Fr 900m 2016-2026

What is the FR 900M?

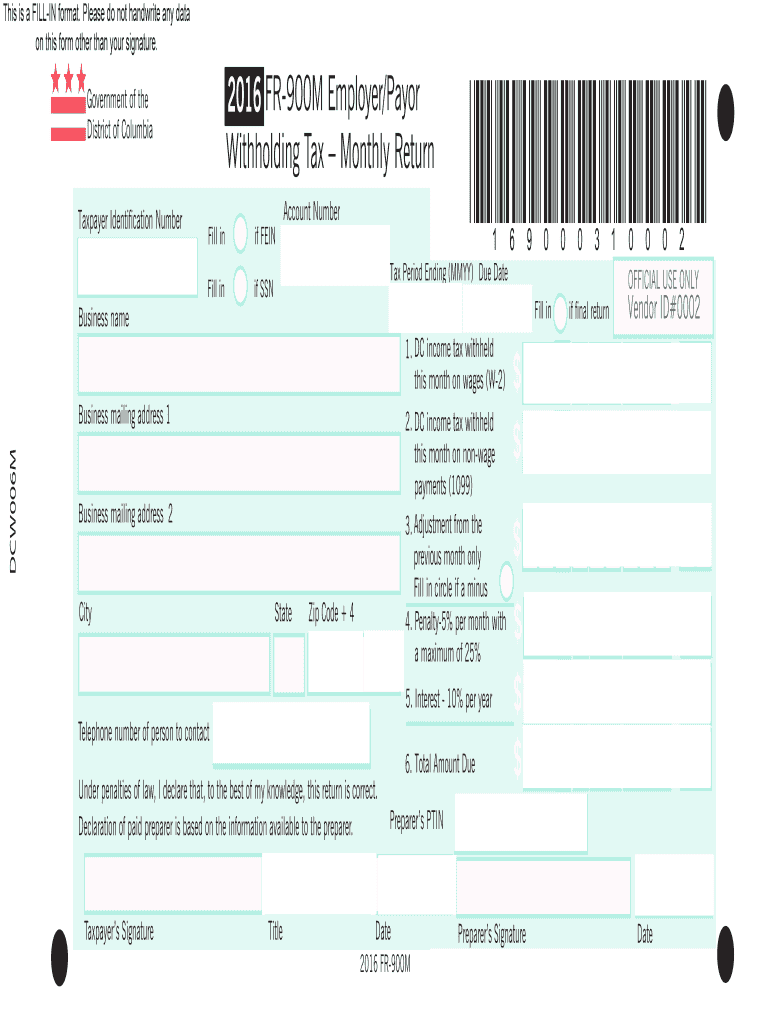

The FR 900M is a tax form used primarily in the District of Columbia for reporting income and withholding information. It is essential for individuals and businesses to accurately report their earnings and comply with local tax regulations. The form is designed to capture various details about income sources, including wages, salaries, and other compensations. Understanding the purpose and requirements of the FR 900M is crucial for ensuring timely and accurate tax submissions.

How to Use the FR 900M

Using the FR 900M involves filling out specific sections that pertain to your income and withholding details. The form includes fields for personal information, income sources, and applicable deductions. It is important to read the instructions carefully to ensure that all necessary information is provided. Users can complete the form electronically, which simplifies the process and enhances accuracy. After filling out the form, it can be submitted either online or via traditional mail, depending on your preference.

Steps to Complete the FR 900M

Completing the FR 900M involves several key steps:

- Gather necessary documents, including W-2s and 1099s, to report all income accurately.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from various sources as specified in the form.

- Include any applicable deductions or credits that may reduce your tax liability.

- Review the completed form for accuracy before submission.

Legal Use of the FR 900M

The FR 900M is legally recognized for tax reporting in the District of Columbia. It adheres to the guidelines set forth by the local tax authority, ensuring that individuals and businesses meet their tax obligations. Using this form correctly helps avoid penalties and ensures compliance with tax laws. It is advisable to retain a copy of the completed form for your records, as it may be needed for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the FR 900M typically align with the federal tax deadlines. Generally, the form must be submitted by April fifteenth of each year for the previous tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to these dates to avoid late penalties and ensure timely compliance.

Who Issues the Form

The FR 900M is issued by the Office of Tax and Revenue in the District of Columbia. This office is responsible for managing tax collections and ensuring compliance with local tax laws. They provide resources and support for individuals and businesses to help them understand their tax obligations and the proper use of forms like the FR 900M.

Quick guide on how to complete d 2848 power of attorney and declaration of representation

Your assistance manual on how to prepare your Fr 900m

If you're interested in understanding how to create and submit your Fr 900m, below are a few straightforward instructions on how to simplify tax filing.

To get started, you just need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a very user-friendly and powerful document solution that enables you to modify, draft, and complete your tax documents with ease. With its editor, you can toggle between text, check boxes, and eSignatures and return to amend details as necessary. Streamline your tax management with enhanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finalize your Fr 900m in a matter of minutes:

- Create your account and begin working on PDFs swiftly.

- Utilize our catalog to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to open your Fr 900m in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if required).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that submitting on paper can elevate return errors and delay refunds. Of course, prior to e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct d 2848 power of attorney and declaration of representation

FAQs

-

Can power of attorney in fact forms be filled out and authorized completely online?

Note: I am not an attorney. Even if I were an attorney, I am not your attorney. This is merely the opinion of a fairly savvy Citizen. It is not legal advice. If you want legal advice hire an actual attorney. In the U.S.A. "signing" something like a Power of Attorney electronically is generally not enforcable* because many (most?) Courts require that the authorizing of them usually requires a "wet" signature which has been signNowd. You could try it but, because they are such powerful documents, almost any court (or business for that matter) will require that the signature be signNowd before allowing them to be enforced and used.In fact many businesses simply have a policy of not recognizing them without a confirming court order as well. This is especially true in health care.This is mainly because the business wants to make damned sure that any liability for errors or misunderstandings lies with someone other than the business. *Note that "not enforcable" =/= "illegal" (or even sick hawk).There's no law preventing you from doing it. It's just completely pointless; because if you complete the Power of Attorney electronically anybody who knows anything about law or contracts or fiduciary duty will simply ignore it... along with any instructions you might try to give them under it.Do yourself a favor by getting an attorney and doing it right.

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

-

Do I need to fill out the self-declaration form in the NEET 2018 application form since I have a domicile of J&K?

since you’re a domicile of J&K & are eligible for J&K counselling process - you’re not required to put self declaration.self declaration is for the students who’re not domicile of J&K but presently are there & unable to avail the domicile benefit .source- http://cbseneet.nic.in

-

Do I have to fill out the form of Railway Group D and Loco pilot separately?

Yes, you have to apply separately for both the posts!You can apply here for Railway Group D: RRB Group D Recruitment 2018: Exam Date, Apply Online, Vacancy, SyllabusYou can apply here for Loco Pilot: - Railway Recritment BoardGood Luck!

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the d 2848 power of attorney and declaration of representation

How to create an eSignature for your D 2848 Power Of Attorney And Declaration Of Representation in the online mode

How to make an eSignature for the D 2848 Power Of Attorney And Declaration Of Representation in Google Chrome

How to make an eSignature for signing the D 2848 Power Of Attorney And Declaration Of Representation in Gmail

How to generate an eSignature for the D 2848 Power Of Attorney And Declaration Of Representation from your smartphone

How to create an electronic signature for the D 2848 Power Of Attorney And Declaration Of Representation on iOS devices

How to make an eSignature for the D 2848 Power Of Attorney And Declaration Of Representation on Android OS

People also ask

-

What is Fr 900m in relation to airSlate SignNow?

Fr 900m refers to a specific pricing tier within airSlate SignNow's subscription plans. It offers businesses a comprehensive solution for sending and eSigning documents with added features that enhance workflow efficiency. Choosing the Fr 900m plan ensures you have access to advanced tools tailored for seamless document management.

-

How does the Fr 900m pricing plan compare to other options?

The Fr 900m pricing plan is designed to be cost-effective while providing robust features suitable for businesses of all sizes. Compared to other plans, it offers a balanced mix of affordability and functionality, making it an ideal choice for teams that require frequent document signing and management solutions.

-

What features are included in the Fr 900m plan?

The Fr 900m plan includes essential features such as unlimited eSigning, document templates, and real-time collaboration tools. Additionally, it provides advanced security options and integration capabilities with other business applications, ensuring a comprehensive document workflow management system.

-

Can I integrate other software with the Fr 900m plan?

Yes, the Fr 900m plan allows for seamless integration with various applications such as CRM systems, cloud storage services, and productivity tools. This flexibility enables businesses to enhance their document workflows by connecting airSlate SignNow with their existing software ecosystem.

-

What are the benefits of using airSlate SignNow with the Fr 900m plan?

Using the Fr 900m plan from airSlate SignNow offers numerous benefits, including increased efficiency in document handling and reduced turnaround time for approvals. The plan is designed to streamline processes, improve collaboration, and ensure a secure signing experience for both businesses and their clients.

-

Is there a free trial available for the Fr 900m plan?

Yes, airSlate SignNow offers a free trial for the Fr 900m plan, allowing prospective users to explore its features without commitment. This trial provides an excellent opportunity for businesses to assess the platform's capabilities and determine if it meets their document management needs.

-

How can the Fr 900m plan enhance my business's productivity?

The Fr 900m plan enhances productivity by automating document workflows and reducing the time spent on manual processes. With features like bulk sending and real-time tracking, teams can focus on their core tasks while ensuring that document signing is quick and efficient.

Get more for Fr 900m

- Royal caribbean cruise flyer birthday girls special occasions form

- Download file the mayoramp39s charity ball themayorscharityball form

- Sa103f form

- Clinilog contour next form

- Dhs 901 semi annual transition plan report dhs 901 michigan form

- 1 a form

- Vac therapy insurance authorization form v

- Shippers letter of instrucktion ecu worldwide form

Find out other Fr 900m

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure