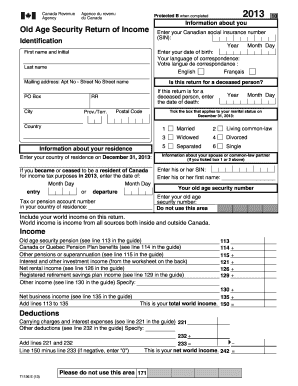

T1136 2013

What is the T1136

The T1136 form is a tax document used for reporting specific financial information to the Internal Revenue Service (IRS) in the United States. This form is primarily utilized by individuals and businesses to disclose certain transactions and financial activities. It ensures compliance with federal tax regulations and helps maintain transparency in financial reporting. Understanding the purpose of the T1136 is essential for accurate tax filing and avoidance of potential penalties.

How to use the T1136

Using the T1136 form involves a few key steps. First, gather all necessary financial documents that relate to the transactions you need to report. This may include bank statements, receipts, and other relevant financial records. Next, accurately fill out the form with the required information, ensuring that all entries are correct and complete. Once the form is completed, it should be submitted to the IRS according to the specified guidelines. It is crucial to keep a copy for your records in case of future inquiries.

Steps to complete the T1136

Completing the T1136 form involves several important steps:

- Collect all relevant financial documents.

- Carefully read the instructions provided with the form.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form to the IRS by the deadline.

Following these steps will help ensure that your T1136 form is completed correctly and submitted on time, minimizing the risk of issues with the IRS.

Legal use of the T1136

The legal use of the T1136 form is governed by IRS regulations. It is important to understand that this form must be used in accordance with federal tax laws. Filing the T1136 accurately and on time is essential to avoid penalties for non-compliance. Additionally, the information provided must be truthful and complete, as any discrepancies can lead to audits or legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the T1136 form are critical to ensure compliance with IRS requirements. Typically, the form must be submitted by a specific date each tax year. It is advisable to check the IRS website or consult with a tax professional for the exact deadlines, as they may vary from year to year. Missing the deadline can result in penalties, so timely submission is essential.

Required Documents

To complete the T1136 form, several documents may be required. These typically include:

- Bank statements related to the transactions.

- Receipts for any expenses being reported.

- Previous tax returns, if applicable.

- Any other financial records that support the information provided on the form.

Having these documents ready will facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Quick guide on how to complete t1136

Complete T1136 effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without interruptions. Manage T1136 on any device using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The most efficient way to modify and eSign T1136 effortlessly

- Obtain T1136 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign T1136 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1136

Create this form in 5 minutes!

How to create an eSignature for the t1136

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t1136 form used for?

The t1136 form is utilized for various tax-related purposes in Canada, particularly for taxpayers who engage in specific activities requiring reporting to the Canada Revenue Agency. Understanding the t1136 form is essential for accurate and compliant tax filings, making it crucial for many businesses. Completing the form correctly can help avoid penalties and ensure proper tax handling.

-

How can airSlate SignNow assist with the t1136 form?

airSlate SignNow streamlines the process of sending and electronically signing the t1136 form, enabling a seamless experience for users. With our electronic signature capabilities, you can quickly obtain the necessary approvals, reducing turnaround times. This efficient process ensures that your t1136 form is handled professionally and securely.

-

Is airSlate SignNow secure for signing the t1136 form?

Yes, airSlate SignNow provides robust security features to protect your t1136 form and other documents. We implement encryption and compliance with major security standards, ensuring that your sensitive data remains confidential. Our platform is designed with security in mind, so you can sign the t1136 form with confidence.

-

What are the pricing options for using airSlate SignNow for the t1136 form?

airSlate SignNow offers flexible pricing plans that accommodate businesses of all sizes, making it easy to access our services for managing the t1136 form. Our plans are cost-effective and designed to provide excellent value when you need to send and eSign documents. Detailed pricing information can be found on our website, allowing you to choose the plan that best fits your needs.

-

Are there any integrations available for the t1136 form with airSlate SignNow?

Yes, airSlate SignNow integrates with various tools and applications to simplify the process of managing your t1136 form. Our platform connects with popular software, including CRM and accounting systems, allowing for uninterrupted workflow and data synchronization. This seamless integration enhances productivity and ensures that your t1136 form is easily accessible.

-

What are the benefits of using airSlate SignNow for the t1136 form?

Using airSlate SignNow for the t1136 form brings several benefits, including enhanced efficiency and reduced processing times. Our electronic signing feature eliminates the need for printing and mailing documents, which can save both time and resources. Additionally, you’ll enjoy the peace of mind that comes with secure document handling.

-

Can multiple users collaborate on the t1136 form with airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate seamlessly on the t1136 form and any other documents. Our platform supports real-time collaboration, enabling teams to work together effectively, regardless of their geographical locations. This feature is particularly useful for teams working on tax documents that require input from multiple stakeholders.

Get more for T1136

- Medicare claims history statement form

- Leave of abscence portland state pdx form

- Facial consent form pdf

- B4e form sample 49168

- Teacher recommendation form howard university howard

- Mdtsea student worksheets answer key form

- Rules in brief arkansas school for mathematics sciences and the asmsa form

- Ems scholarship application form

Find out other T1136

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document