Bridge Financing Warrant Form

What is the Bridge Financing Warrant

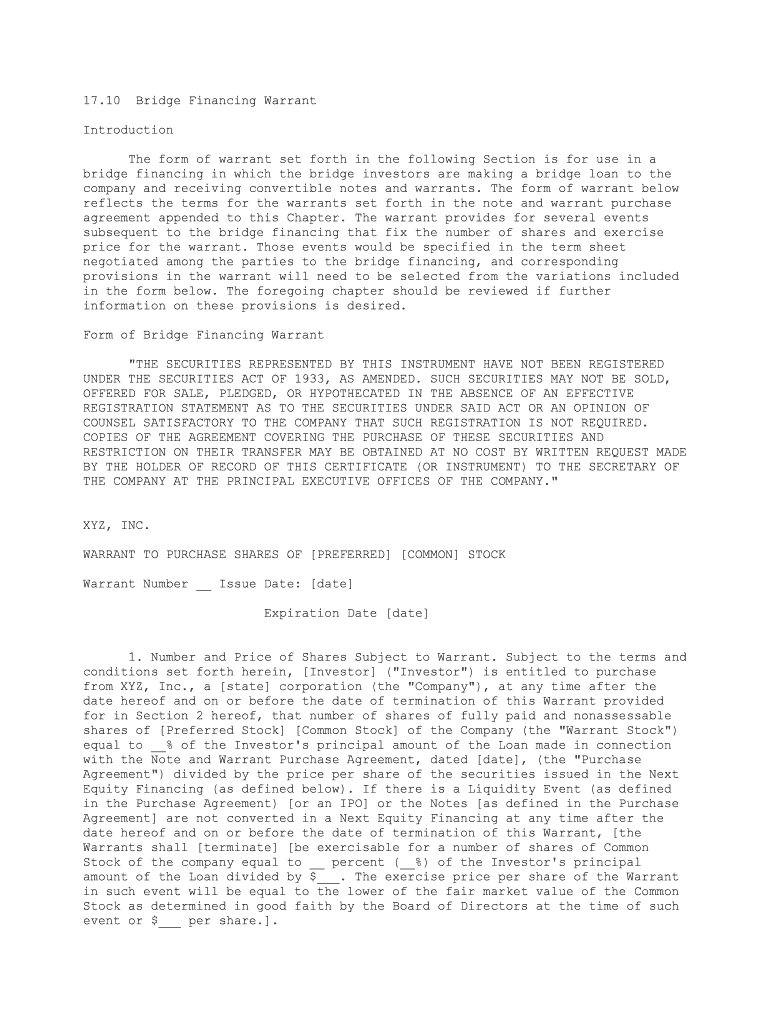

The Bridge Financing Warrant is a financial instrument that provides investors the right to purchase equity in a company at a predetermined price within a specified time frame. This warrant is often issued alongside bridge financing, which is a short-term loan that helps a company meet its immediate cash flow needs while waiting for more permanent financing. By holding a warrant, investors can benefit from potential future growth, as they can convert their warrants into shares if the company's value increases.

How to use the Bridge Financing Warrant

To effectively use a Bridge Financing Warrant, investors should first review the terms outlined in the warrant agreement. This includes understanding the exercise price, expiration date, and any conditions that must be met before exercising the warrant. Investors typically exercise the warrant when the market price of the underlying shares exceeds the exercise price, allowing them to purchase shares at a discount. It is essential to keep track of the warrant's expiration date to ensure timely exercise.

Steps to complete the Bridge Financing Warrant

Completing a Bridge Financing Warrant involves several key steps:

- Review the warrant agreement to understand the terms and conditions.

- Gather necessary documentation, including identification and proof of investment.

- Fill out the warrant exercise form, providing required details such as the number of warrants being exercised.

- Submit the completed form along with any payment for the shares, if applicable.

- Keep a copy of the submitted form and any correspondence for your records.

Legal use of the Bridge Financing Warrant

The legal use of a Bridge Financing Warrant is governed by securities laws and regulations. It is crucial for both issuers and investors to comply with these laws to ensure the validity of the warrant. This includes proper disclosure of the terms and conditions of the warrant, as well as adherence to any state-specific regulations. Legal counsel may be advisable to navigate these complexities and ensure compliance throughout the process.

Key elements of the Bridge Financing Warrant

Several key elements define a Bridge Financing Warrant:

- Exercise Price: The price at which the warrant holder can purchase shares.

- Expiration Date: The date by which the warrant must be exercised.

- Transferability: Terms regarding whether the warrant can be sold or transferred to another party.

- Conditions: Any specific conditions that must be met before the warrant can be exercised.

Examples of using the Bridge Financing Warrant

Investors may use a Bridge Financing Warrant in various scenarios. For instance, a startup may issue warrants to early investors as an incentive for providing immediate funding. If the startup later grows and its stock value increases, investors can exercise their warrants, purchasing shares at the lower exercise price. Alternatively, a company may issue warrants during a merger or acquisition to attract investors who believe in the company's future potential.

Quick guide on how to complete bridge financing warrant

Complete Bridge Financing Warrant effortlessly across any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary for you to create, modify, and electronically sign your documents swiftly and without delay. Manage Bridge Financing Warrant on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The simplest way to modify and electronically sign Bridge Financing Warrant with ease

- Find Bridge Financing Warrant and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, either via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Bridge Financing Warrant and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Bridge Financing Warrant?

A Bridge Financing Warrant is a financial instrument that provides companies an opportunity to raise short-term capital while offering investors the right to purchase equity at a predetermined price. It serves as a valuable tool for startups needing quick funding without immediate dilution of ownership.

-

How does airSlate SignNow facilitate the management of Bridge Financing Warrants?

airSlate SignNow simplifies the process of managing Bridge Financing Warrants by providing an intuitive platform for digital signatures and document management. This efficiency allows companies to execute warrant agreements swiftly, ensuring that all parties involved are aligned and informed throughout the process.

-

What are the costs associated with using airSlate SignNow for Bridge Financing Warrants?

Using airSlate SignNow for Bridge Financing Warrants is cost-effective, with various pricing plans available to suit different business sizes and needs. Companies can select a plan that allows for seamless document signing and management, optimizing the handling of bridge financing agreements without overspending.

-

What features does airSlate SignNow offer for handling Bridge Financing Warrants?

airSlate SignNow offers a suite of features designed for Bridge Financing Warrants, including customizable templates, secure eSigning, and real-time tracking of document status. These features help streamline the process, ensuring that businesses can efficiently manage their financing agreements and maintain compliance.

-

What are the benefits of using airSlate SignNow for Bridge Financing Warrants?

The benefits of using airSlate SignNow for Bridge Financing Warrants include increased efficiency in document execution, enhanced security for sensitive financial agreements, and improved accessibility for stakeholders. Utilizing this solution reduces the turnaround time for securing financing without the hassle of traditional paperwork.

-

Can airSlate SignNow integrate with other financial software for Bridge Financing Warrants?

Yes, airSlate SignNow can seamlessly integrate with various financial software solutions, enhancing the management of Bridge Financing Warrants. This integration allows businesses to centralize their financial operations, simplifying workflows and ensuring that all necessary documents are readily accessible.

-

How secure is the information on Bridge Financing Warrants when using airSlate SignNow?

airSlate SignNow prioritizes the security of your information, especially regarding sensitive documents like Bridge Financing Warrants. The platform employs advanced encryption measures and complies with strict data protection regulations to ensure that your documents remain safe and confidential.

Get more for Bridge Financing Warrant

- Notice of paymentsuspension of benefits wc 002 form

- Subpoena state board of workers compensation sbwc georgia form

- Georgia wc 131a form

- Rules and regulations of the state board of workers form

- Employer quarterly report for a nurse on probation in form

- Special leave form

- Ged transcripts pa form

- Certificate of readiness tennessee form

Find out other Bridge Financing Warrant

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now