7,300 to DIVIDE a CORPORATION into Form

What is the 7,300 TO DIVIDE A CORPORATION INTO

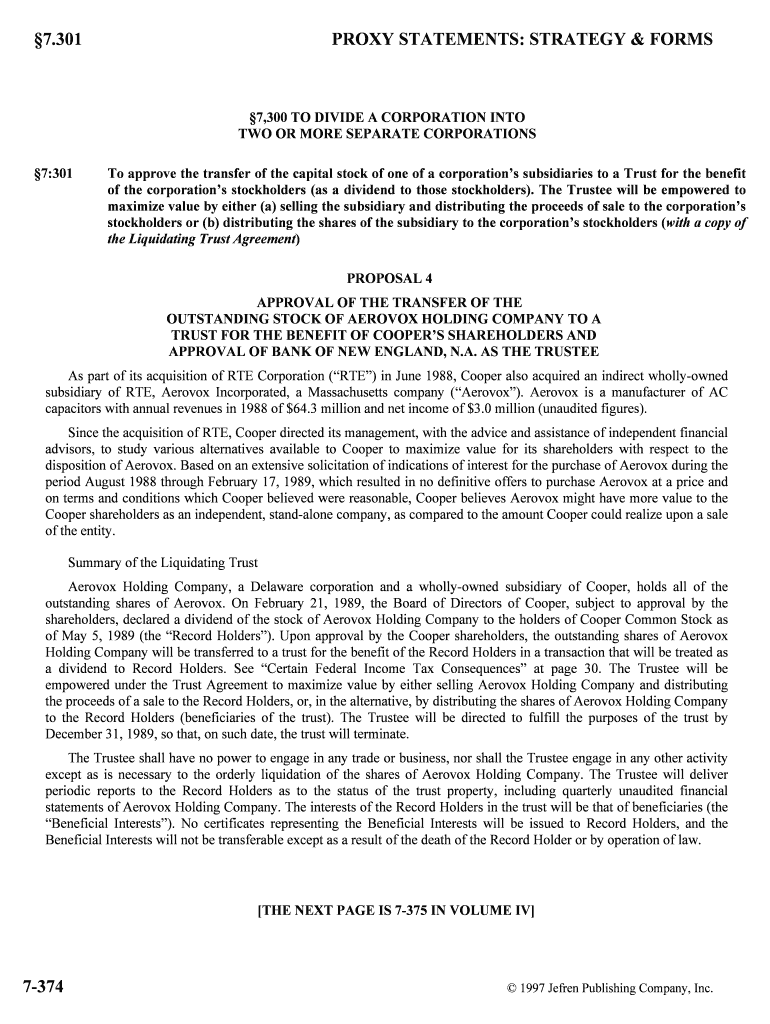

The 7,300 to divide a corporation into form is a legal document used primarily in the United States for the purpose of dividing a corporation's assets and liabilities among its shareholders. This form is essential for corporations undergoing restructuring, mergers, or divisions. It ensures that the division is conducted in compliance with state and federal regulations, providing a clear framework for the allocation of corporate resources. Understanding the purpose and implications of this form is crucial for business owners and legal professionals involved in corporate governance.

How to use the 7,300 TO DIVIDE A CORPORATION INTO

Using the 7,300 to divide a corporation into form involves several key steps. First, gather all necessary information about the corporation, including its assets, liabilities, and shareholder details. Next, accurately fill out the form, ensuring that all sections are completed according to the specific requirements of your state. Once the form is completed, it should be reviewed by legal counsel to ensure compliance with applicable laws. Finally, submit the form to the appropriate state agency, following any specific submission guidelines they may have.

Steps to complete the 7,300 TO DIVIDE A CORPORATION INTO

Completing the 7,300 to divide a corporation into form requires careful attention to detail. Here are the steps to follow:

- Identify the corporation's assets and liabilities.

- Gather shareholder information, including names and ownership percentages.

- Fill out the form with accurate and complete information.

- Review the form for any errors or omissions.

- Consult with a legal professional to ensure compliance.

- Submit the form to the relevant state authority.

