Missouri Sales Tax Form 2760 2012-2026

What is the Missouri Sales Tax Form 2760

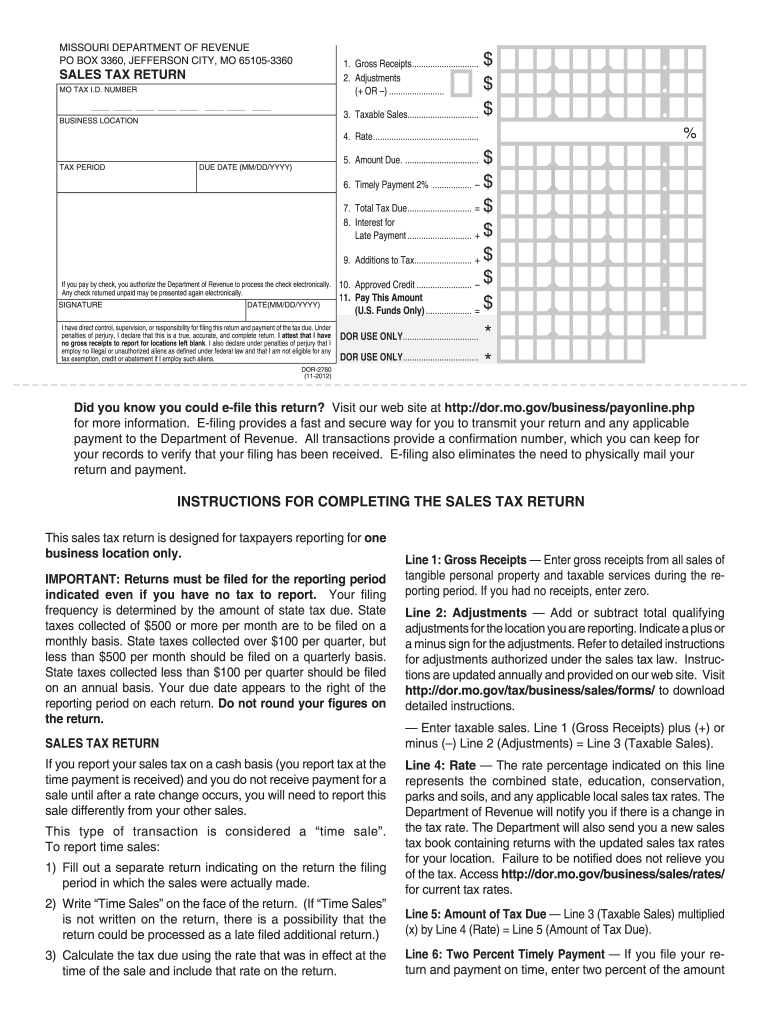

The Missouri Sales Tax Form 2760 is a specific document used by businesses and individuals to report and pay sales tax in the state of Missouri. This form is essential for those who make taxable sales or purchases within the state. It captures vital information such as the total sales made, the amount of tax collected, and any exemptions that may apply. Understanding this form is crucial for compliance with state tax regulations.

Steps to complete the Missouri Sales Tax Form 2760

Completing the Missouri Sales Tax Form 2760 involves several key steps:

- Gather necessary information: Collect all relevant sales data, including total sales, tax collected, and any exemptions.

- Fill in the form: Enter the required information accurately in the designated fields of the form.

- Review your entries: Double-check all information for accuracy to avoid any errors that could lead to penalties.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent by the deadline.

How to obtain the Missouri Sales Tax Form 2760

The Missouri Sales Tax Form 2760 can be obtained through various methods. It is available on the official Missouri Department of Revenue website, where users can download a PDF version of the form. Additionally, individuals can request a physical copy by contacting the local Department of Revenue office. Ensuring you have the correct and most recent version of the form is essential for accurate reporting.

Key elements of the Missouri Sales Tax Form 2760

Several key elements are essential when filling out the Missouri Sales Tax Form 2760:

- Taxpayer Identification: This includes the name, address, and identification number of the taxpayer.

- Total Sales Amount: The total value of sales made during the reporting period must be clearly indicated.

- Sales Tax Collected: The total amount of sales tax collected from customers should be reported accurately.

- Exemptions: Any applicable exemptions should be documented to ensure compliance with state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Missouri Sales Tax Form 2760 vary based on the reporting frequency assigned to the taxpayer. Generally, forms are due monthly, quarterly, or annually. It is important to be aware of these deadlines to avoid late fees and penalties. The Missouri Department of Revenue provides a calendar of important dates that can assist taxpayers in staying compliant.

Form Submission Methods (Online / Mail / In-Person)

The Missouri Sales Tax Form 2760 can be submitted through various methods to accommodate different preferences:

- Online Submission: Taxpayers can file the form electronically through the Missouri Department of Revenue's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person Submission: Taxpayers may also choose to deliver the form in person at their local Department of Revenue office.

Quick guide on how to complete mo dor sales tax single location form

Your assistance manual on how to prepare your Missouri Sales Tax Form 2760

If you're looking to learn how to create and transmit your Missouri Sales Tax Form 2760, here are some straightforward instructions to simplify tax reporting.

First, you need to register your airSlate SignNow profile to transform how you manage documents online. airSlate SignNow is a user-friendly and powerful document solution that enables you to modify, compose, and finalize your tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and electronic signatures, returning to adjust responses as necessary. Streamline your tax administration with advanced PDF editing, electronic signing, and user-friendly sharing.

Adhere to the steps below to complete your Missouri Sales Tax Form 2760 in just a few minutes:

- Establish your account and start handling PDFs within minutes.

- Utilize our directory to obtain any IRS tax document; browse through versions and schedules.

- Click Retrieve form to open your Missouri Sales Tax Form 2760 in our editor.

- Fill in the mandatory fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-binding electronic signature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to return errors and delay refunds. Naturally, before electronically filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

What tax forms would I have to fill out for a single-owner LLC registered in Delaware (generating income in California)?

A2A - LLC are a tax fiction - they do not exist for tax purposes. There are default provisions thus assuming you've done nothing you are a sole proprietor.Sounds to me link you have a Delaware, California, and whatever your state of residence is in addition to federal.You've not provided enough information to answer it properly however.

Create this form in 5 minutes!

How to create an eSignature for the mo dor sales tax single location form

How to make an electronic signature for the Mo Dor Sales Tax Single Location Form online

How to create an eSignature for your Mo Dor Sales Tax Single Location Form in Google Chrome

How to create an eSignature for signing the Mo Dor Sales Tax Single Location Form in Gmail

How to make an electronic signature for the Mo Dor Sales Tax Single Location Form from your smartphone

How to create an eSignature for the Mo Dor Sales Tax Single Location Form on iOS

How to make an electronic signature for the Mo Dor Sales Tax Single Location Form on Android devices

People also ask

-

What are modor forms and how do they work?

Modor forms are customizable digital forms that facilitate data collection and document processing. With airSlate SignNow, you can easily create and manage modor forms to streamline your workflows and enhance productivity. They allow users to fill out information, sign documents electronically, and ensure all data is captured efficiently.

-

How much does it cost to use modor forms on airSlate SignNow?

The pricing for using modor forms on airSlate SignNow is competitive and based on the features you choose. We offer various plans to meet the needs of businesses of all sizes. You can select a plan that includes essential features for modor forms, ensuring you get the best value for your investment.

-

What features do modor forms offer?

Modor forms come with a range of features including customizable templates, automated workflows, and secure eSigning capabilities. Users can easily design forms to fit their specific needs and track submissions in real-time. airSlate SignNow enhances the functionality of modor forms by integrating seamlessly with other tools.

-

What are the benefits of using modor forms?

The main benefits of using modor forms include increased efficiency, reduced paper usage, and improved data accuracy. By automating the document handling process, businesses can save time and minimize errors. Additionally, airSlate SignNow provides a user-friendly interface that makes creating modor forms simple and effective.

-

Can I integrate modor forms with other applications?

Yes, you can integrate modor forms with a variety of applications through airSlate SignNow's robust integration capabilities. This allows you to connect with tools you already use, enhancing your overall workflow. Whether it's CRM systems or project management tools, modor forms can easily fit into your existing tech ecosystem.

-

Are modor forms secure?

Absolutely! Modor forms on airSlate SignNow are designed with security in mind. They include encryption and compliance features to ensure that your data is protected throughout the document signing process, giving you peace of mind when handling sensitive information.

-

How can modor forms improve my team’s productivity?

Modor forms streamline the document management process, signNowly boosting team productivity. By automating data entry and eSigning, your team can focus on more strategic tasks. airSlate SignNow provides instant access to completed forms, minimizing delays and enhancing collaboration among team members.

Get more for Missouri Sales Tax Form 2760

- Fill free fillable ma sunset clause pdf form

- Commonwealth of massachusetts ss housing court department form

- Housing court finding and order for approval of attachment form

- To the sheriffs of our several counties or their deputies form

- Release and satisfaction of judgment form first boston software

- 2018 form ma statement of small claim and notice fill online

- Housing court division form

- To the above named plaintiff form

Find out other Missouri Sales Tax Form 2760

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word