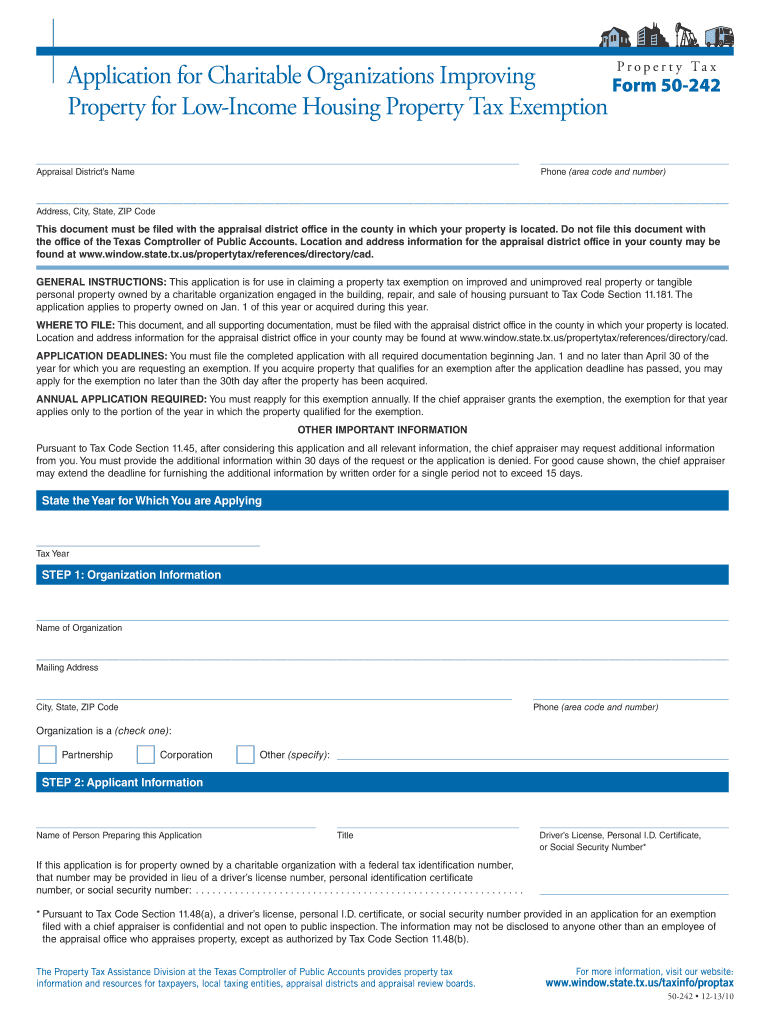

Application for Charitable Organizations Improving Property for Low Income Housing Property Tax Exemption Window Texas Form

What is Form 50-115?

Form 50-115, also known as the Application for Charitable Organizations Improving Property for Low Income Housing Property Tax Exemption, is a document used in Texas. This form allows qualifying charitable organizations to apply for a property tax exemption on properties used for low-income housing. By completing this form, organizations can potentially reduce their property tax burden, thereby allowing them to allocate more resources toward their charitable missions.

Eligibility Criteria for Form 50-115

To qualify for the exemption under Form 50-115, organizations must meet specific criteria set forth by Texas law. These criteria typically include:

- The organization must be a charitable entity recognized by the IRS.

- The property must be used exclusively for low-income housing purposes.

- The organization must provide proof of its charitable status and the intended use of the property.

Understanding these eligibility requirements is crucial for organizations seeking to benefit from the exemption.

Steps to Complete Form 50-115

Completing Form 50-115 involves several key steps to ensure accuracy and compliance with Texas regulations:

- Gather necessary documentation, including proof of charitable status and property use.

- Fill out the form with accurate and complete information regarding the organization and the property.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate local appraisal district office.

Following these steps can help streamline the application process and increase the chances of approval.

Required Documents for Form 50-115

When applying with Form 50-115, organizations must submit several supporting documents to substantiate their claims. These documents may include:

- Proof of the organization’s tax-exempt status, such as a letter from the IRS.

- Documentation demonstrating the use of the property for low-income housing, such as lease agreements or occupancy records.

- Financial statements that reflect the organization’s operations and expenditures related to the property.

Providing comprehensive documentation is essential for a successful application.

Form Submission Methods for Form 50-115

Organizations can submit Form 50-115 through various methods, depending on local regulations. Common submission methods include:

- Online submission via the local appraisal district’s website, if available.

- Mailing the completed form and supporting documents to the designated appraisal district office.

- In-person submission at the local appraisal district office during business hours.

Choosing the appropriate submission method can help ensure timely processing of the application.

Legal Use of Form 50-115

Form 50-115 is legally binding once submitted and accepted by the local appraisal district. It is important for organizations to ensure that all information provided is accurate and truthful. Misrepresentation or failure to meet eligibility requirements can lead to penalties, including denial of the exemption or future audits. Compliance with all relevant laws and regulations is essential for maintaining the exemption status.

Quick guide on how to complete application for charitable organizations improving property for low income housing property tax exemption window texas

Effortlessly Prepare Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed materials, as you can easily locate the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas with Ease

- Obtain Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas and click Get Form to begin.

- Utilize the features we offer to fill out your document.

- Emphasize key sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this functionality.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sharing your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate the worry of misplaced files, tedious document searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Modify and eSign Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for charitable organizations improving property for low income housing property tax exemption window texas

How to make an electronic signature for the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas online

How to generate an electronic signature for your Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas in Chrome

How to generate an electronic signature for putting it on the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas in Gmail

How to generate an electronic signature for the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas straight from your smart phone

How to generate an eSignature for the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas on iOS

How to create an eSignature for the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas on Android OS

People also ask

-

What is the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas?

The Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas is a form designed to help charitable organizations apply for property tax exemptions aimed at improving low-income housing. This application can signNowly reduce the financial burden on these organizations, allowing them to focus more on their mission of providing affordable housing.

-

How can airSlate SignNow assist with the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas?

airSlate SignNow streamlines the process of completing and submitting the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas. Our platform allows you to eSign and send documents securely, ensuring that your applications are processed quickly and efficiently.

-

What are the pricing options for using airSlate SignNow for my charitable organization’s application needs?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of charitable organizations. By choosing our services for the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas, you gain access to cost-effective solutions that simplify document management and eSigning.

-

What features does airSlate SignNow provide for managing the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas?

Our platform provides a range of features for managing the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas, including customizable templates, automated workflows, and real-time tracking. These features make it easier to complete and monitor your applications efficiently.

-

Are there integrations available for airSlate SignNow that support the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas?

Yes, airSlate SignNow integrates seamlessly with popular applications and services that can support the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas. This integration allows you to streamline your workflow and enhance productivity by connecting your existing tools with our platform.

-

What benefits does airSlate SignNow offer for charitable organizations working on property tax exemption applications?

By using airSlate SignNow for the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas, organizations can enjoy faster processing times, reduced paperwork, and improved compliance. Our solution empowers you to focus on your mission while we handle the complexities of document management.

-

How secure is the airSlate SignNow platform for submitting the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security measures to ensure that all documents, including the Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas, are safely stored and transmitted, protecting sensitive information.

Get more for Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas

Find out other Application For Charitable Organizations Improving Property For Low Income Housing Property Tax Exemption Window Texas

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple