Conveyance of Net Profits Interests and Overriding Royalty Form

What is the Conveyance Of Net Profits Interests And Overriding Royalty

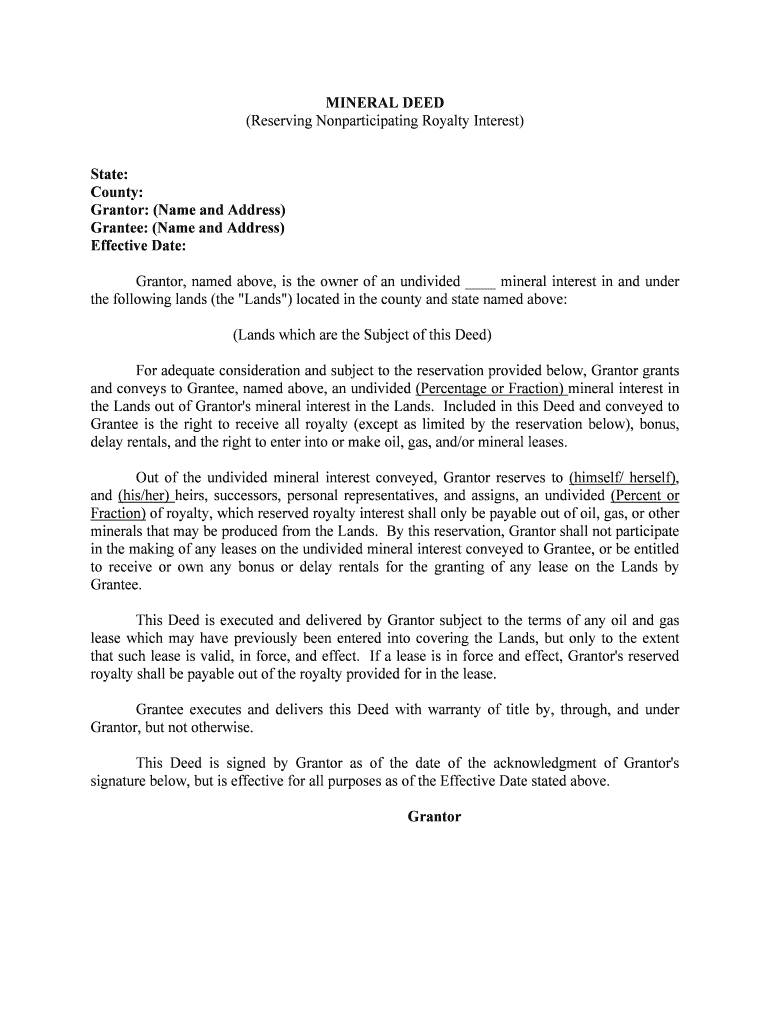

The conveyance of net profits interests and overriding royalty is a legal document used in the oil and gas industry. It allows the holder to receive a share of the profits generated from the production of minerals, without owning the underlying property. This form is essential for parties looking to structure financial interests in mineral rights, ensuring that profits are distributed according to agreed terms. Understanding this conveyance is crucial for stakeholders involved in resource extraction and management.

Key Elements of the Conveyance Of Net Profits Interests And Overriding Royalty

Several key elements define the conveyance of net profits interests and overriding royalty. These include:

- Parties Involved: The document identifies the grantor and grantee, clarifying who is transferring the interest and who is receiving it.

- Interest Type: It specifies whether the interest is a net profits interest or an overriding royalty, each with distinct financial implications.

- Payment Terms: The form outlines how and when payments will be made, including any deductions or expenses that may apply.

- Duration: It details the length of time the interest is valid, which can be crucial for both parties.

Steps to Complete the Conveyance Of Net Profits Interests And Overriding Royalty

Completing the conveyance of net profits interests and overriding royalty involves several steps:

- Gather Necessary Information: Collect all relevant details about the parties involved and the property in question.

- Draft the Document: Use clear language to outline the terms of the conveyance, ensuring all key elements are included.

- Review Legal Requirements: Confirm that the document complies with state laws and industry regulations.

- Sign the Document: Ensure all parties sign the form, which may require notarization for legal validity.

- Distribute Copies: Provide all parties with copies of the signed document for their records.

Legal Use of the Conveyance Of Net Profits Interests And Overriding Royalty

For the conveyance of net profits interests and overriding royalty to be legally valid, it must adhere to specific legal standards. This includes compliance with state laws governing mineral rights and contracts. Additionally, the document should be executed with proper signatures and, where necessary, notarization. Understanding these legal requirements ensures that the conveyance is enforceable and protects the interests of all parties involved.

Examples of Using the Conveyance Of Net Profits Interests And Overriding Royalty

This conveyance can be utilized in various scenarios, such as:

- A landowner granting a net profits interest to an investor in exchange for funding exploration activities.

- An oil company transferring an overriding royalty interest to a contractor as part of a service agreement.

- Individuals pooling resources to acquire mineral rights, using the conveyance to outline profit-sharing arrangements.

State-Specific Rules for the Conveyance Of Net Profits Interests And Overriding Royalty

Each state in the U.S. may have unique regulations governing the conveyance of net profits interests and overriding royalty. It is important to consult state-specific laws to ensure compliance. Some states may require specific language in the document, while others might have particular filing requirements. Being aware of these rules helps prevent legal disputes and ensures smooth transactions in the oil and gas sector.

Quick guide on how to complete conveyance of net profits interests and overriding royalty

Prepare Conveyance Of Net Profits Interests And Overriding Royalty seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Conveyance Of Net Profits Interests And Overriding Royalty on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Conveyance Of Net Profits Interests And Overriding Royalty with ease

- Locate Conveyance Of Net Profits Interests And Overriding Royalty and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Conveyance Of Net Profits Interests And Overriding Royalty and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Conveyance Of Net Profits Interests And Overriding Royalty?

The Conveyance Of Net Profits Interests And Overriding Royalty refers to the legal transfer of rights to a portion of profits from resources like oil or gas. Understanding this concept is essential for businesses involved in resource management and financial transactions, making airSlate SignNow a valuable tool for facilitating these documents.

-

How can airSlate SignNow simplify the Conveyance Of Net Profits Interests And Overriding Royalty process?

airSlate SignNow streamlines the Conveyance Of Net Profits Interests And Overriding Royalty process by providing templates and tools for easy document creation and eSigning. This allows businesses to efficiently manage agreements while ensuring legal compliance and security.

-

What are the pricing options for using airSlate SignNow for Conveyance Of Net Profits Interests And Overriding Royalty documentation?

airSlate SignNow offers flexible pricing plans to accommodate various business sizes and needs. Whether you require basic features or advanced functionalities for the Conveyance Of Net Profits Interests And Overriding Royalty, there’s a tailored plan that suits your budget.

-

Does airSlate SignNow offer any integrations for handling Conveyance Of Net Profits Interests And Overriding Royalty documents?

Yes, airSlate SignNow integrates seamlessly with various platforms, enhancing workflows related to the Conveyance Of Net Profits Interests And Overriding Royalty. This allows users to connect existing tools and automate document processes, saving time and reducing errors.

-

What features does airSlate SignNow provide for managing Conveyance Of Net Profits Interests And Overriding Royalty?

Key features of airSlate SignNow for managing the Conveyance Of Net Profits Interests And Overriding Royalty include secure document sharing, customizable templates, and real-time tracking of document status. These tools help ensure that all parties are informed and compliant throughout the transaction.

-

How does airSlate SignNow ensure the security of Conveyance Of Net Profits Interests And Overriding Royalty documents?

airSlate SignNow prioritizes document security through encryption and secure access controls, protecting sensitive information related to the Conveyance Of Net Profits Interests And Overriding Royalty. Users can confidently manage their documents knowing they are safeguarded against unauthorized access.

-

Can airSlate SignNow assist with legal compliance when dealing with Conveyance Of Net Profits Interests And Overriding Royalty?

Absolutely. airSlate SignNow provides tools and resources to help ensure legal compliance for the Conveyance Of Net Profits Interests And Overriding Royalty. By offering templates and guidance, businesses can navigate regulatory requirements more effectively.

Get more for Conveyance Of Net Profits Interests And Overriding Royalty

- Form trademark application state of hawaii

- Ag balance sheet your county bank form

- State of illinois invention developer bond to the people of the state form

- Statement of reissuable get form

- Registration or renewal of name illinois secretary of state form

- Dsdcdts 82 form

- Text us government publishing office form

- Food and equipment cooling log form

Find out other Conveyance Of Net Profits Interests And Overriding Royalty

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer