L 2045 the South Carolina Department of Revenue Sctax 2001

What is the L-2045 The South Carolina Department of Revenue Sctax

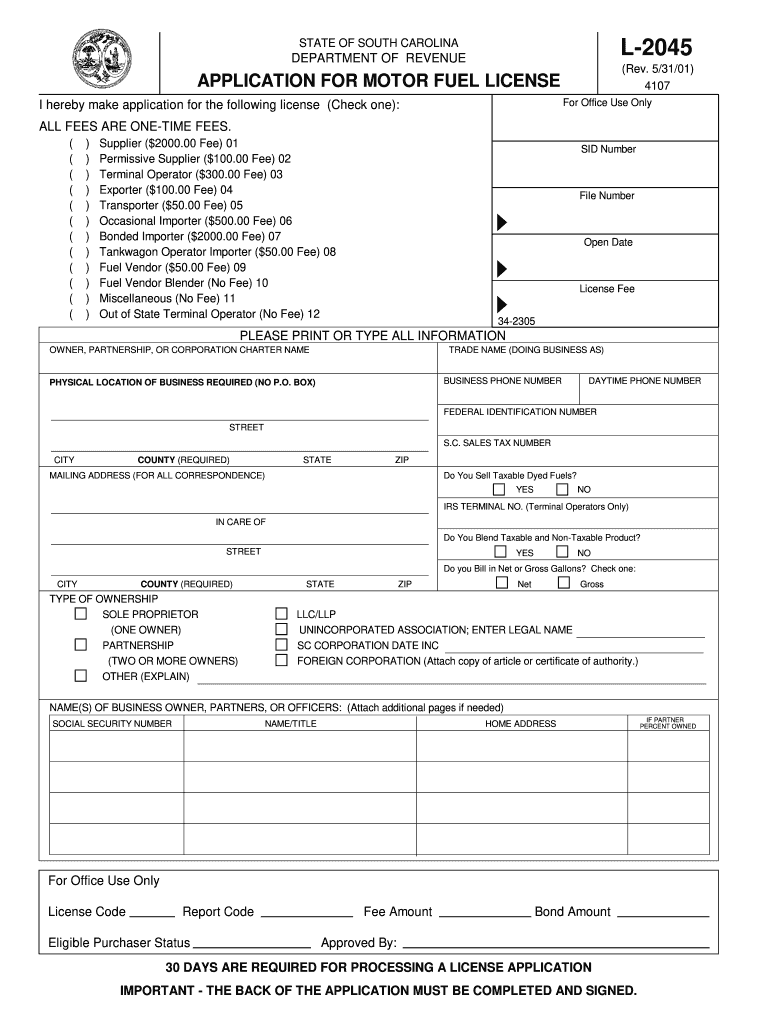

The L-2045 form is a tax document provided by the South Carolina Department of Revenue. It is specifically designed for taxpayers to report their income and calculate their tax liabilities. This form is essential for ensuring compliance with state tax regulations and helps streamline the tax filing process. Understanding the purpose of the L-2045 is crucial for accurate reporting and timely submission.

Steps to complete the L-2045 The South Carolina Department of Revenue Sctax

Completing the L-2045 form involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with the required information, ensuring that all fields are completed accurately. After filling out the form, review it for any errors or omissions. Finally, sign the document electronically or by hand, and prepare it for submission according to the preferred method.

How to use the L-2045 The South Carolina Department of Revenue Sctax

The L-2045 form can be used by individuals and businesses to report their tax information to the South Carolina Department of Revenue. To use the form effectively, begin by accessing the official template online. Fill in the required fields with accurate data, ensuring that you follow the guidelines provided by the state. Once completed, the form can be submitted electronically, which is a convenient option that reduces the need for physical paperwork.

Filing Deadlines / Important Dates

Timely filing of the L-2045 form is critical to avoid penalties. The South Carolina Department of Revenue typically sets specific deadlines for tax submissions. It is important to be aware of these dates, which may vary each year. Generally, the deadline for filing individual income tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be adjusted. Always check the latest updates from the department to ensure compliance.

Legal use of the L-2045 The South Carolina Department of Revenue Sctax

The L-2045 form is legally recognized as a valid document for reporting tax information in South Carolina. To ensure its legal standing, it must be completed in accordance with state regulations. This includes providing accurate information, signing the form appropriately, and submitting it by the established deadlines. Utilizing an eSignature solution can enhance the legal validity of the form while maintaining compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act.

Required Documents

When preparing to complete the L-2045 form, certain documents are required to provide the necessary information. These typically include proof of income, such as W-2 forms or 1099 statements, as well as any relevant deductions or credits. Additionally, having previous tax returns on hand can assist in ensuring that all information is accurate and complete. Gathering these documents in advance can streamline the filing process and help avoid delays.

Quick guide on how to complete l 2045 the south carolina department of revenue sctax

Your assistance manual on how to prepare your L 2045 The South Carolina Department Of Revenue Sctax

If you are interested in learning how to fill out and submit your L 2045 The South Carolina Department Of Revenue Sctax, here are some concise instructions on how to simplify tax submission.

To begin, all you need to do is set up your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is an extraordinarily user-friendly and robust document solution that enables you to modify, create, and complete your income tax forms with ease. With its editor, you can alternate between text, check boxes, and eSignatures and return to amend details as necessary. Enhance your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your L 2045 The South Carolina Department Of Revenue Sctax in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to locate any IRS tax document; explore various versions and schedules.

- Click Obtain form to open your L 2045 The South Carolina Department Of Revenue Sctax in our editor.

- Fill out the mandatory fillable fields with your details (text, numbers, checkmarks).

- Use the Signature Tool to add your legally-binding eSignature (if needed).

- Examine your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can raise return mistakes and delay refunds. Naturally, before e-filing your taxes, check the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct l 2045 the south carolina department of revenue sctax

FAQs

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do I find out how much taxes I owe to the state of South Carolina?

Not a lengthy answer just read information : Tax Help Blog | Tax Problem Resolution | IRS Tax Debt Relief Information

-

What is the total number of federal applications, documents, or forms from all the departments of government that US citizens are required by law to fill out?

I am not an American. But it would depend on the person's circumstances. How much do they earn? If you earn little then you don't need to file a tax return. How do they earn it? Self employed or employed?Do they travel? You need a passport.How long do they live? - if they die after birth then it is very little. Do they live in the USA?What entitlements do they have?Do they have dialysis? This is federally funded.Are they on medicaid/medicare?.Are they in jail or been charged with a crime?Then how do you count it? Do you count forms filled in by the parents?Then there is the census the Constitution which held every ten years.

-

How can I fill out the form of DTE MPonline to take admission in IET DAVV Indore? Provide the site (link).

See their is no seperate form for iet davv, you have to fill this college during the choice filling stage of counselling.The procedure for the DTE counselling is very simple thier are 3 main steps you need to follow.RegistrationChoice fillingReporting to alloted institute.For all this the website you should visit is https://dte.mponline.gov.in/port...Here at the top right corner you will see a menu as select course for counselling, click on it, select bachelor of engineering then full time and then apply online. This is how you will register for counselling.Hope it helps.Feel free to ask any other problem you face regarding counselling or college selection.

Create this form in 5 minutes!

How to create an eSignature for the l 2045 the south carolina department of revenue sctax

How to generate an eSignature for your L 2045 The South Carolina Department Of Revenue Sctax online

How to create an electronic signature for the L 2045 The South Carolina Department Of Revenue Sctax in Chrome

How to create an eSignature for putting it on the L 2045 The South Carolina Department Of Revenue Sctax in Gmail

How to generate an electronic signature for the L 2045 The South Carolina Department Of Revenue Sctax right from your mobile device

How to create an electronic signature for the L 2045 The South Carolina Department Of Revenue Sctax on iOS devices

How to make an eSignature for the L 2045 The South Carolina Department Of Revenue Sctax on Android devices

People also ask

-

What is L 2045 The South Carolina Department Of Revenue Sctax?

L 2045 The South Carolina Department Of Revenue Sctax is a tax form used for reporting and paying specific taxes in South Carolina. This form is essential for businesses and individuals to ensure compliance with state tax regulations. Using airSlate SignNow, you can easily eSign and submit this form directly to the South Carolina Department of Revenue.

-

How can airSlate SignNow help with L 2045 The South Carolina Department Of Revenue Sctax submissions?

airSlate SignNow simplifies the process of submitting L 2045 The South Carolina Department Of Revenue Sctax by allowing users to eSign documents quickly and securely. Our platform ensures that your submissions are compliant with state requirements, reducing the risk of errors. Plus, you can track the status of your submissions in real-time.

-

What are the pricing options for using airSlate SignNow for L 2045 The South Carolina Department Of Revenue Sctax?

airSlate SignNow offers flexible pricing plans designed to accommodate different business needs, including those who need to file L 2045 The South Carolina Department Of Revenue Sctax. Our plans are affordable and provide access to a range of features such as unlimited eSigning and document storage. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow provide for handling L 2045 The South Carolina Department Of Revenue Sctax?

With airSlate SignNow, you can easily create, edit, and eSign L 2045 The South Carolina Department Of Revenue Sctax documents. Our platform includes templates, automated workflows, and secure storage options. These features streamline your tax filing process, ensuring that you can manage all your documents efficiently.

-

Is airSlate SignNow secure for submitting L 2045 The South Carolina Department Of Revenue Sctax forms?

Yes, airSlate SignNow prioritizes the security of your documents, including L 2045 The South Carolina Department Of Revenue Sctax forms. We use advanced encryption and comply with data protection regulations to ensure your information is safe. You can trust our platform for secure eSigning and document management.

-

Can I integrate airSlate SignNow with other applications for L 2045 The South Carolina Department Of Revenue Sctax?

Absolutely! airSlate SignNow offers integration with various applications and services, allowing you to streamline your workflow when handling L 2045 The South Carolina Department Of Revenue Sctax. This includes integrations with popular CRMs, cloud storage solutions, and productivity tools, making document management even easier.

-

What are the benefits of using airSlate SignNow for L 2045 The South Carolina Department Of Revenue Sctax?

Using airSlate SignNow for L 2045 The South Carolina Department Of Revenue Sctax provides numerous benefits, including time savings, enhanced accuracy, and improved compliance. Our platform simplifies the eSigning process, allowing you to focus on your business rather than paperwork. Additionally, you can access your documents from anywhere, ensuring you never miss a deadline.

Get more for L 2045 The South Carolina Department Of Revenue Sctax

- Affidavit of attorney form

- For rent payments under the lease agreement up to the amount of the guarantee as described form

- 10 tips for writing a persuasive family law declaration form

- The uniform child custody jurisdiction and ncjrs

- Rule 36 requests for admissionfederal rules of civil form

- Above named by and through his form

- Medical records release request i dob ss form

- The state of minnesota to the above named form

Find out other L 2045 The South Carolina Department Of Revenue Sctax

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation