A REVIEW of TEXAS REAL PROPERTY LIENS Form

What is the A REVIEW OF TEXAS REAL PROPERTY LIENS

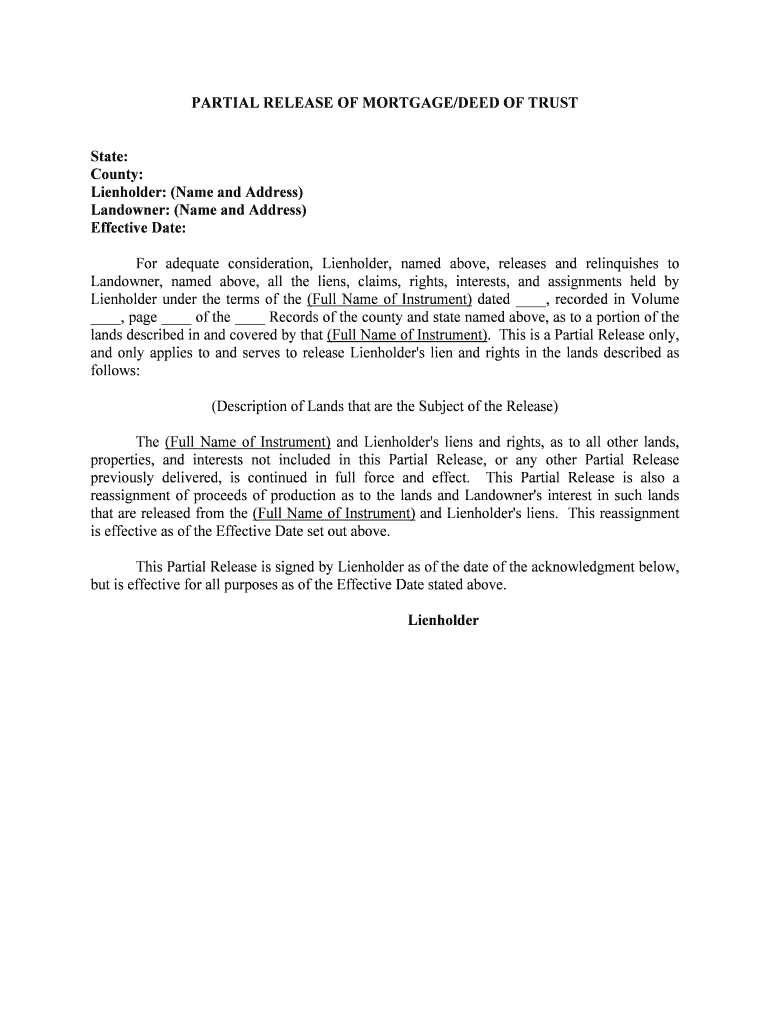

The A REVIEW OF TEXAS REAL PROPERTY LIENS form is a legal document used to assess and document any liens placed on real property in Texas. Liens are claims against a property, typically resulting from unpaid debts, which can affect ownership rights and the ability to sell or refinance the property. This form serves as a crucial tool for property owners, lenders, and legal professionals to ensure transparency and clarity regarding the financial obligations associated with a property.

How to use the A REVIEW OF TEXAS REAL PROPERTY LIENS

Using the A REVIEW OF TEXAS REAL PROPERTY LIENS form involves several steps to ensure accurate completion. First, gather all relevant property information, including the property address and details of any existing liens. Next, fill out the form with precise data, ensuring that all fields are completed to avoid delays. After completing the form, it may need to be submitted to the appropriate county clerk or legal authority for processing, depending on local regulations.

Steps to complete the A REVIEW OF TEXAS REAL PROPERTY LIENS

Completing the A REVIEW OF TEXAS REAL PROPERTY LIENS form requires careful attention to detail. Follow these steps:

- Gather necessary documents, including property deeds and lien information.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the completed form to the designated authority, such as the county clerk's office.

Legal use of the A REVIEW OF TEXAS REAL PROPERTY LIENS

The legal use of the A REVIEW OF TEXAS REAL PROPERTY LIENS form is essential for establishing a clear record of liens on a property. It is important for property owners to understand their rights and obligations regarding any liens. Properly executed, this form can help protect property interests and ensure compliance with Texas property laws.

Key elements of the A REVIEW OF TEXAS REAL PROPERTY LIENS

Several key elements must be included in the A REVIEW OF TEXAS REAL PROPERTY LIENS form to ensure its validity:

- Property identification details, including the legal description and address.

- Information about the lienholder, including name and contact information.

- Details of the lien, such as the amount owed and the nature of the debt.

- Signature of the property owner or authorized representative.

State-specific rules for the A REVIEW OF TEXAS REAL PROPERTY LIENS

Texas has specific regulations governing the use of the A REVIEW OF TEXAS REAL PROPERTY LIENS form. These rules dictate how liens are filed, the timeframes for filing, and the rights of property owners. Understanding these state-specific rules is crucial for ensuring compliance and protecting property rights in Texas.

Quick guide on how to complete a review of texas real property liens

Effortlessly prepare A REVIEW OF TEXAS REAL PROPERTY LIENS on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely archive it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage A REVIEW OF TEXAS REAL PROPERTY LIENS on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-oriented task today.

How to modify and electronically sign A REVIEW OF TEXAS REAL PROPERTY LIENS effortlessly

- Locate A REVIEW OF TEXAS REAL PROPERTY LIENS and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using the tools airSlate SignNow specifically provides for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to apply your changes.

- Choose your preferred method of submission for your form, whether by email, SMS, invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you select. Modify and electronically sign A REVIEW OF TEXAS REAL PROPERTY LIENS and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a review of Texas real property liens?

A review of Texas real property liens involves assessing the legal claims against a property due to unpaid debts. Understanding this process is crucial for property buyers and sellers in Texas, ensuring they are aware of any claims that could affect ownership. This review can help prevent future legal disputes.

-

Why are Texas real property liens important for homeowners?

Texas real property liens are important for homeowners as they serve as public records of any debts attached to a property. A review of Texas real property liens can uncover potential financial obligations that could impact the sale or refinancing of a home. This awareness helps protect homeowners from unexpected complications.

-

How can airSlate SignNow assist in managing Texas real property liens?

AirSlate SignNow provides a user-friendly platform for electronically signing and sending documents related to Texas real property liens. This simplifies the process of managing liens, allowing homeowners and real estate professionals to streamline documentation. By ensuring signatures are collected quickly, airSlate SignNow enhances efficiency in real estate transactions.

-

What features does airSlate SignNow offer for real estate transactions?

AirSlate SignNow offers features such as eSigning, document templates, and automated workflows tailored for real estate transactions. These tools ensure compliance and efficiency when handling documents related to a review of Texas real property liens. Users can easily track the status of their documents for added convenience.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, from individual users to large enterprises. The cost-effective solutions make it accessible for anyone needing a review of Texas real property liens, ensuring that all parties can participate without breaking the bank. Pricing typically depends on the features and the number of users needed.

-

Does airSlate SignNow integrate with other tools for real estate professionals?

Yes, airSlate SignNow offers integrations with various tools commonly used by real estate professionals, such as CRM systems and property management software. These integrations facilitate a comprehensive workflow, making it easier to manage documents and a review of Texas real property liens seamlessly. Users benefit from a connected experience that enhances productivity.

-

What are the benefits of conducting a review of Texas real property liens before purchasing property?

Conducting a review of Texas real property liens before purchasing property helps buyers avoid unforeseen financial burdens and legal disputes. It enables potential owners to make informed decisions and negotiate terms based on the property's lien status. This proactive approach is crucial in securing a valuable investment.

Get more for A REVIEW OF TEXAS REAL PROPERTY LIENS

- Spokane valley rifle ampampamp pistol club liability release waiver form

- Declaration of intent to provide home based instruction for form

- How to set up the scan cover sheet feature in docushare form

- E certification for washington state educators ospi form

- Plant classification form california state water

- Sit intake form

- 4025e form

- Wa 8 form

Find out other A REVIEW OF TEXAS REAL PROPERTY LIENS

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF