Sample Gross Up Clause that Should Be Used in a Base Year Form

What is the Sample Gross up Clause That Should Be Used In A Base Year

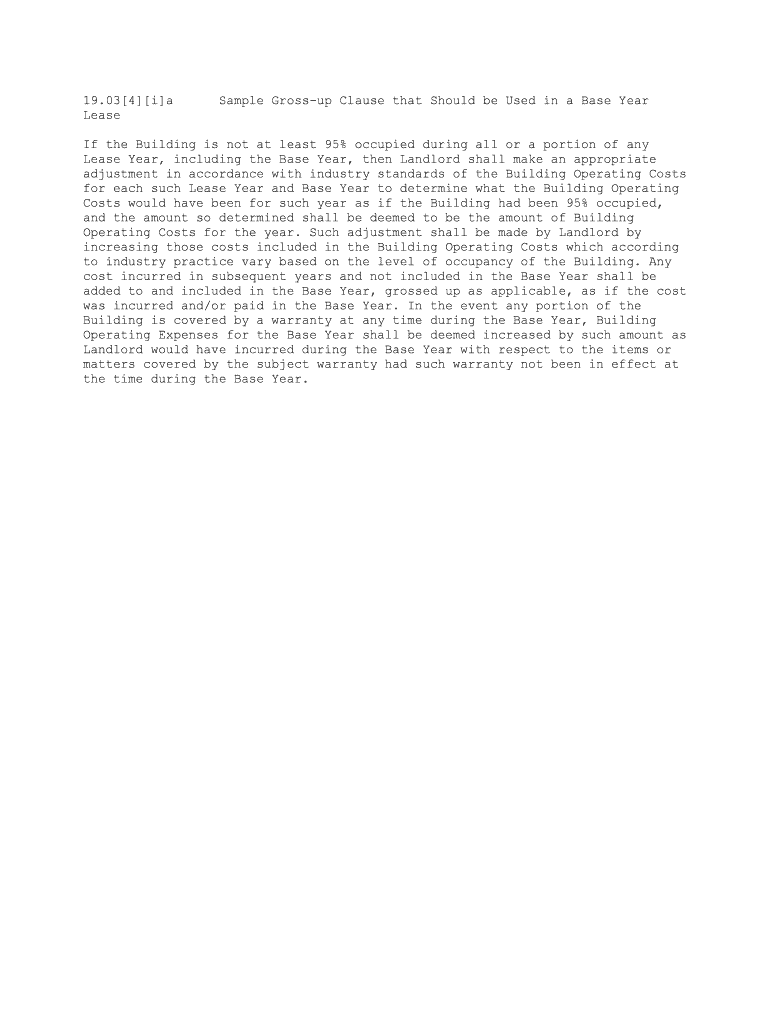

The sample gross up clause that should be used in a base year is a contractual provision typically included in lease agreements or financial documents. It ensures that the base year expenses, such as operating costs or taxes, are adjusted to reflect the actual costs incurred by the property owner or landlord. This clause is essential for accurately determining rent adjustments or reimbursement obligations over the lease term. By specifying how expenses will be calculated and adjusted, it protects both parties from unexpected financial burdens.

Key Elements of the Sample Gross up Clause That Should Be Used In A Base Year

Several key elements define the sample gross up clause that should be used in a base year. These include:

- Definition of Base Year: Clearly defines the initial year for which expenses will be calculated.

- Expense Categories: Specifies which expenses are subject to gross up, such as maintenance, utilities, and property taxes.

- Gross Up Percentage: Indicates the percentage by which expenses will be adjusted, often based on occupancy levels.

- Adjustment Mechanism: Outlines how adjustments will be made in subsequent years based on changes in actual expenses.

Steps to Complete the Sample Gross up Clause That Should Be Used In A Base Year

Completing the sample gross up clause that should be used in a base year involves several steps:

- Identify the Base Year: Determine the specific year that will serve as the reference point for expense calculations.

- Gather Expense Data: Collect all relevant financial data for the base year, including operating costs and taxes.

- Calculate Gross Up: Apply the agreed-upon gross up percentage to the base year expenses to determine adjusted amounts.

- Document the Clause: Clearly articulate the gross up clause in the lease or financial document, ensuring all parties understand the terms.

Legal Use of the Sample Gross up Clause That Should Be Used In A Base Year

The legal use of the sample gross up clause that should be used in a base year is crucial for enforceability. To ensure compliance with applicable laws, the clause must be clearly defined and mutually agreed upon by all parties involved. It is advisable to consult legal counsel when drafting or reviewing the clause to confirm that it aligns with state and federal regulations. Additionally, maintaining transparency in how expenses are calculated and adjusted can help prevent disputes and foster trust between landlords and tenants.

How to Use the Sample Gross up Clause That Should Be Used In A Base Year

Using the sample gross up clause that should be used in a base year effectively involves understanding its application in lease agreements. Parties should:

- Review the clause during lease negotiations to ensure it meets both parties' needs.

- Monitor actual expenses throughout the lease term to accurately apply the gross up percentage.

- Communicate any changes in expense categories or gross up percentages to all stakeholders.

- Keep thorough records of all calculations and adjustments for future reference and potential audits.

Examples of Using the Sample Gross up Clause That Should Be Used In A Base Year

Examples of using the sample gross up clause that should be used in a base year can illustrate its practical application. For instance:

- A commercial lease may state that the base year for operating expenses is 2022, with a gross up percentage of 10%. If the total operating expenses for 2022 are $100,000, the adjusted amount for subsequent years would be $110,000.

- In a multi-tenant building, if one tenant occupies 50% of the space, the gross up clause may stipulate that their share of the expenses will be calculated based on the grossed-up amount, ensuring fair distribution of costs.

Quick guide on how to complete sample gross up clause that should be used in a base year

Handle Sample Gross up Clause That Should Be Used In A Base Year with ease on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without complications. Manage Sample Gross up Clause That Should Be Used In A Base Year on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Sample Gross up Clause That Should Be Used In A Base Year effortlessly

- Obtain Sample Gross up Clause That Should Be Used In A Base Year and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Sample Gross up Clause That Should Be Used In A Base Year and ensure exceptional communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Sample Gross up Clause That Should Be Used In A Base Year?

A Sample Gross up Clause That Should Be Used In A Base Year is a contract provision that establishes how operating costs are calculated and adjusted in lease agreements. It ensures that landlords and tenants agree on how expenses are covered during the base year period, contributing to fair rent calculations. Understanding this sample clause is essential for both parties in a leasing negotiation.

-

How can airSlate SignNow assist with implementing a Sample Gross up Clause That Should Be Used In A Base Year?

airSlate SignNow simplifies the process of integrating a Sample Gross up Clause That Should Be Used In A Base Year into your documents. With its user-friendly interface, you can easily draft, edit, and eSign leases that include this important clause. This efficient solution streamlines the agreement process, saving you time and ensuring accuracy.

-

Are there specific features in airSlate SignNow for managing lease agreements with a Sample Gross up Clause That Should Be Used In A Base Year?

Yes, airSlate SignNow offers features that are perfect for managing lease agreements containing a Sample Gross up Clause That Should Be Used In A Base Year. These features include customizable templates, smart fields for easy data entry, and secure eSigning capabilities to facilitate swift agreements. These tools enhance the overall document management experience.

-

What benefits does airSlate SignNow provide for businesses using a Sample Gross up Clause That Should Be Used In A Base Year?

Using airSlate SignNow to handle a Sample Gross up Clause That Should Be Used In A Base Year provides various benefits, such as increased efficiency, reduced administrative burdens, and improved accuracy in lease agreements. By digitizing the process, businesses can lower operational costs and expedite workflow. This ultimately leads to better occupancy management and improved tenant relations.

-

Is airSlate SignNow compliant with legal standards for using a Sample Gross up Clause That Should Be Used In A Base Year?

Absolutely, airSlate SignNow ensures compliance with legal standards when incorporating a Sample Gross up Clause That Should Be Used In A Base Year into documents. The platform is designed to meet legal requirements concerning electronic signatures and document management, providing businesses with peace of mind. Our solution is regularly updated to stay aligned with changing laws.

-

What pricing options are available with airSlate SignNow for managing Sample Gross up Clause That Should Be Used In A Base Year agreements?

airSlate SignNow offers flexible pricing options to accommodate businesses of all sizes who need to manage Sample Gross up Clause That Should Be Used In A Base Year agreements. Our subscription plans are designed to fit different budgets while providing access to essential features for document management. This cost-effective solution ensures you get the best value for your investment.

-

Can airSlate SignNow integrate with other software to enhance the use of a Sample Gross up Clause That Should Be Used In A Base Year?

Yes, airSlate SignNow seamlessly integrates with various software platforms, making it easier to enhance the use of a Sample Gross up Clause That Should Be Used In A Base Year. Integrations with CRM systems, accounting software, and additional document management tools ensure a cohesive workflow. This capability allows you to consolidate your processes for greater efficiency.

Get more for Sample Gross up Clause That Should Be Used In A Base Year

- Sample motion to lift no contact order form

- Oath of attorney wsba form

- Changed as it is listed on form

- Free wisconsin name change forms how to change your

- Cv 450 petition for name change for adult or minor 14 or older form

- Adult or minor 14 or older 30708 form

- Pdf illinois statewide forms request for name change minor

- Cv 455 petition for name change minor child under 14 form

Find out other Sample Gross up Clause That Should Be Used In A Base Year

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template