Grantors, Remise, Release, and Forever Quitclaim Unto , a Limited Liability Form

What is the Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability

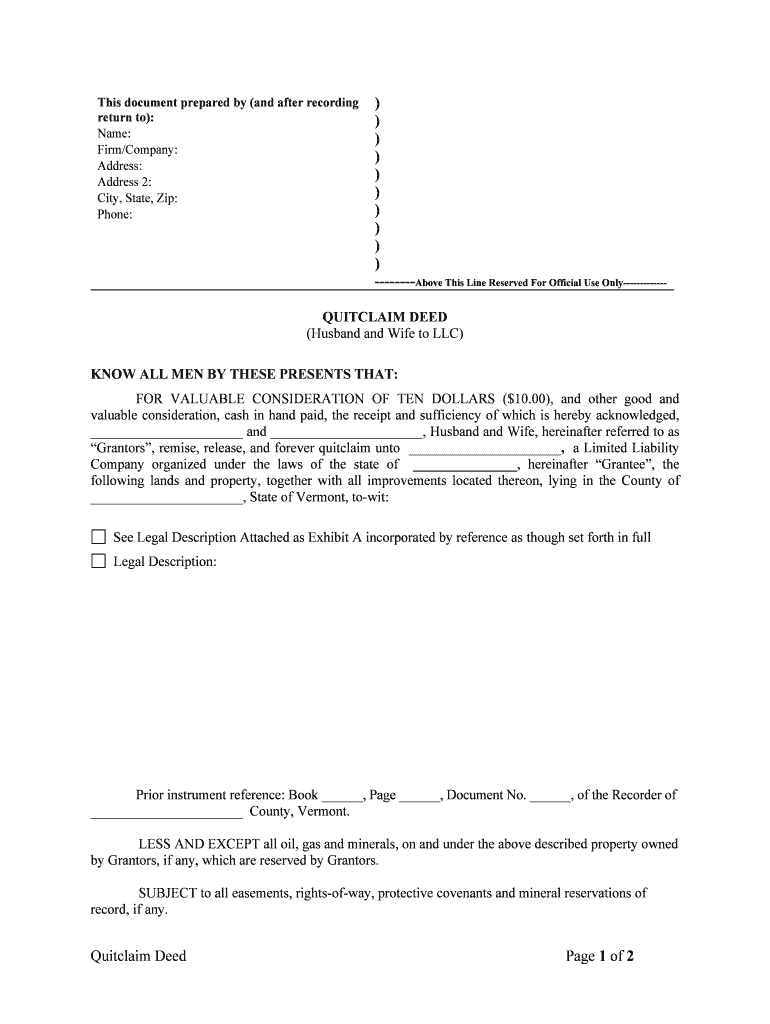

The Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability form serves as a legal document that allows one party, known as the grantor, to transfer their interest in a property to another party, typically a limited liability company (LLC). This type of quitclaim deed is particularly useful in real estate transactions where the grantor wishes to relinquish any claim to the property without providing warranties regarding the title. It is essential for the parties involved to understand that this form does not guarantee that the grantor holds clear title to the property. Instead, it simply conveys whatever interest the grantor has at the time of signing.

How to Use the Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability

Using the Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability form involves several steps. First, the grantor must accurately fill out the form, including the names of all parties involved and a detailed description of the property being transferred. It is crucial to ensure that the information is correct to avoid any legal disputes in the future. Once completed, the form should be signed in the presence of a notary public to validate the transaction. After notarization, the document needs to be filed with the appropriate county office to officially record the transfer of interest.

Key Elements of the Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability

Several key elements must be included in the Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability form to ensure its legality and effectiveness. These elements include:

- Grantor and Grantee Information: Full names and addresses of both parties.

- Property Description: A clear and accurate description of the property being transferred, including legal descriptions if necessary.

- Consideration: The amount paid for the property, if applicable, or a statement indicating that the transfer is a gift.

- Signatures: Signatures of the grantor and a notary public to validate the document.

Steps to Complete the Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability

Completing the Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability form involves the following steps:

- Gather necessary information about the property and the parties involved.

- Fill out the form accurately, ensuring all details are correct.

- Sign the document in front of a notary public to ensure its validity.

- File the completed form with the appropriate county office to record the transaction.

Legal Use of the Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability

The legal use of the Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability form is primarily in real estate transactions. It is important to note that this form is not suitable for every situation. It is typically used when the grantor is transferring property to an LLC or when the transfer is made without any warranties. Understanding the legal implications of this form is crucial, as it may affect the rights of the parties involved and their ability to claim ownership in the future.

State-Specific Rules for the Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability

Each state may have specific rules and requirements regarding the use of the Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability form. It is essential to check the local laws to ensure compliance. Some states may require additional documentation or specific language to be included in the form. Additionally, the process for filing the form may vary by state, including the fees associated with recording the document. Consulting with a legal professional familiar with local real estate laws can provide clarity and ensure that the form is completed correctly.

Quick guide on how to complete grantors remise release and forever quitclaim unto a limited liability

Effortlessly Prepare Grantors, Remise, Release, And Forever Quitclaim Unto , A Limited Liability on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents promptly without delays. Manage Grantors, Remise, Release, And Forever Quitclaim Unto , A Limited Liability on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

Steps to Edit and Electronically Sign Grantors, Remise, Release, And Forever Quitclaim Unto , A Limited Liability with Ease

- Access Grantors, Remise, Release, And Forever Quitclaim Unto , A Limited Liability and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Grantors, Remise, Release, And Forever Quitclaim Unto , A Limited Liability to maintain exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability?

Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability is a legal document used to transfer property rights. This document serves as a formal declaration that allows the Granter to relinquish their claim to the property, ensuring a clean transfer without further liabilities. Our platform simplifies the eSigning process for these types of documents.

-

How does airSlate SignNow help with Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability?

With airSlate SignNow, you can easily create, send, and eSign Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability documents. Our user-friendly interface guides you through the process, making it straightforward to manage property transfers. Additionally, the built-in templates streamline the workflow for your contracts.

-

What is the pricing structure for using airSlate SignNow for legal documents?

airSlate SignNow offers competitive pricing plans that cater to various business needs. These plans include features for managing Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability documents, along with other essential eSignature functionalities. You can select a plan that fits your budget and workflow requirements.

-

Are there any integrations available for managing Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability documents?

Yes, airSlate SignNow integrates with various third-party applications, such as CRM and document management systems, to streamline your workflow. These integrations allow you to manage Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability seamlessly within your preferred tools. This enhances collaboration and document tracking.

-

What security measures are in place for signing Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability documents?

airSlate SignNow prioritizes document security with end-to-end encryption and secure cloud storage. This ensures that all Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability documents are protected against unauthorized access. Additionally, our audit trails provide transparency and accountability for every signed document.

-

Is it easy to customize Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability documents on airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize their Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability templates easily. You can add your branding, modify terms, and tailor the content to fit specific legal requirements, ensuring that each document meets your unique needs.

-

What are the benefits of using airSlate SignNow for property transfers?

The main benefits of using airSlate SignNow for property transfers include increased efficiency and reduced costs. Handling Grantors, Remise, Release, And Forever Quitclaim Unto, A Limited Liability becomes faster, allowing businesses to finalize transactions quickly. Our solution also minimizes paperwork, providing an eco-friendly alternative.

Get more for Grantors, Remise, Release, And Forever Quitclaim Unto , A Limited Liability

- Hawassa university registration date 2013 form

- Pt chart form

- Osas psu palawan edu ph form

- Interest inventory for elementary students form

- Junior kabaddi registration form 2021

- Ccb nevada form

- Form a58 apply for an adoption order gov ukform a58 apply for an adoption order gov ukadoption forms family amp community

- Florida supreme court approved family law form 12 970a

Find out other Grantors, Remise, Release, And Forever Quitclaim Unto , A Limited Liability

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template