DETERMINING CONTRACTOR STATUS Form

What is the DETERMINING CONTRACTOR STATUS

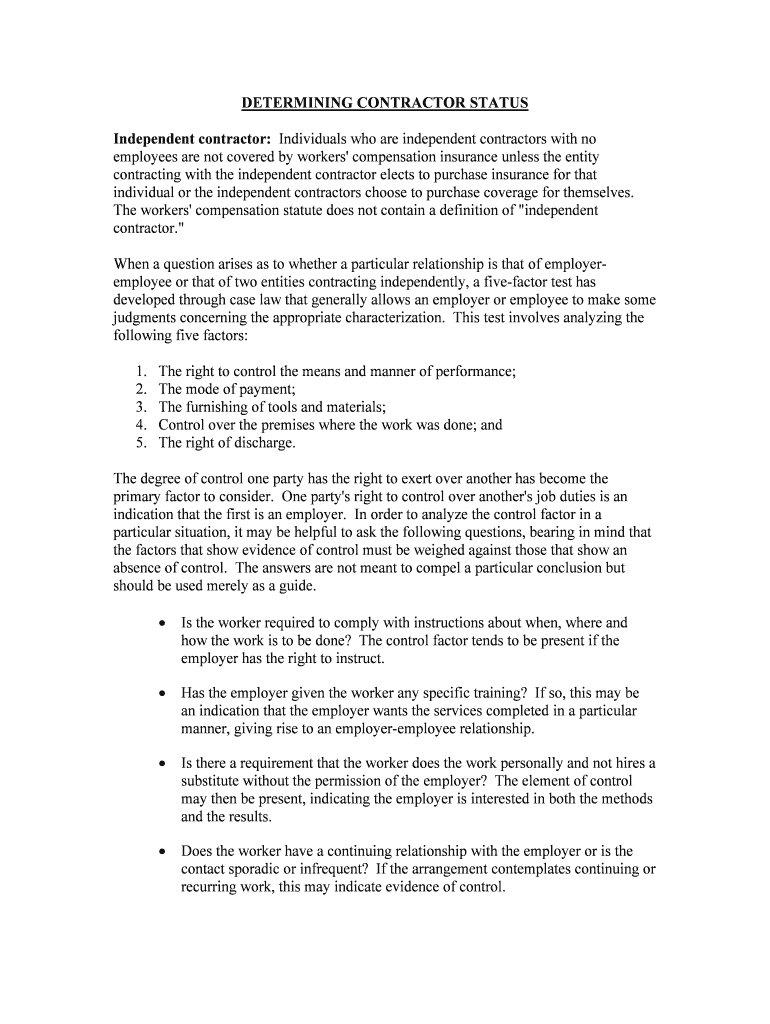

The determining contractor status form is a crucial document used to establish the classification of a worker as either an independent contractor or an employee. This classification can significantly impact tax obligations, benefits eligibility, and legal responsibilities for both the worker and the hiring entity. Understanding the nuances of this form is essential for compliance with federal and state regulations.

Steps to complete the DETERMINING CONTRACTOR STATUS

Completing the determining contractor status form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information about the worker, including their role, payment structure, and the nature of their work relationship with the hiring entity. Next, carefully fill out the form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions before submission. It is advisable to keep a copy for your records.

Legal use of the DETERMINING CONTRACTOR STATUS

The legal use of the determining contractor status form is governed by various federal and state laws. Proper classification is vital to avoid misclassification penalties, which can include back taxes and fines. The form serves as a legal document that can be referenced in disputes regarding worker classification. Compliance with the IRS guidelines and relevant labor laws is essential to ensure that the form is used correctly and that the rights of both parties are protected.

Eligibility Criteria

Eligibility criteria for using the determining contractor status form depend on the nature of the work arrangement. Typically, the worker must meet specific conditions to be classified as an independent contractor, such as having control over how their work is completed and the ability to work for multiple clients. Understanding these criteria is essential for businesses to ensure compliance and avoid potential legal issues.

IRS Guidelines

The IRS provides guidelines that outline the criteria for determining whether a worker is an independent contractor or an employee. These guidelines focus on factors such as behavioral control, financial control, and the type of relationship between the worker and the employer. Adhering to these guidelines is critical for businesses to avoid penalties associated with misclassification and to ensure proper tax reporting.

Form Submission Methods

The determining contractor status form can typically be submitted through various methods, including online, by mail, or in person. Each submission method has its own requirements and processing times. Online submissions may offer faster processing, while mail submissions require careful attention to ensure that the form is sent to the correct address. It is important to choose the method that best suits your needs while ensuring compliance with submission guidelines.

Quick guide on how to complete determining contractor status

Complete DETERMINING CONTRACTOR STATUS effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without complications. Manage DETERMINING CONTRACTOR STATUS on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign DETERMINING CONTRACTOR STATUS with ease

- Find DETERMINING CONTRACTOR STATUS and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign DETERMINING CONTRACTOR STATUS and guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the importance of determining contractor status?

Determining contractor status is crucial for businesses as it influences tax obligations, liability, and compliance with labor laws. Misclassifying employees as contractors can lead to legal issues and financial penalties. Understanding the distinction helps in making informed decisions for workforce management.

-

How does airSlate SignNow assist in determining contractor status?

airSlate SignNow provides a streamlined process for documenting contractor agreements, which is essential for determining contractor status. The platform allows businesses to create, send, and eSign contracts efficiently, ensuring that all necessary information is captured accurately. By utilizing airSlate SignNow, companies can reduce misclassification risks.

-

What features does airSlate SignNow offer for eSigning contractor agreements?

airSlate SignNow offers a range of features including customizable templates, in-app signatures, and real-time tracking. These tools facilitate efficient management of contractor agreements, enhancing accuracy when determining contractor status. The easy-to-use interface helps ensure compliance with industry standards.

-

Is airSlate SignNow suitable for small businesses looking to determine contractor status?

Yes, airSlate SignNow is an ideal solution for small businesses that need to determine contractor status while managing costs. With its affordable pricing plans, businesses can access essential eSigning features without breaking the bank. This cost-effective approach allows small businesses to remain compliant and organized.

-

Can airSlate SignNow integrate with other business tools to help determine contractor status?

Absolutely! airSlate SignNow integrates seamlessly with various business tools such as CRM and project management software. This integration enables businesses to manage contractor agreements effectively while determining contractor status and streamlining overall workflow. Enhance your operational efficiency with these powerful integrations.

-

What are the benefits of using airSlate SignNow for contractor agreements?

Using airSlate SignNow for contractor agreements enhances clarity and reduces the risk of disputes when determining contractor status. The platform ensures secure storage of all signed documents and provides easy access for future reference. This leads to improved compliance and efficiency in handling contractor relationships.

-

How does airSlate SignNow ensure the security of contractor agreements?

airSlate SignNow prioritizes security through features like encryption, secure access, and audit trails for contractor agreements. These measures protect sensitive information while determining contractor status and ensure that all transactions are traceable. Trust in airSlate SignNow’s robust security protocols to keep your data safe.

Get more for DETERMINING CONTRACTOR STATUS

Find out other DETERMINING CONTRACTOR STATUS

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online