Legal use of the 7,300 TO DIVIDE A CORPORATION INTO

The legal use of the 7,300 to divide a corporation into form is vital for ensuring that the division of assets and liabilities is conducted lawfully. This form serves as a record of the division process and provides legal protection for both the corporation and its shareholders. It is important to adhere to the legal requirements set forth by state law, as improper use of the form can result in penalties or disputes among shareholders. Consulting with legal experts can help navigate the complexities involved in the division process.

Required Documents

To successfully complete the 7,300 to divide a corporation into form, several documents may be required. These typically include:

- Articles of incorporation for the corporation.

- Current financial statements, including balance sheets and income statements.

- Shareholder agreements outlining ownership percentages.

- Any previous filings related to corporate structure changes.

Having these documents ready can streamline the process and ensure compliance with legal requirements.

Form Submission Methods

The 7,300 to divide a corporation into form can be submitted through various methods, depending on the regulations of the state in which the corporation is registered. Common submission methods include:

- Online submission via the state’s business registration portal.

- Mailing the completed form to the designated state agency.

- In-person submission at the state office.

It is important to verify the specific submission requirements for your state to ensure timely and accurate processing.

Quick guide on how to complete 7300 to divide a corporation into

Complete 7,300 TO DIVIDE A CORPORATION INTO effortlessly on any device

Digital document management has gained traction among businesses and individuals. It presents a perfect eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without hindrances. Handle 7,300 TO DIVIDE A CORPORATION INTO on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign 7,300 TO DIVIDE A CORPORATION INTO with ease

- Locate 7,300 TO DIVIDE A CORPORATION INTO and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Accentuate important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers explicitly for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal significance as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to distribute your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and eSign 7,300 TO DIVIDE A CORPORATION INTO and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does '7,300 TO DIVIDE A CORPORATION INTO' mean?

The phrase '7,300 TO DIVIDE A CORPORATION INTO' refers to a specific legal framework for dividing corporate entities under certain financial conditions. Understanding this process is vital for businesses looking to restructure or manage assets more effectively. airSlate SignNow can help facilitate this process by providing the necessary documentation tools.

-

How can airSlate SignNow assist with '7,300 TO DIVIDE A CORPORATION INTO'?

airSlate SignNow streamlines the document signing process required for '7,300 TO DIVIDE A CORPORATION INTO'. Our platform allows you to easily create, send, and securely eSign documents, ensuring compliance and efficiency. This simplifies the steps needed to implement corporate divisions.

-

What are the pricing options for using airSlate SignNow?

Our pricing plans are designed to accommodate businesses of all sizes, allowing for flexibility when considering '7,300 TO DIVIDE A CORPORATION INTO'. We offer a range of subscription models to fit your budget, from basic to advanced features. Each plan simplifies the document workflow to support your corporate needs.

-

Does airSlate SignNow offer integrations with other software?

Yes, airSlate SignNow seamlessly integrates with various applications that can aid in the process of '7,300 TO DIVIDE A CORPORATION INTO'. Whether you use CRM, project management, or bookkeeping software, our integrations ensure your document workflows remain uninterrupted. This connectivity enhances collaboration across your teams.

-

What are the key features of airSlate SignNow that relate to '7,300 TO DIVIDE A CORPORATION INTO'?

Key features of airSlate SignNow include customizable templates, automated workflows, and secure data storage, all crucial for '7,300 TO DIVIDE A CORPORATION INTO'. These functionalities enable users to efficiently manage corporate restructuring paperwork without the hassle of traditional methods.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and authentication processes to protect documents involved in '7,300 TO DIVIDE A CORPORATION INTO'. Our commitment to data security ensures that all sensitive information remains confidential and safe from unauthorized access.

-

Can airSlate SignNow help with compliance during corporate divisions?

Yes, compliance is critical when executing '7,300 TO DIVIDE A CORPORATION INTO', and airSlate SignNow assists in ensuring that all legal requirements are met. Our platform provides templates that align with regulatory standards, thus safeguarding your business during the division process.

Get more for 7,300 TO DIVIDE A CORPORATION INTO

Find out other 7,300 TO DIVIDE A CORPORATION INTO

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free