Paid by Grantor Form

What is the Paid By Grantor

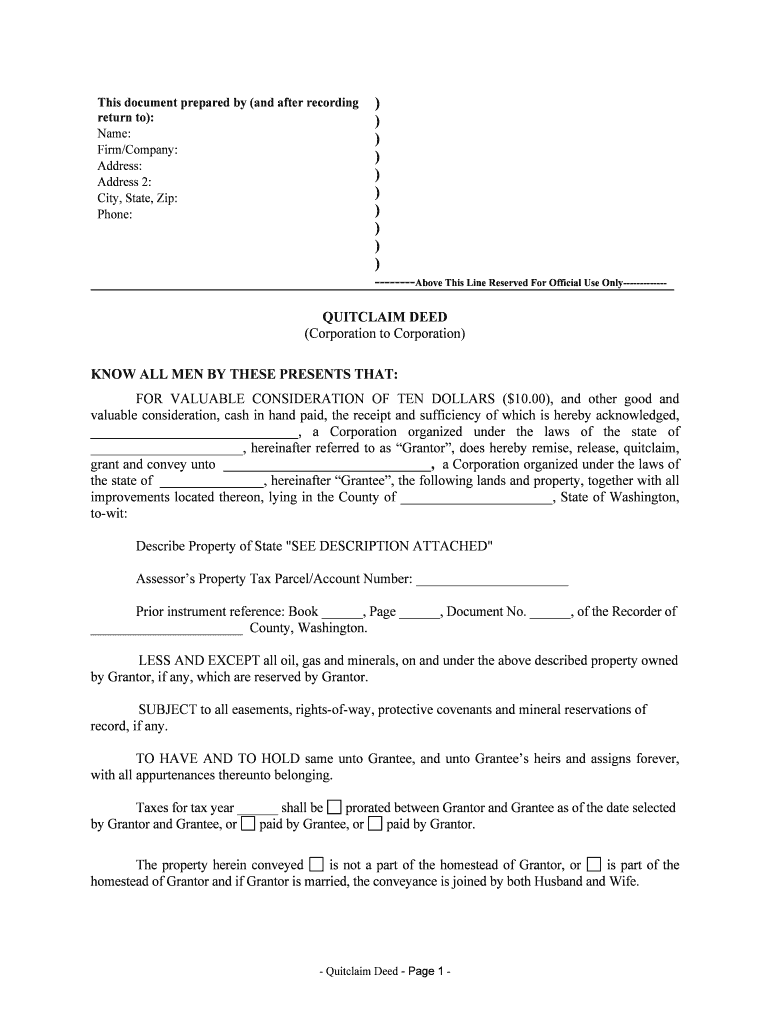

The Paid By Grantor form is a legal document often used in real estate transactions, where the grantor, or seller, specifies that certain costs associated with the transfer of property will be covered by them. This form ensures clarity regarding financial responsibilities during the transaction process. It typically includes details about the property being transferred, the parties involved, and the specific costs that the grantor agrees to pay.

How to use the Paid By Grantor

To effectively use the Paid By Grantor form, start by gathering all necessary information about the property and the parties involved. Clearly outline the costs that the grantor will cover, such as closing costs or repairs. Once the form is filled out, both the grantor and the grantee should review it for accuracy. After both parties agree to the terms, the form must be signed and dated to ensure its legal validity.

Steps to complete the Paid By Grantor

Completing the Paid By Grantor form involves several key steps:

- Gather all relevant information about the property and the parties involved.

- Clearly define the financial responsibilities of the grantor.

- Fill out the form with accurate details.

- Review the document for any errors or omissions.

- Have both parties sign and date the form.

- Keep a copy for your records.

Legal use of the Paid By Grantor

The Paid By Grantor form is legally binding when completed correctly and signed by both parties. It is important to ensure that the form complies with local and state laws regarding real estate transactions. This compliance helps protect both the grantor and the grantee by clearly outlining the terms of the agreement and the financial obligations involved.

Key elements of the Paid By Grantor

Key elements of the Paid By Grantor form include:

- Identification of the grantor and grantee.

- Detailed description of the property being transferred.

- Specific costs that the grantor agrees to pay.

- Signatures of both parties, along with the date of signing.

Examples of using the Paid By Grantor

Examples of using the Paid By Grantor form can include scenarios such as:

- A seller agreeing to cover closing costs for a buyer to facilitate the sale.

- A grantor paying for necessary repairs before the transfer of ownership.

- Situations where the grantor wants to make the property more appealing by assuming certain financial responsibilities.

IRS Guidelines

While the Paid By Grantor form is primarily a real estate document, it may also have implications for tax purposes. The IRS requires accurate reporting of any financial transactions related to property transfers. It is advisable to consult IRS guidelines to understand how costs covered by the grantor may affect tax liabilities for both parties.

Quick guide on how to complete paid by grantor

Complete Paid By Grantor effortlessly on any device

Managing documents online has become increasingly popular among corporations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the features you need to generate, modify, and electronically sign your documents swiftly and without delays. Handle Paid By Grantor on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The simplest way to alter and electronically sign Paid By Grantor with ease

- Find Paid By Grantor and select Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive details using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Paid By Grantor and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'Paid By Grantor' mean in airSlate SignNow?

'Paid By Grantor' refers to the payment structure where the grantor is responsible for any associated fees in the signing process. This arrangement can simplify transactions, ensuring that the document is processed efficiently without additional burdens on the recipient. Understanding this term is crucial for both grantors and signers using airSlate SignNow.

-

How does airSlate SignNow support the 'Paid By Grantor' option?

airSlate SignNow allows users to set up payment preferences, including the 'Paid By Grantor' option, ensuring that all necessary fees are covered. This feature streamlines document sending and eSigning, making it easier for grantors to manage their financial responsibilities. By utilizing this feature, users can enhance their transaction efficiency.

-

Are there any additional costs associated with using the 'Paid By Grantor' feature?

While using the 'Paid By Grantor' feature in airSlate SignNow is straightforward, there may be standard fees related to document processing. It’s essential to review the pricing details on our website to fully understand any charges that may apply. This ensures that both grantors and recipients are well-informed before proceeding.

-

What are the benefits of choosing 'Paid By Grantor' in your documents?

Opting for 'Paid By Grantor' streamlines transactions, reducing the administrative burden on your recipients. This approach can enhance the speed of document processing and can improve customer satisfaction, as grantors handle the associated fees directly. Overall, it creates a seamless experience within airSlate SignNow.

-

Can I integrate airSlate SignNow with other platforms when using 'Paid By Grantor'?

Absolutely! airSlate SignNow offers integrations with various platforms, allowing you to incorporate the 'Paid By Grantor' payment structure seamlessly into your existing workflows. These integrations help automate processes, making eSigning easier while maintaining clarity on who covers the fees.

-

How secure is the 'Paid By Grantor' payment process on airSlate SignNow?

Security is a top priority for airSlate SignNow. The 'Paid By Grantor' payment process is protected by industry-standard encryption to safeguard sensitive information. Users can trust that transactions are secure, allowing grantors to focus on what matters most—effective document management.

-

Does airSlate SignNow provide support for using 'Paid By Grantor'?

Yes, airSlate SignNow offers comprehensive support for all features, including 'Paid By Grantor.' Our customer service team is available to assist with any questions or concerns, ensuring that users have the guidance they need to successfully implement this payment option. We're here to help you maximize your experience!

Get more for Paid By Grantor

- Los angeles county confidential morbidity report of tuberculosis suspects and cases form

- Retirement allowance estimate request calpers cagov form

- Cal pers pers bsd 470 form

- Disclosure of ownership form texas clia

- Medical marijuana identification card cdph form 9042

- An initial application cdph 283b california department of form

- Please complete this form fully incomplete applications will be returned cdph ca

- Dmh rendering provider form

Find out other Paid By Grantor

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online