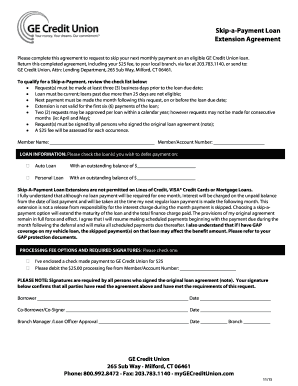

Ge Credit Union Skip a Payment Form

Understanding the GECU Auto Loan Grace Period

The GECU auto loan grace period is a specific timeframe that allows borrowers to make their payments without incurring late fees. Typically, this period lasts for a short duration, often around ten to fifteen days after the due date. During this time, your account remains in good standing, and no negative impact occurs on your credit report. It is essential to be aware of the exact terms of your loan agreement, as grace periods can vary based on the type of loan and the credit union's policies.

How to Utilize the GECU Auto Loan Grace Period

To take advantage of the GECU auto loan grace period, borrowers should ensure they understand the specific terms outlined in their loan agreement. If you find yourself unable to make a payment on the due date, it is advisable to contact GECU directly. They can provide guidance on how to proceed and confirm that you are within the grace period. Keeping open communication with your lender can help avoid any misunderstandings or penalties.

Steps to Complete the GECU Skip a Payment Process

To initiate the process of skipping a payment with GECU, follow these steps:

- Review your loan agreement to confirm eligibility for skipping a payment.

- Contact GECU customer service or visit their website to find the skip a payment form.

- Fill out the necessary information on the form, ensuring all details are accurate.

- Submit the form electronically through the GECU online portal or via mail, as per the instructions provided.

- Keep a copy of your submission for your records.

Key Elements of the GECU Skip a Payment Option

The GECU skip a payment option includes several key elements that borrowers should consider:

- Eligibility: Not all loans qualify for the skip a payment option. Check your loan terms.

- Fees: Some loans may incur a fee when opting to skip a payment, while others may not.

- Impact on Loan Term: Skipping a payment may extend the loan term, affecting the total interest paid.

- Notification: Ensure you receive confirmation from GECU that your payment has been successfully skipped.

Legal Considerations for the GECU Skip a Payment

Using the GECU skip a payment option is subject to specific legal considerations. Borrowers should be aware that skipping a payment may affect their loan agreement. It is crucial to read and understand any amendments to the terms of the loan. Additionally, ensure compliance with state regulations, as they may dictate how grace periods and skipped payments are handled. Always consult with GECU representatives if you have questions about legal implications.

Eligibility Criteria for Skipping a Payment

Eligibility for skipping a payment with GECU typically depends on several factors:

- Your payment history must be in good standing, with no recent late payments.

- The loan must be current and not in default.

- Specific loan types may be excluded from the skip a payment option.

It is advisable to check with GECU for any additional eligibility requirements that may apply to your specific loan.

Quick guide on how to complete ge credit union skip a payment

Effortlessly complete Ge Credit Union Skip A Payment on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the needed form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Ge Credit Union Skip A Payment on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to modify and electronically sign Ge Credit Union Skip A Payment effortlessly

- Locate Ge Credit Union Skip A Payment and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure sensitive data with the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and has the same legal standing as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Ge Credit Union Skip A Payment and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ge credit union skip a payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the general electric credit union grace period auto loan?

The general electric credit union grace period auto loan is a financing option that allows borrowers to have a specific time frame after their due date to make their payments without incurring late fees. This grace period offers flexibility and ease of management for your auto loan. Knowing how this period works can help you avoid penalties and better manage your finances.

-

How does the grace period work with a general electric credit union auto loan?

With the general electric credit union grace period auto loan, you typically have a 15 to 30-day grace period after your due date. During this time, you can make your payment without facing any late fees. It’s essential to understand the specific terms as they can vary, so reviewing your loan agreement is recommended.

-

Are there any fees associated with the grace period in the general electric credit union auto loan?

Generally, there are no fees for utilizing the grace period with a general electric credit union grace period auto loan, provided that you make your payment during the grace timeframe. However, late payments beyond the grace period may incur fees or affect your credit score. Always check the loan agreement for exact details.

-

What are the benefits of choosing a general electric credit union grace period auto loan?

Choosing a general electric credit union grace period auto loan provides borrowers with financial flexibility and peace of mind knowing they have extra time to fulfill their payment obligations. This can be particularly beneficial during unexpected financial challenges. Additionally, it helps maintain a good credit score by preventing late payments.

-

Can I extend the grace period on my general electric credit union auto loan?

Typically, the grace period on a general electric credit union grace period auto loan cannot be extended automatically. However, if you're experiencing financial difficulties, it’s best to contact customer service as they may offer alternative solutions or modifications to your loan terms.

-

What are the eligibility requirements for applying for a general electric credit union grace period auto loan?

To be eligible for a general electric credit union grace period auto loan, applicants generally must be members of the credit union, have a steady income, and meet minimum credit score requirements. It’s advisable to check with the credit union directly for specific eligibility criteria to ensure you qualify.

-

How can I make payments on my general electric credit union grace period auto loan?

Payments on a general electric credit union grace period auto loan can be made through various methods, including online banking, mobile apps, direct bank transfers, or by mail. Setting up automatic payments is also an option to ensure you never miss a due date, even within the grace period.

Get more for Ge Credit Union Skip A Payment

Find out other Ge Credit Union Skip A Payment

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online