INSTRUCTIONS You Are Required to Complete and File the 813B If Form

What is the INSTRUCTIONS You Are Required To Complete And File The 813B If

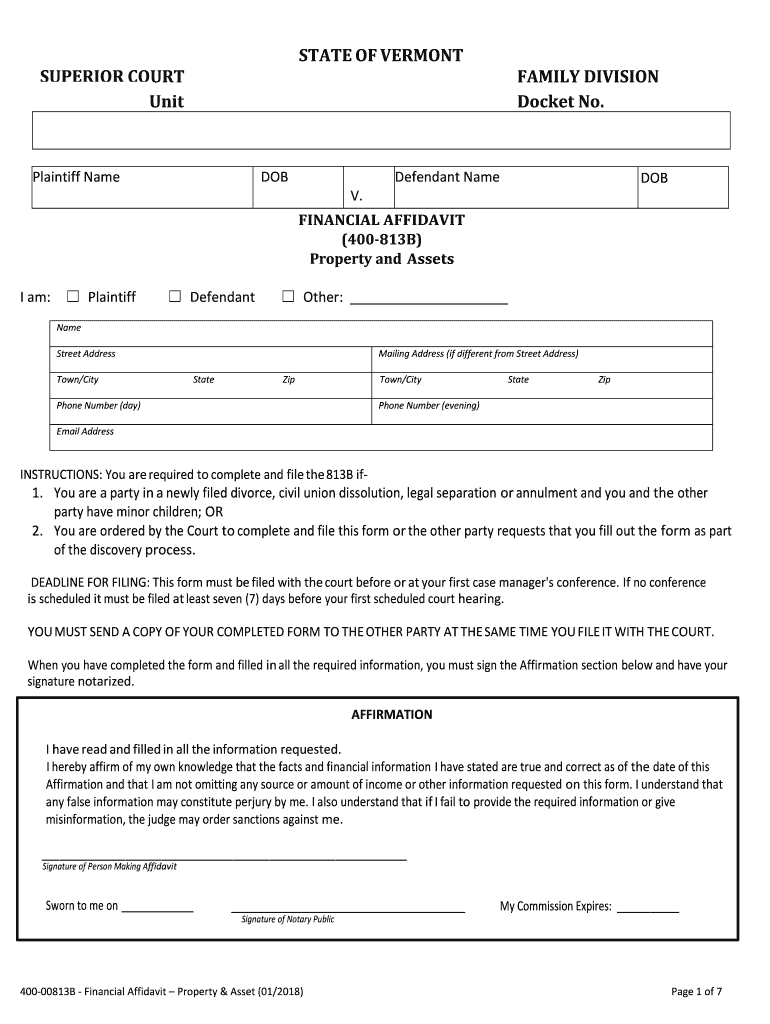

The form known as the 813B is a crucial document used primarily for reporting specific financial information to the Internal Revenue Service (IRS). It is often required in various scenarios, such as when individuals or businesses need to disclose certain tax-related details. Understanding the purpose of this form is essential for compliance and ensuring that all necessary information is accurately reported. The instructions associated with the 813B guide users on how to fill out the form correctly, ensuring that all required fields are completed and that the submission adheres to IRS regulations.

Steps to complete the INSTRUCTIONS You Are Required To Complete And File The 813B If

Completing the 813B form involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including any financial records relevant to the information being reported. Next, carefully read through the instructions provided with the form to understand the specific requirements for each section. Fill out the form methodically, ensuring that all fields are completed as per the guidelines. After completing the form, review it for any errors or omissions. Finally, submit the form by the specified deadline, either electronically or by mail, depending on the submission options available.

Legal use of the INSTRUCTIONS You Are Required To Complete And File The 813B If

The legal use of the 813B form is governed by IRS regulations, which outline the requirements for accurately reporting financial information. Proper completion of this form is essential for compliance with tax laws in the United States. Failure to adhere to these regulations can result in penalties or legal repercussions. Therefore, it is crucial to ensure that the form is completed truthfully and accurately, reflecting all necessary details as required by law. Utilizing a reliable electronic signature solution can also enhance the legal validity of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the 813B form can vary based on the specific circumstances under which it is required. Generally, it is important to be aware of the annual tax filing deadline, which is typically April 15 for most taxpayers. However, if the 813B is associated with a specific event or circumstance, such as a business transaction or financial disclosure, additional deadlines may apply. Staying informed about these deadlines is essential to avoid late penalties and ensure timely compliance with IRS requirements.

Required Documents

When preparing to complete the 813B form, it is important to gather all required documents beforehand. This may include financial statements, tax returns, and any other relevant documentation that supports the information being reported. Having these documents readily available will facilitate a smoother completion process and ensure that all necessary details are accurately reflected on the form. Additionally, keeping copies of submitted documents is advisable for future reference and record-keeping purposes.

Form Submission Methods (Online / Mail / In-Person)

The 813B form can typically be submitted through various methods, depending on the preferences of the filer and the requirements set by the IRS. Common submission methods include electronic filing through authorized platforms, mailing a physical copy to the appropriate IRS address, or, in some cases, submitting the form in person at designated IRS offices. Each method has its own guidelines and potential processing times, so it is important to choose the one that best suits your needs while ensuring compliance with IRS regulations.

Quick guide on how to complete instructions you are required to complete and file the 813b if

Complete INSTRUCTIONS You Are Required To Complete And File The 813B If effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage INSTRUCTIONS You Are Required To Complete And File The 813B If on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to edit and eSign INSTRUCTIONS You Are Required To Complete And File The 813B If without hassle

- Locate INSTRUCTIONS You Are Required To Complete And File The 813B If and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to share your form: via email, text message (SMS), invitation link, or download it to your PC.

Eliminate issues with missing or lost documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Alter and eSign INSTRUCTIONS You Are Required To Complete And File The 813B If to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the INSTRUCTIONS You Are Required To Complete And File The 813B If?

The INSTRUCTIONS You Are Required To Complete And File The 813B If documents will guide you through the necessary steps required to file your 813B form accurately. These instructions will ensure you understand all requirements, helping you avoid common pitfalls during the filing process.

-

How can airSlate SignNow simplify the filing of the 813B?

airSlate SignNow simplifies the process of completing and filing the 813B with its user-friendly interface. Our platform allows you to prepare documents, obtain eSignatures, and securely store your files, all in one location, making compliance easier than ever.

-

What features does airSlate SignNow offer for 813B filing?

airSlate SignNow offers several features tailored for 813B filing, including customizable templates, automated reminders, and a secure eSignature solution. These features ensure that you can follow the INSTRUCTIONS You Are Required To Complete And File The 813B If seamlessly and efficiently.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial so you can explore its features and determine how it meets your needs for completing and filing the 813B. The trial allows you to test all functionalities, ensuring you have everything needed to follow the INSTRUCTIONS You Are Required To Complete And File The 813B If.

-

How does airSlate SignNow ensure document security when filing the 813B?

Document security is a top priority at airSlate SignNow. Our platform employs advanced encryption methods and secure cloud storage to ensure that your documents, including those related to the INSTRUCTIONS You Are Required To Complete And File The 813B If, are safe from unauthorized access.

-

Can I integrate airSlate SignNow with other software for 813B filing?

Absolutely! airSlate SignNow can be integrated with a variety of business applications to enhance your workflow in preparing and filing the 813B. These integrations allow you to consolidate efforts and streamline the procedures outlined in the INSTRUCTIONS You Are Required To Complete And File The 813B If.

-

What benefits does eSigning offer for the 813B process?

eSigning offers several benefits for the 813B process, including faster turnaround times and reduced need for physical paperwork. With airSlate SignNow, you can easily eSign documents while following the INSTRUCTIONS You Are Required To Complete And File The 813B If, enabling you to finalize your filings more quickly and efficiently.

Get more for INSTRUCTIONS You Are Required To Complete And File The 813B If

- 2021 form 952 application for manufactured home personal property exemption

- Applicant s social security number tax year state of form

- Property tax exemption 501c2 property tax exemptions form

- Tax certificate to accompany fiduciary accounts form

- Tb risk assessment form kentucky

- Prea form

- Crcl complaint form

- Safecom fact sheet cisa form

Find out other INSTRUCTIONS You Are Required To Complete And File The 813B If

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile