2 CFR200 464 Relocation Costs of Employees CFRUS Form

What is the 2 CFR200 464 Relocation Costs Of Employees CFRUS

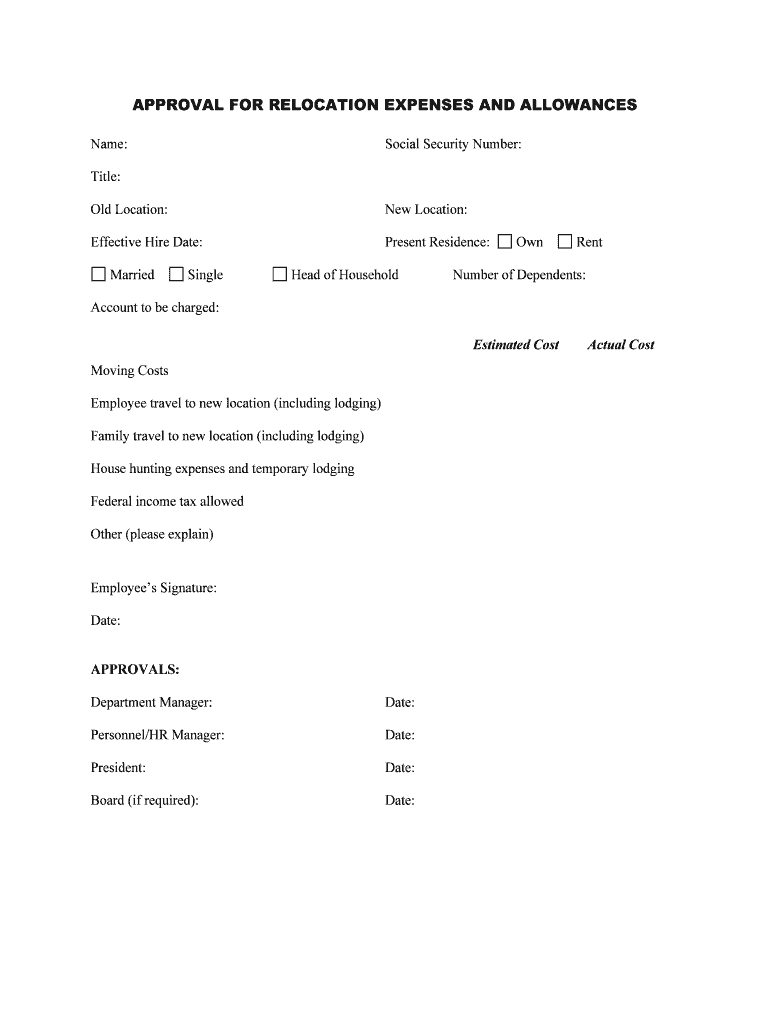

The 2 CFR200 464 Relocation Costs Of Employees CFRUS form is a regulatory document that outlines the guidelines for reimbursing employees for relocation expenses incurred as part of their job duties. This form is particularly relevant for federal agencies and organizations that receive federal funding, as it ensures compliance with federal regulations regarding employee relocation costs. The regulations specify what types of expenses can be reimbursed, the documentation required to support these expenses, and the conditions under which reimbursement is permissible.

Steps to complete the 2 CFR200 464 Relocation Costs Of Employees CFRUS

Completing the 2 CFR200 464 Relocation Costs Of Employees CFRUS form involves several key steps. First, gather all relevant documentation, including receipts for moving expenses, travel costs, and any other related expenses. Next, fill out the form accurately, ensuring that all required fields are completed. This includes providing details about the employee's relocation, the nature of the expenses, and any supporting documentation. After completing the form, review it for accuracy and completeness before submitting it to the appropriate department for processing.

Legal use of the 2 CFR200 464 Relocation Costs Of Employees CFRUS

The legal use of the 2 CFR200 464 Relocation Costs Of Employees CFRUS form is governed by federal regulations that dictate how relocation costs can be reimbursed. To ensure compliance, organizations must adhere to the guidelines set forth in the Code of Federal Regulations. This includes maintaining accurate records, providing necessary documentation, and ensuring that all expenses claimed are allowable under federal law. Failure to comply with these regulations can result in penalties, including the denial of reimbursement claims.

Key elements of the 2 CFR200 464 Relocation Costs Of Employees CFRUS

Key elements of the 2 CFR200 464 Relocation Costs Of Employees CFRUS form include the types of allowable expenses, such as transportation costs, temporary lodging, and storage fees. Additionally, the form requires detailed information about the employee's relocation, including the starting and ending locations, as well as the dates of the move. Proper documentation, such as receipts and invoices, must be included to substantiate the claims made on the form. Understanding these elements is crucial for ensuring accurate and compliant submissions.

Examples of using the 2 CFR200 464 Relocation Costs Of Employees CFRUS

Examples of using the 2 CFR200 464 Relocation Costs Of Employees CFRUS form include situations where an employee is transferred to a new job location or when a new hire relocates for employment. In these cases, the form can be used to claim reimbursement for moving expenses incurred during the transition. For instance, if an employee incurs costs for hiring a moving company, purchasing packing materials, or traveling to the new location, these expenses can be documented and submitted for reimbursement using this form.

Required Documents

To complete the 2 CFR200 464 Relocation Costs Of Employees CFRUS form, several documents are required. These typically include receipts for all claimed expenses, a copy of the employment offer letter or transfer notice, and any additional documentation that supports the relocation claim. It is essential to keep copies of all submitted documents for record-keeping purposes, as they may be needed for future reference or audits.

Quick guide on how to complete 2 cfr200464 relocation costs of employeescfrus

Prepare 2 CFR200 464 Relocation Costs Of Employees CFRUS effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can acquire the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle 2 CFR200 464 Relocation Costs Of Employees CFRUS on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign 2 CFR200 464 Relocation Costs Of Employees CFRUS without effort

- Obtain 2 CFR200 464 Relocation Costs Of Employees CFRUS and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, painstaking form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign 2 CFR200 464 Relocation Costs Of Employees CFRUS and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are 2 CFR200 464 Relocation Costs Of Employees CFRUS?

2 CFR200 464 Relocation Costs Of Employees CFRUS refers to the specific guidelines and provisions under federal regulations for reimbursing relocating employees' expenses. Understanding these costs is crucial for organizations planning employee relocations to ensure compliance and appropriate budgeting.

-

How can airSlate SignNow assist with managing 2 CFR200 464 Relocation Costs Of Employees CFRUS?

airSlate SignNow offers a streamlined document management platform that simplifies the process of tracking and approving relocation reimbursements under 2 CFR200 464. With eSign capabilities, businesses can quickly get the necessary signatures on relocation agreements, ensuring efficient handling of employee costs.

-

What features does airSlate SignNow provide for managing relocation documents?

airSlate SignNow includes features like customizable templates, eSignature capabilities, and document workflows specifically designed for relocation processes. These features allow businesses to effectively manage and document their 2 CFR200 464 Relocation Costs Of Employees CFRUS, ensuring smooth transitions for relocating staff.

-

Is airSlate SignNow cost-effective for businesses managing 2 CFR200 464 Relocation Costs Of Employees CFRUS?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to manage 2 CFR200 464 Relocation Costs Of Employees CFRUS. With affordable pricing plans and features designed to optimize workflow, companies can save time and reduce costs associated with document management.

-

Can airSlate SignNow integrate with other HR systems for handling relocation costs?

Absolutely, airSlate SignNow can seamlessly integrate with various HR systems to ensure a coherent management approach for 2 CFR200 464 Relocation Costs Of Employees CFRUS. This integration helps streamline workflows and provides a centralized platform for employee documentation and relocation tracking.

-

What benefits can businesses expect from using airSlate SignNow for relocation processing?

Businesses utilizing airSlate SignNow for processing 2 CFR200 464 Relocation Costs Of Employees CFRUS can expect faster turnaround times, enhanced accuracy in documentation, and greater compliance with federal regulations. These benefits translate to improved employee satisfaction and efficient relocation management.

-

How does airSlate SignNow ensure compliance with 2 CFR200 464 regulations?

airSlate SignNow provides templates and workflows that adhere to 2 CFR200 464 regulations, making it easier for companies to comply with federal guidelines. Additionally, the platform allows businesses to maintain thorough records of all relocation expenses and approvals, ensuring regulatory compliance.

Get more for 2 CFR200 464 Relocation Costs Of Employees CFRUS

Find out other 2 CFR200 464 Relocation Costs Of Employees CFRUS

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template