gaining deep insights into conspiracy offenses related to tax law. This resource will enhance their understanding of legal strategies and improve their ability to represent clients effectively in tax-related cases.

-

Does the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE integrate with other legal resources?

Yes, the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE is designed to integrate seamlessly with other legal databases and resources. Users can easily reference linked materials and case law while using our manual for a comprehensive understanding of the topic.

-

Can I find case studies related to conspiracy in the Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE?

Absolutely! The Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE contains various case studies that illustrate real-world applications of conspiracy laws. These case studies serve as practical examples for understanding the nuances and implications of conspiracy in criminal tax contexts.

Get more for Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE

Find out other Criminal Tax Manual 23 00 CONSPIRACY TO COMMIT OFFENSE

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe