Contractor is Form

What is the Contractor Is

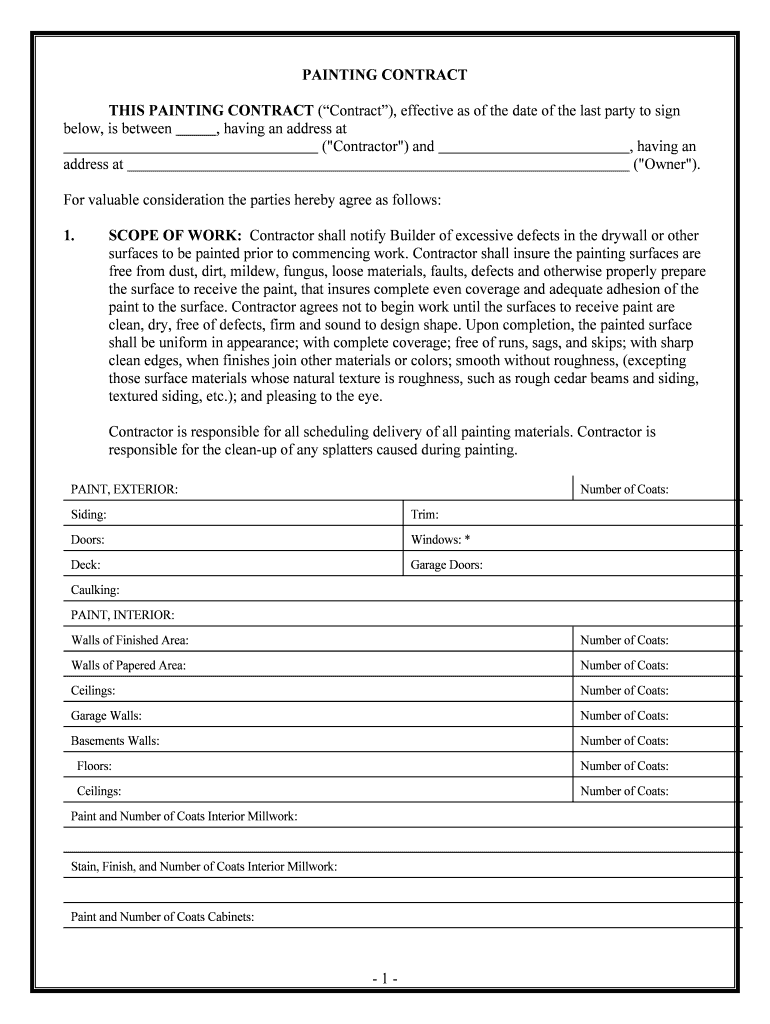

The Contractor Is form is a crucial document used primarily in the context of independent contracting and business relationships. It serves to clarify the status of a contractor, detailing the nature of their work and the terms of their engagement. This form is often utilized by businesses to ensure compliance with tax regulations and to establish clear expectations between the contractor and the hiring entity. By defining the scope of work, payment terms, and responsibilities, the Contractor Is form helps prevent misunderstandings and legal disputes.

How to Use the Contractor Is

Using the Contractor Is form involves several key steps to ensure that all necessary information is accurately captured. First, gather relevant details about the contractor, including their name, contact information, and tax identification number. Next, outline the specific services they will provide, along with any deadlines or milestones. It is also important to include payment terms, such as rates and invoicing procedures. Once completed, both parties should review the document to confirm its accuracy before signing. Utilizing electronic signature solutions can streamline this process, ensuring that the form is executed efficiently and securely.

Steps to Complete the Contractor Is

Completing the Contractor Is form requires attention to detail to ensure compliance and clarity. Follow these steps:

- Gather all necessary information about the contractor and the nature of the work.

- Clearly define the scope of services to be provided.

- Specify payment terms, including rates and invoicing schedules.

- Include any relevant deadlines or project milestones.

- Review the form for accuracy and completeness.

- Obtain signatures from both parties to formalize the agreement.

Legal Use of the Contractor Is

The legal use of the Contractor Is form is essential for establishing a formal relationship between a contractor and a business. This document helps clarify the nature of the working relationship, which can impact tax obligations and liability. For the form to be legally binding, it must be filled out accurately and signed by both parties. Compliance with relevant federal and state laws is crucial, as misclassifying a worker can lead to significant penalties. Therefore, understanding the legal implications of this form is vital for both contractors and businesses.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the classification of workers as independent contractors versus employees. These guidelines are important when using the Contractor Is form, as they help determine the correct tax treatment for payments made to contractors. Key factors include the degree of control the business has over the worker, the financial aspects of the relationship, and the nature of the work performed. Adhering to IRS guidelines ensures compliance and reduces the risk of audits or penalties.

Required Documents

When completing the Contractor Is form, certain documents may be necessary to support the information provided. These can include:

- W-9 form to collect the contractor's taxpayer identification number.

- Proof of insurance or licenses, if applicable.

- Contracts or agreements detailing the terms of the engagement.

Having these documents ready can facilitate a smoother completion process and enhance the legitimacy of the Contractor Is form.

Penalties for Non-Compliance

Failing to comply with the regulations surrounding the Contractor Is form can result in significant penalties for businesses. Misclassifying workers can lead to back taxes, fines, and legal disputes. The IRS may impose penalties for failing to withhold appropriate taxes, while state agencies may have their own penalties for misclassification. Understanding these risks emphasizes the importance of accurately completing and using the Contractor Is form in accordance with legal requirements.

Quick guide on how to complete contractor is

Finish Contractor Is effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It provides an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Contractor Is on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign Contractor Is with ease

- Locate Contractor Is and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Contractor Is to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the primary function of airSlate SignNow for contractors?

airSlate SignNow enables contractors to easily send, eSign, and manage documents online. This streamlined process helps contractors save time and reduce paperwork, making it simple to keep projects moving. With airSlate SignNow, contractors can focus on their core work rather than getting bogged down by document management.

-

How does pricing for airSlate SignNow work for contractors?

airSlate SignNow offers flexible pricing plans tailored to the needs of contractors. These plans are cost-effective, ensuring you only pay for what you need. With various options available, contractors can find the perfect plan that scales with their business without incurring unnecessary costs.

-

What features are most beneficial to contractors using airSlate SignNow?

Contractors benefit from features like template creation, document tracking, and advanced eSignature options. These tools allow contractors to customize their documents, streamline workflows, and maintain visibility over document status. Overall, these features make managing contractor workflows much more efficient.

-

Can airSlate SignNow integrate with other tools that contractors commonly use?

Yes, airSlate SignNow offers integrations with various popular tools that contractors rely on. From project management software to accounting applications, these integrations help contractors maintain seamless workflows. This connectivity enhances productivity by allowing more efficient information sharing across platforms.

-

How can airSlate SignNow enhance communication for contractors?

By enabling faster document approvals and real-time tracking, airSlate SignNow improves communication for contractors. This real-time capability ensures that all parties involved are on the same page and can make informed decisions quickly. Consequently, contractors can reduce bottlenecks that typically arise from miscommunication.

-

Is airSlate SignNow secure for contractors to use?

Absolutely, airSlate SignNow prioritizes security, employing industry-standard encryption to protect sensitive contractor information. This commitment to data security ensures that documents and communications remain confidential and are only accessible to authorized parties. Contractors can use the platform with confidence knowing that their information is safe.

-

What types of documents can contractors use with airSlate SignNow?

Contractors can utilize airSlate SignNow for a variety of documents, including contracts, invoices, and release forms. This versatility allows contractors to manage all aspects of their business documentation from a single platform. Whether it's a simple agreement or complex project documents, airSlate SignNow caters to all needs.

Get more for Contractor Is

- T1 general form

- Suncorp cash back form

- Activity notification form scouts nsw scouts australia

- Fillable online master limit restructure request form

- Co operative program household information form

- Thirty day notice of termination of tenancy regency property form

- Background check verified volunteers sterling volunteers form

- Ncw incident report form utah department of health

Find out other Contractor Is

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online