Your Partnership Income Tax Questions Answered Form

What is the Your Partnership Income Tax Questions Answered

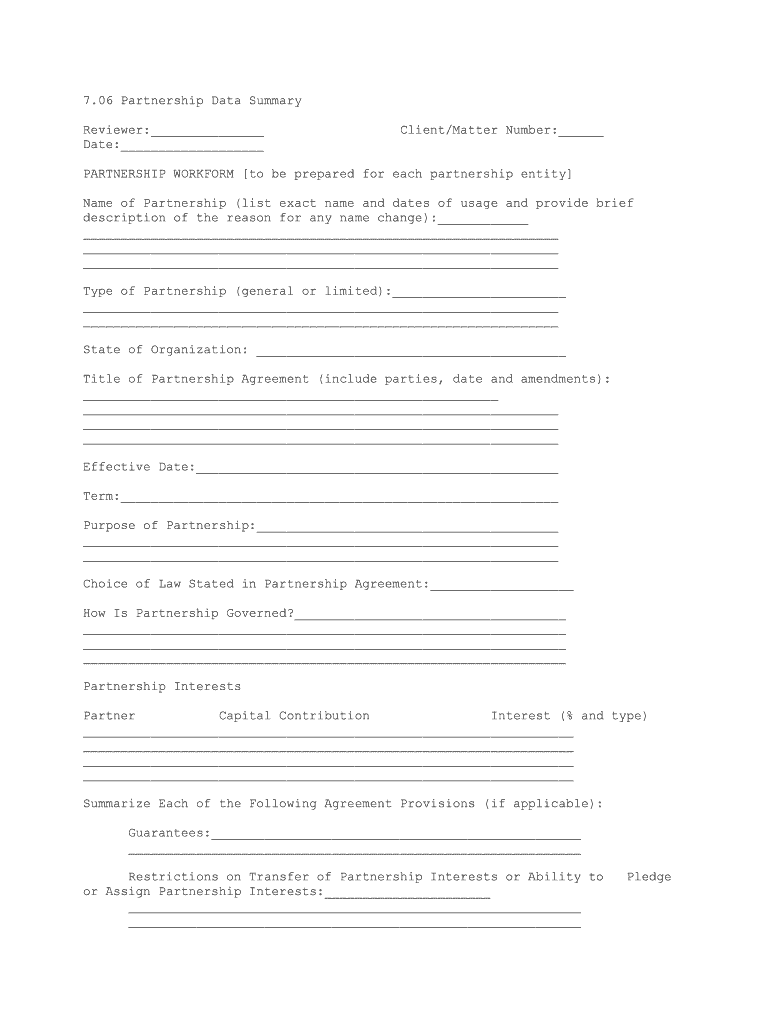

The Your Partnership Income Tax Questions Answered form serves as a crucial resource for partnerships navigating their tax obligations. This form addresses various inquiries related to partnership income, deductions, and tax liabilities. It is designed to clarify the responsibilities of partners and ensure compliance with Internal Revenue Service (IRS) regulations. Understanding this form is essential for partnerships to accurately report income and avoid potential penalties.

How to use the Your Partnership Income Tax Questions Answered

Using the Your Partnership Income Tax Questions Answered form involves several straightforward steps. First, gather all necessary financial documents, including income statements, expense receipts, and previous tax returns. Next, carefully read through the form to identify the specific questions that pertain to your partnership's situation. Fill out the form with accurate information, ensuring that all calculations are correct. Once completed, review the form for any errors before submission to ensure compliance with IRS guidelines.

Steps to complete the Your Partnership Income Tax Questions Answered

Completing the Your Partnership Income Tax Questions Answered form requires a systematic approach:

- Gather all relevant financial documents.

- Review the form's instructions carefully.

- Fill in partnership details, including names and tax identification numbers.

- Provide accurate income figures and deductions applicable to the partnership.

- Double-check all entries for accuracy and completeness.

- Sign and date the form as required.

Legal use of the Your Partnership Income Tax Questions Answered

The legal use of the Your Partnership Income Tax Questions Answered form is governed by IRS regulations. When completed accurately, this form serves as a legally binding document that can be used to demonstrate compliance with federal tax laws. It is essential for partnerships to ensure that all information is truthful and complete, as discrepancies can lead to audits or penalties. Utilizing electronic signature solutions, like those offered by signNow, can enhance the legal validity of the completed form.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Your Partnership Income Tax Questions Answered form. These guidelines outline the necessary information required, the deadlines for submission, and the acceptable methods for filing. Adhering to these guidelines is crucial for partnerships to avoid complications with tax authorities. It is advisable to consult the latest IRS publications or a tax professional to ensure compliance with current regulations.

Filing Deadlines / Important Dates

Partnerships must be aware of critical filing deadlines associated with the Your Partnership Income Tax Questions Answered form. Typically, the deadline for submitting partnership tax returns is March 15 for calendar-year partnerships. However, if additional time is needed, partnerships can file for an extension, which grants an additional six months. Keeping track of these dates is vital to avoid late fees and penalties.

Quick guide on how to complete your partnership income tax questions answered

Generate Your Partnership Income Tax Questions Answered effortlessly on any gadget

Digital document management has gained signNow traction among businesses and individuals. It offers a perfect eco-conscious substitute for conventional printed and signed documents, allowing you to locate the right format and securely store it online. airSlate SignNow equips you with all the essentials to create, alter, and eSign your files swiftly, without any holdups. Handle Your Partnership Income Tax Questions Answered on any gadget using the airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

The easiest way to alter and eSign Your Partnership Income Tax Questions Answered with minimal effort

- Locate Your Partnership Income Tax Questions Answered and click Get Form to begin.

- Utilize the instruments we provide to complete your document.

- Highlight pertinent sections of the files or redact confidential information with tools specifically designed for that by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to share your document, through email, text (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Alter and eSign Your Partnership Income Tax Questions Answered and guarantee outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the best way to manage partnership income tax with airSlate SignNow?

Your Partnership Income Tax Questions Answered begin with a clear understanding of the documentation process. airSlate SignNow enables you to streamline the signing and management of critical tax documents, ensuring timely submissions and compliance. Our platform simplifies collaboration among partners, making tax season less stressful.

-

How does airSlate SignNow integrate with accounting software for tax purposes?

Your Partnership Income Tax Questions Answered also include inquiries about integrations. airSlate SignNow seamlessly connects with various accounting software, allowing you to import and export documents with ease. This integration ensures that all necessary tax documents are accurate and readily available for your financial records.

-

What features does airSlate SignNow offer to help with tax documentation?

When seeking solutions, Your Partnership Income Tax Questions Answered highlight the features of airSlate SignNow. Our platform offers templates, eSignature capabilities, and storage for critical documents, making it easier to manage your partnership's tax requirements. These features enhance efficiency and reduce the risk of errors.

-

Is airSlate SignNow a cost-effective solution for partnership tax needs?

Many prospective customers wonder this as they explore options. Your Partnership Income Tax Questions Answered indicate that airSlate SignNow offers competitive pricing based on usage, ensuring you only pay for what you need. This allows partnerships to save money while maintaining access to essential document management capabilities.

-

Can I track document status during the income tax filing process?

Another common concern that Your Partnership Income Tax Questions Answered address is document tracking. With airSlate SignNow, you can easily monitor the status of documents in real-time. This feature ensures that all partners are informed and can follow up as needed, streamlining the entire tax filing process.

-

What benefits does airSlate SignNow provide for remote partnerships?

Your Partnership Income Tax Questions Answered should also consider the needs of remote teams. airSlate SignNow supports remote collaboration, allowing partners to sign and complete tax documents from anywhere. This flexibility is crucial for modern partnerships and helps maintain productivity.

-

How secure is my partnership's information with airSlate SignNow?

Your Partnership Income Tax Questions Answered certainly involve security concerns. airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect your partnership's sensitive data. We take your privacy seriously, ensuring compliance with industry standards.

Get more for Your Partnership Income Tax Questions Answered

Find out other Your Partnership Income Tax Questions Answered

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History