FLSA EXEMPTNON EXEMPT COMPLIANCE FORM

What is the FLSA Exempt/Non-Exempt Compliance Form

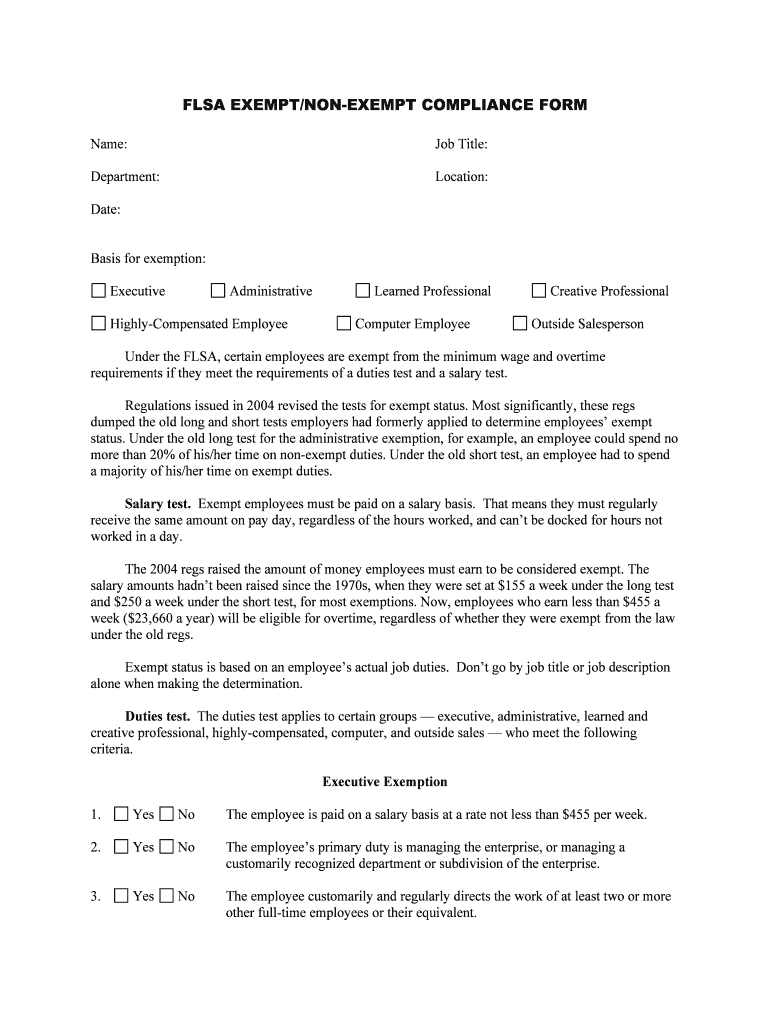

The FLSA Exempt/Non-Exempt Compliance Form is a critical document used by employers to determine the classification of employees under the Fair Labor Standards Act (FLSA). This classification affects eligibility for overtime pay and minimum wage protections. Employees classified as exempt typically do not receive overtime pay, while non-exempt employees are entitled to it. Understanding the distinctions between these classifications is essential for compliance with federal labor laws.

How to Use the FLSA Exempt/Non-Exempt Compliance Form

Utilizing the FLSA Exempt/Non-Exempt Compliance Form involves several key steps. First, employers must gather information about the employee's job duties, salary, and work hours. Next, they should carefully assess the employee's role against the criteria outlined in the FLSA. After determining the appropriate classification, the form should be filled out accurately to reflect this decision. It is advisable to keep a copy of the completed form for record-keeping and compliance purposes.

Steps to Complete the FLSA Exempt/Non-Exempt Compliance Form

Completing the FLSA Exempt/Non-Exempt Compliance Form requires attention to detail. Follow these steps:

- Gather necessary employee information, including job title, salary, and job description.

- Review the FLSA criteria for exempt and non-exempt classifications.

- Determine the classification based on the employee's duties and salary.

- Fill out the form, ensuring all sections are completed accurately.

- Sign and date the form, and provide a copy to the employee.

Legal Use of the FLSA Exempt/Non-Exempt Compliance Form

The legal use of the FLSA Exempt/Non-Exempt Compliance Form is vital for employers to avoid potential violations of labor laws. Proper classification protects businesses from legal disputes and penalties. Employers must ensure that the form is completed in accordance with the FLSA guidelines and that it accurately reflects the employee's job duties and compensation structure. Regular reviews of employee classifications are recommended to maintain compliance as job roles and responsibilities may change over time.

Key Elements of the FLSA Exempt/Non-Exempt Compliance Form

Several key elements should be included in the FLSA Exempt/Non-Exempt Compliance Form:

- Employee's name and job title

- Detailed job description outlining primary duties

- Salary information, including any bonuses or commissions

- Classification determination (exempt or non-exempt)

- Signatures of both the employer and employee

Penalties for Non-Compliance

Failure to comply with FLSA regulations regarding employee classification can result in significant penalties for employers. These may include back pay for unpaid overtime, fines, and legal fees. Additionally, non-compliance can damage a company's reputation and employee morale. It is essential for businesses to take the classification process seriously and ensure that they adhere to all applicable labor laws.

Quick guide on how to complete flsa exemptnon exempt compliance form

Complete FLSA EXEMPTNON EXEMPT COMPLIANCE FORM easily on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle FLSA EXEMPTNON EXEMPT COMPLIANCE FORM on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign FLSA EXEMPTNON EXEMPT COMPLIANCE FORM effortlessly

- Locate FLSA EXEMPTNON EXEMPT COMPLIANCE FORM and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign FLSA EXEMPTNON EXEMPT COMPLIANCE FORM and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the FLSA EXEMPTNON EXEMPT COMPLIANCE FORM?

The FLSA EXEMPTNON EXEMPT COMPLIANCE FORM is a document that helps employers determine the classification of their employees under the Fair Labor Standards Act. This classification is crucial for ensuring that companies adhere to wage and hour laws. Using airSlate SignNow, businesses can securely create and manage these compliance forms efficiently.

-

How can airSlate SignNow help with the FLSA EXEMPTNON EXEMPT COMPLIANCE FORM?

airSlate SignNow simplifies the process of generating the FLSA EXEMPTNON EXEMPT COMPLIANCE FORM by offering customizable templates and easy eSigning capabilities. This allows businesses to quickly complete and legally sign necessary documents online. Additionally, you can track the status of your forms in real time.

-

Is there a cost associated with using airSlate SignNow for FLSA EXEMPTNON EXEMPT COMPLIANCE FORM?

Yes, airSlate SignNow offers various pricing plans tailored to the needs of different businesses. Each plan includes features for managing FLSA EXEMPTNON EXEMPT COMPLIANCE FORM creation and signing. You can choose the plan that best fits your compliance and document management needs.

-

What features does airSlate SignNow offer for managing compliance forms?

airSlate SignNow includes features such as document editing, secure eSigning, template creation, and analytics for tracking compliance form usage. These tools streamline the workflow for FLSA EXEMPTNON EXEMPT COMPLIANCE FORMs and ensure that businesses remain compliant with legal standards. The intuitive interface makes it easy for users of all levels.

-

Can I integrate airSlate SignNow with other software for FLSA EXEMPTNON EXEMPT COMPLIANCE FORM management?

Absolutely! airSlate SignNow supports integrations with various software to enhance the management of FLSA EXEMPTNON EXEMPT COMPLIANCE FORMs. Whether you use HR management tools or other document management systems, you can connect airSlate SignNow seamlessly to improve your processes.

-

How does airSlate SignNow guarantee the security of the FLSA EXEMPTNON EXEMPT COMPLIANCE FORM?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption protocols and secure data storage to protect all documents, including the FLSA EXEMPTNON EXEMPT COMPLIANCE FORM. This ensures that your sensitive information remains confidential and secure throughout the signing process.

-

What benefits will I gain from using airSlate SignNow for compliance forms?

Using airSlate SignNow for your FLSA EXEMPTNON EXEMPT COMPLIANCE FORM offers signNow benefits, including improved efficiency, reduced paper usage, and streamlined workflows. The platform allows multiple signers to complete compliance forms quickly and easily, saving you time and resources while ensuring legal compliance.

Get more for FLSA EXEMPTNON EXEMPT COMPLIANCE FORM

Find out other FLSA EXEMPTNON EXEMPT COMPLIANCE FORM

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT