Common Insurance Terms in Mobile Alabama and Mississippi Form

What is the Common Insurance Terms In Mobile Alabama And Mississippi

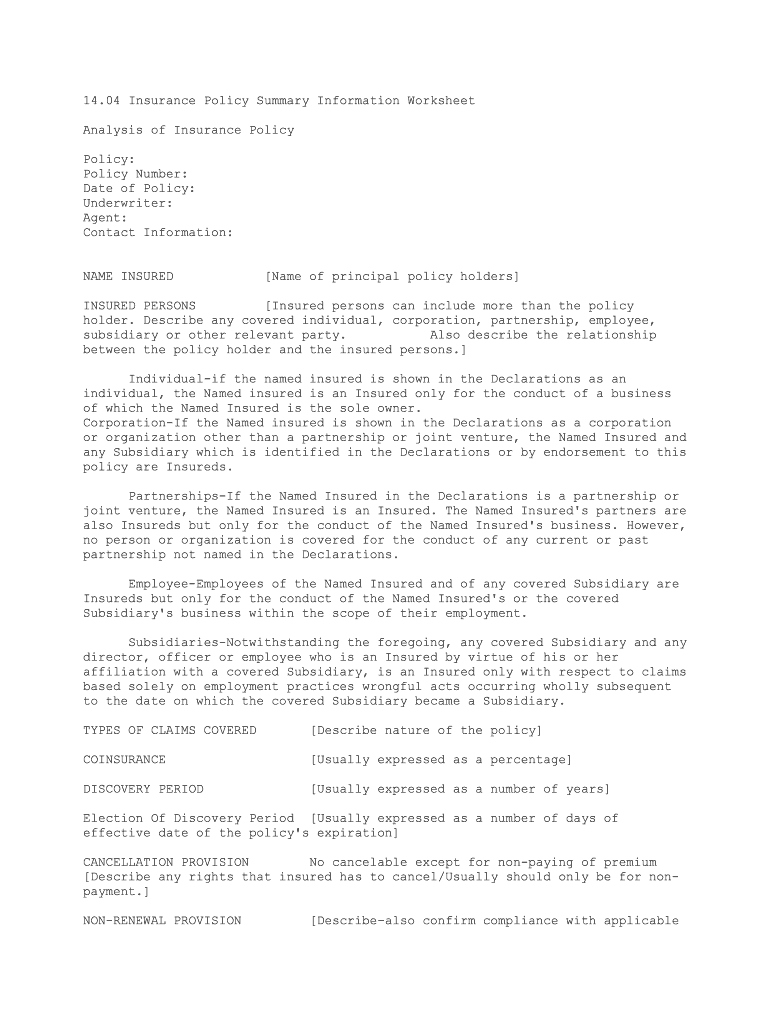

The Common Insurance Terms in Mobile Alabama and Mississippi refer to a standardized set of definitions and conditions related to insurance policies applicable in these states. This form outlines the various terms and conditions that policyholders and insurers must understand to navigate their insurance agreements effectively. Key components often include definitions of coverage types, exclusions, and responsibilities of both parties involved in the insurance contract.

How to use the Common Insurance Terms In Mobile Alabama And Mississippi

Using the Common Insurance Terms in Mobile Alabama and Mississippi involves reviewing the document to understand the specific terms applicable to your insurance policy. Policyholders should familiarize themselves with definitions, coverage limits, and any exclusions that may impact their claims. It is advisable to consult with an insurance professional if there are any uncertainties about the terms outlined in the document.

Steps to complete the Common Insurance Terms In Mobile Alabama And Mississippi

Completing the Common Insurance Terms in Mobile Alabama and Mississippi typically requires the following steps:

- Review the terms carefully to ensure understanding.

- Fill out any required fields accurately, including personal and policy information.

- Sign the document electronically using a secure eSignature platform to ensure compliance with legal standards.

- Submit the completed form to your insurance provider as instructed.

