Letter Informing Debt Collector of Unfair Practices in

Understanding the Letter Informing Debt Collector Of Unfair Practices In

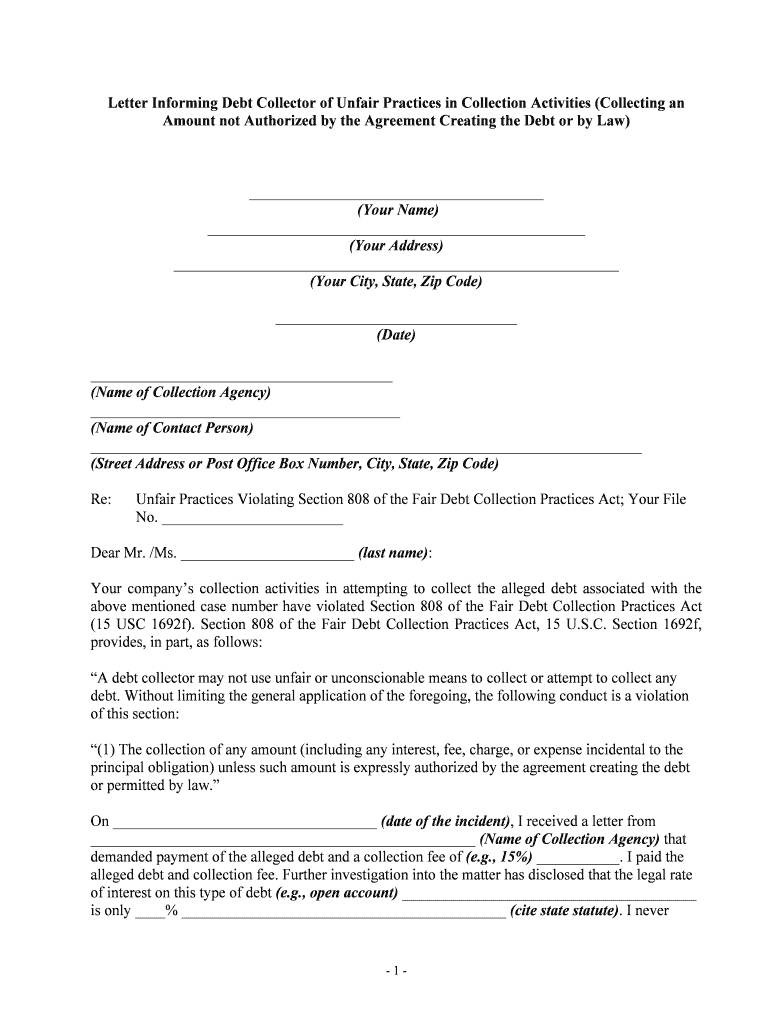

The Letter Informing Debt Collector Of Unfair Practices In serves as a formal notification to a debt collector regarding their inappropriate or unlawful actions. This letter is crucial for individuals who feel that a debt collector has violated their rights under the Fair Debt Collection Practices Act (FDCPA). By documenting these unfair practices, consumers can take a stand against harassment or misleading tactics used by debt collectors. This letter not only helps in asserting one’s rights but also creates a record that can be useful in any potential legal proceedings.

Steps to Complete the Letter Informing Debt Collector Of Unfair Practices In

Completing the Letter Informing Debt Collector Of Unfair Practices In requires careful attention to detail to ensure all relevant information is included. Here are the steps to follow:

- Begin with your contact information at the top of the letter, including your name, address, and phone number.

- Clearly state the date of writing the letter.

- Include the debt collector's name and address to ensure it reaches the correct party.

- Open with a clear statement of your intent to inform them of their unfair practices.

- Detail the specific practices you consider unfair, citing dates and any relevant conversations or communications.

- Request a specific action from the debt collector, such as ceasing communication or correcting the misinformation.

- Conclude with a polite yet firm closing statement, reiterating your expectation for resolution.

Legal Use of the Letter Informing Debt Collector Of Unfair Practices In

This letter is legally significant as it acts as a formal complaint against the debt collector's actions. Under the FDCPA, consumers have the right to dispute debts and request validation. By sending this letter, you establish a record of your grievances, which can be beneficial if further legal action becomes necessary. It is essential to keep a copy of the letter for your records, as well as any correspondence you receive in response. This documentation can support your case should you need to escalate the matter to a regulatory agency or seek legal advice.

Key Elements of the Letter Informing Debt Collector Of Unfair Practices In

To ensure the effectiveness of the letter, it should contain several key elements:

- Your contact information: This includes your full name, address, and phone number.

- Date: The date the letter is written should be clearly indicated.

- Debt collector's information: Include the name and address of the debt collection agency.

- Specific allegations: Clearly outline the unfair practices, providing details and examples.

- Requested actions: Specify what you want the debt collector to do in response to your letter.

- Signature: Sign the letter to validate it as an official document.

How to Use the Letter Informing Debt Collector Of Unfair Practices In

Using the Letter Informing Debt Collector Of Unfair Practices In effectively involves several steps. First, ensure that the letter is complete and free of errors. Once finalized, send it via a method that provides proof of delivery, such as certified mail. This ensures that you have a record of the correspondence, which can be crucial if the situation escalates. After sending the letter, monitor any responses from the debt collector. If they fail to address your concerns or continue with unfair practices, you may consider reporting them to the Consumer Financial Protection Bureau (CFPB) or consulting with a legal professional.

Examples of Using the Letter Informing Debt Collector Of Unfair Practices In

Examples of situations where this letter may be used include:

- Receiving repeated phone calls outside of legal hours.

- Being contacted about a debt that has already been settled.

- Experiencing threats or intimidation tactics from debt collectors.

- Receiving misleading information about the amount owed or the consequences of non-payment.

Each of these scenarios illustrates the importance of documenting unfair practices and taking proactive steps to protect your rights as a consumer.

Quick guide on how to complete letter informing debt collector of unfair practices in

Complete Letter Informing Debt Collector Of Unfair Practices In effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Letter Informing Debt Collector Of Unfair Practices In on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign Letter Informing Debt Collector Of Unfair Practices In with ease

- Find Letter Informing Debt Collector Of Unfair Practices In and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select key sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or shared link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Letter Informing Debt Collector Of Unfair Practices In and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Letter Informing Debt Collector Of Unfair Practices In?

A Letter Informing Debt Collector Of Unfair Practices In is a formal document that individuals can send to debt collectors when they believe their rights are being violated. This letter outlines the specific unfair practices and requests that the debt collector cease such actions immediately. Utilizing airSlate SignNow, you can create and send this letter quickly and securely.

-

How can airSlate SignNow help me create a Letter Informing Debt Collector Of Unfair Practices In?

airSlate SignNow provides a user-friendly platform where you can easily draft and customize a Letter Informing Debt Collector Of Unfair Practices In. Our templates allow you to input your details and articulate your concerns efficiently. Plus, eSigning the document adds a layer of authenticity to your correspondence.

-

Is there a cost associated with using airSlate SignNow for sending a Letter Informing Debt Collector Of Unfair Practices In?

Yes, airSlate SignNow offers various pricing plans tailored to meet different needs and budgets. Our plans include features such as unlimited document signing, secure storage, and integrations. You can choose a plan that best suits your requirements, ensuring cost-effectiveness while dealing with debt collection issues.

-

What features does airSlate SignNow offer for sending letters to debt collectors?

airSlate SignNow includes features like customizable templates, electronic signing, and document tracking for your Letter Informing Debt Collector Of Unfair Practices In. These features ensure that your correspondence is not only professional but also legally binding. Additionally, our platform protects your information with advanced security measures.

-

Can I integrate airSlate SignNow with other tools to manage my debt collection letters?

Absolutely! airSlate SignNow integrates seamlessly with various tools and applications, making it easy to manage your Letter Informing Debt Collector Of Unfair Practices In alongside other business processes. Whether you use CRMs, email services, or document management systems, integration is streamlined for enhanced efficiency.

-

What are the benefits of using airSlate SignNow for debt collection letters?

Utilizing airSlate SignNow for your Letter Informing Debt Collector Of Unfair Practices In allows you to save time and enhance productivity. You can quickly create, send, and track your letters, ensuring timely responses from debt collectors. Furthermore, our platform's security measures ensure that your sensitive information remains protected.

-

How do I ensure my Letter Informing Debt Collector Of Unfair Practices In is legally compliant?

When using airSlate SignNow, you can access templates that are compliant with relevant laws and regulations regarding debt collection practices. It's essential to tailor your letter to include specific details about the unfair practices you've experienced. airSlate SignNow also allows you to eSign your letter, adding to its legal weight.

Get more for Letter Informing Debt Collector Of Unfair Practices In

- Want to print out a restraining order form

- General judgment court form

- Evictions feds form

- 2018 oregon ct 12f form

- Pc 77 general release rhode island office of the secretary of state sos ri form

- Ri probate court form

- Ppb 6 application for license as gunsmith dealer in firearms form

- Form hsmv 83045fill out and use this pdf

Find out other Letter Informing Debt Collector Of Unfair Practices In

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form