Legal use of the Common Insurance Terms In Mobile Alabama And Mississippi

The legal use of the Common Insurance Terms in Mobile Alabama and Mississippi is governed by state laws that recognize electronic signatures and documents as valid. To ensure the form is legally binding, it must meet specific requirements, such as being signed by all parties involved and maintained in a secure manner. Compliance with the ESIGN Act and UETA is essential for the electronic execution of this form.

Key elements of the Common Insurance Terms In Mobile Alabama And Mississippi

Key elements of the Common Insurance Terms in Mobile Alabama and Mississippi include:

- Definitions: Clear explanations of terms used within the insurance policy.

- Coverage Details: Information about what is covered under the policy and any limitations.

- Exclusions: Specific situations or conditions that are not covered by the insurance.

- Claims Process: Guidelines on how to file a claim and what documentation is required.

State-specific rules for the Common Insurance Terms In Mobile Alabama And Mississippi

State-specific rules for the Common Insurance Terms in Mobile Alabama and Mississippi may vary based on local regulations. Each state may have unique requirements regarding the types of coverage mandated by law, as well as specific consumer protections in place. It is essential for policyholders to be aware of these differences to ensure compliance and adequate coverage.

Quick guide on how to complete common insurance terms in mobile alabama and mississippi

Complete Common Insurance Terms In Mobile Alabama And Mississippi effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Common Insurance Terms In Mobile Alabama And Mississippi on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and electronically sign Common Insurance Terms In Mobile Alabama And Mississippi without hassle

- Obtain Common Insurance Terms In Mobile Alabama And Mississippi and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to finalize your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Alter and electronically sign Common Insurance Terms In Mobile Alabama And Mississippi and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the common insurance terms in Mobile Alabama and Mississippi that I should know?

Common insurance terms in Mobile Alabama and Mississippi include premiums, deductibles, and copayments. Understanding these terms can help you navigate your insurance options effectively. Familiarity with these terms ensures you comprehend the costs and coverage specifics when selecting a policy.

-

How can airSlate SignNow help me understand these common insurance terms?

AirSlate SignNow provides easy-to-use document management solutions that can help you organize and understand insurance documents. With access to clear definitions and explanations, you can stay informed about common insurance terms in Mobile Alabama and Mississippi. This clarity can streamline your insurance decision-making process.

-

Are the pricing options for airSlate SignNow competitive for handling insurance documents?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to various business sizes. Our solutions help you manage insurance documents efficiently without breaking the bank. This makes it a popular choice for understanding and utilizing common insurance terms in Mobile Alabama and Mississippi.

-

What features does airSlate SignNow offer for managing insurance-related documents?

AirSlate SignNow includes features like eSigning, secure document storage, and seamless workflow management. These tools help you manage insurance applications and policies while ensuring compliance with common insurance terms in Mobile Alabama and Mississippi. Efficient document handling streamlines the entire insurance process for your business.

-

How can I integrate airSlate SignNow with my existing insurance management systems?

AirSlate SignNow supports integrations with many popular software platforms, allowing you to streamline your existing insurance management systems. This compatibility ensures that you can continue using your preferred tools while managing common insurance terms in Mobile Alabama and Mississippi effectively. Integration enhances your overall workflow and efficiency.

-

What are the benefits of using airSlate SignNow for insurance companies in Mobile Alabama and Mississippi?

Using airSlate SignNow allows insurance companies to expedite the signing process, reduce paperwork, and enhance client communication. Our platform simplifies the management of common insurance terms in Mobile Alabama and Mississippi, making it easier for businesses to maintain accurate records. This leads to a more efficient and customer-friendly experience.

-

Can airSlate SignNow assist in educating clients about common insurance terms?

Absolutely! AirSlate SignNow can be used to create and distribute educational materials regarding common insurance terms in Mobile Alabama and Mississippi. By providing clients with accessible information, you enhance their understanding and engagement, leading to better decision-making regarding their insurance options.

Get more for Common Insurance Terms In Mobile Alabama And Mississippi

Find out other Common Insurance Terms In Mobile Alabama And Mississippi

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself